Workshop helps Chinese business owners on filing taxes

|

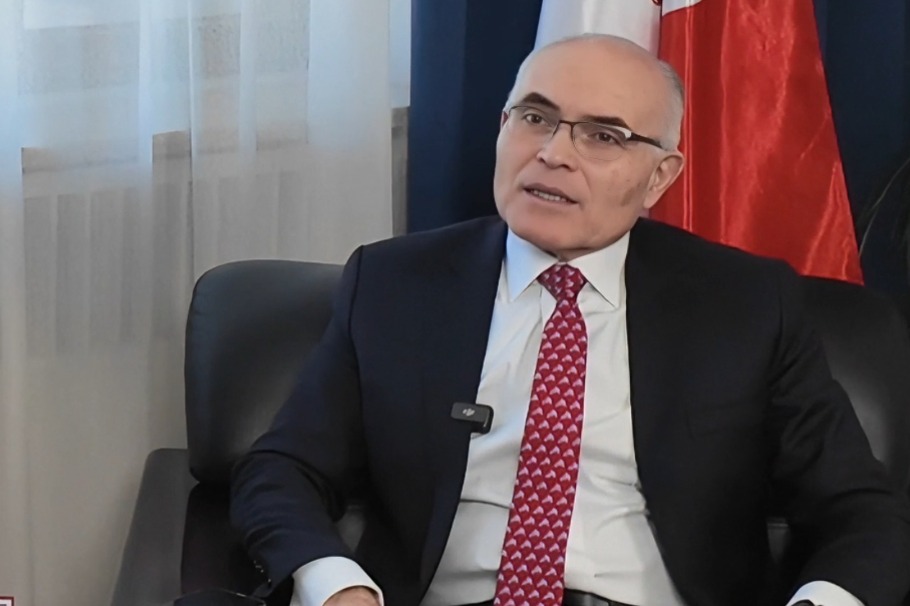

| Founder of One Flushing John Choe (left) poses for photos with Christine Cheung and Sisley He, partners at C & S Accounting & Tax Inc. at the Business Income & Expenses/Accounting workshop for small business owners in Flushing on July 2. [Elizabeth Wu/China Daily] |

"Should I file as a C or S corporation? And do I have to charge tax if someone makes a purchase online?"

Those are some of the questions that often puzzle many Chinese small business owners in New York, according to tax specialists who participated in a recent workshop for small business owners in Flushing, Queens.

"A lot of the time I think people don't know what forms to file." said Sisley He of C & S Accounting & Tax Inc at the

One Flushing Business Boot Camp. The workshop was part of a business assistance program developed in collaboration with the US Internal Revenue Services (IRS).

The audience at the workshop was familiar to He. "Most of our clients are from Queens or Brooklyn, they're mainly small business owners," she said.

He and her partner Christine Cheung highlighted the types of taxes businesses must pay annually, as well as which forms to use.

Small businesses are registered as C Corporations when they first start out, when they fill out the tax form they can decide whether they want to stay as a C Corporation or switch to S, He explained to the audience.

He said small business owners sometimes don't understand what items are subject to sales tax.

They also need to understand sales and payroll tax that must be filed every season in the calendar year or fiscal year, depending on which cycle they choose. One to be filed with the Federal government and another with the state in which the business is registered.

"If I sell things online, do I need to register for a business license and file taxes?" asked a small business owner in the workshop audience.

He explained that strictly speaking all online buying transactions related to an exchange of money should be taxed, but Amazon has much stricter tax regulations than eBay, which does not require tax reports from many of their sellers.

The tax specialists also explained that if a purchase is made online outside of the state where their business is located, then the product will not be taxed.

The workshop reviewed the different types of business structures (C Corp, S Corp, sole proprietor, partnership, and LLC) and the different types of tax forms required to file. "No matter what their business entity, they need to file sales and payroll tax," said He.

Peter Au, who used to own a luncheonette, asked:

"There are lots of Chinese restaurants, what (type of business entity) should they go under when filing taxes?"

Cheung told Au that they might start out as a C Corporation and eventually file to become an S Corporation if they qualify. C Corporations have to go through double taxation, whereas S Corporations do not.

Haide Chien, president of A-Image LLC, which makes banners for trade shows, and who has more than 30 years of business-to-business service experience, said that the workshop was "very informative" and "very helpful in detecting what types of business there are". Chien also said he was surprised to learn that all online purchases require the filing of sales tax.