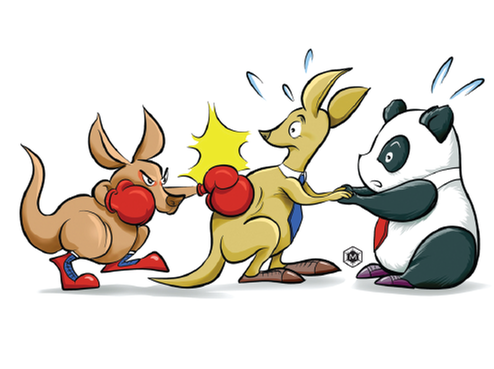

Is Australia hugging or bashing the panda?

|

| MA XUEJING/CHINA DAILY |

China is now central to Australia's economic prosperity. It overtook Japan as Australia's top export destination early this century and is now Australia's top partner in terms of exports, imports, tourism and education. And there are a number of "mega trends" that are likely to make China more important for Australia.

First, China is transitioning from a country of shippers to a nation of shoppers. It is no longer just about low cost manufacturing but also about a rising middle income group that will add around 850 million people to its ranks between 2009 and 2030.

Second, China is about urbanization, too. The country was once just about "the big four": Beijing, Shanghai, Guangzhou and Shenzhen. Now it is also about second- and third-tier cities such as Chengdu, Chongqing, Wuhan, Xi'an and Qingdao. In fact, in the near future, more than 80 percent of China's middle income group will be living in the second- and third-tier cities. No wonder these cities are attracting many Australian architects to help build or rebuild them.

Third, China faces a fast aging population, which offers Australian healthcare companies such as Blackmores and Australian Medical Tourism enough scope to expand their businesses.

Fourth, Australia's relationship with China is going "from the mining boom to the dining boom". Australia knows its rocks and crops, to a certain extent, facilitated China's economic miracle in the past. Now, what matters more are Australian agricultural exports to China-worth $9 billion, or 72 percent more than to the United States.

Fifth, China matters a lot to Australia in terms of services. China is Australia's top source of tourists, who spend more than double the amount of their counterparts from the United Kingdom, and foreign students-2.4 times more than those from India.

And finally, as an airport economist I know Australia's relationship with China is constantly strengthening in fields such as education, tourism and professional services and trade. Six years ago, from Australia you could fly to only "the big four" cities in China, but today, you can fly to 11 Chinese mainland cities, including Chengdu (the panda capital) Chongqing, Wuhan and Xi'an.

All this means you don't need to be as big as Woodside or BHP Billiton to succeed in China. Australia's future is as much about Blackmores as it is about BlueScope today, with small and medium-sized enterprises also having the opportunity to get a slice of the action. According to the Australian Bureau of Statistics, 10,000 Australian SMEs export goods to China, directly or via Hong Kong, and 3,000 Australian companies have offices in China (compared to only 100 in Japan).

But despite all this, why this uncertainty over China-Australia ties? Perhaps because of Chinese foreign investment in agricultural land. Overall, China's direct investment in Australia is pretty small, and Australia doesn't owe a huge amount to China. Australia's net debt is mainly held by the UK, Belgium, the US and Japan. But you don't see too many headlines about Australia being enslaved by UK or Belgian investors.

In fact, a lot of Chinese investment is productive and creates jobs. So if China's investment is relatively small and productive, why the fuss? Partly because of the link between the Chinese government and State-owned enterprises. In fact, China's direct investment in Australia has attracted more media attention than that by India, whose private enterprises have invested in Australia without drawing much attention (with some notable exceptions).

China has to get used to operating in a relatively unfriendly world. China is learning the rules of outward investment and issues such as intellectual property rights and other governance issues as it ventures beyond its borders. And it will soon not only learn that the rules of cross-border investment are more complex and controversial than those of trade, but also master them.

The author is the JW Nevile Fellow in Economics at the University of New South Wales, Sydney, and the host of The Airport Economist on Sky News and Qantas.