Europeans should embrace Singles Day

Market penetration and brand building, rather than just discounting, should dominate the business landscape for annual Chinese sales spree

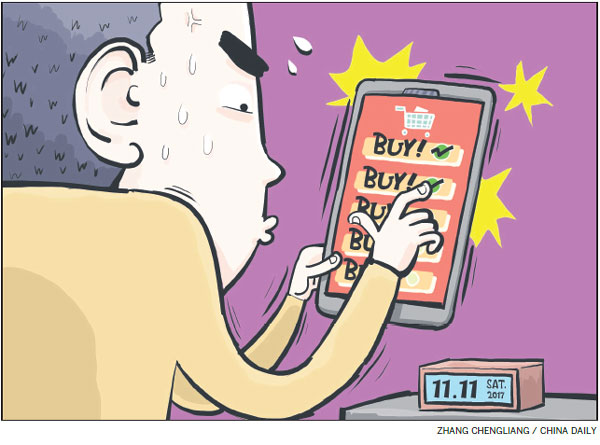

Singles Day, China's annual shopping frenzy on Nov 11, has again confounded many with a new record for sales. Beating last year's incredible $17.8 billion (15.1 billion euros; £13.5 billion) sales total, Singles Day 2017 saw sales climb to a whopping $25.4 billion.

European retailers and manufacturers need to not just take a closer look at this ever increasing Singles Day spending spree across the Chinese mainland, but should also take note of the continued changes this reflects as China moves toward a consumption-led economy.

Nine out of 10 purchases were completed via the use of mobile devices, a change in the nature of Chinese consumer purchase behavior that European businesses would do well to understand further, and in so doing strengthen their online presence where the Chinese mainland market is concerned.

Of course, high-tech consumption continues to lead this change, but sales on this year's Singles Day ranged from smartphones and other related gadgets to fashion and sports brands and even agricultural produce, with a significant increase in participation by the mainland's rural communities.

But the signs of European retailer and producer participation in Singles Day are brighter. In recent years, an increasing number of European companies have participated on Tmall and/or Tmall Global.

Chinese conglomerate Alibaba, whose sprawling business empire now extends far beyond online shopping, remains the prime architect of and participant in Singles Day, and its online shopping platforms Tmall and Tmall Global are the place to be for European businesses keen to capitalize on Singles Day sales and further penetration of the Chinese mainland market.

In 2015, household UK brands Sainsbury's and House of Fraser both launched on Tmall, and both acknowledged the strategic importance of this decision. That year also saw the likes of Spanish grocery retailer DIA and Coop Italia set up on Tmall.

Last year, fashion retailer Topshop followed Sainsbury's and House of Fraser's lead and also established a presence on Tmall, as did German cash-and-carry chain Metro. Last year also marked the debut for Marks & Spencer and Holland& Barrett, both of which registered Tmall accounts.

Not to be outdone, French food retailer Carrefour chose to run in-store Singles Day promotions over the past few years.

Clearly, more European companies, retailers in particular, now see Singles Day and a presence on Tmall or Tmall Global as a lower-risk and far faster method of penetrating the Chinese mainland market, compared with the riskier alternatives of stand-alone websites and/or brick-and-mortar stores.

But many more need to follow suit. For example, it is difficult to comprehend British luxury brand Burberry's continued refusal to participate, which may help explain the brand's recent, relatively lackluster, performance in China.

Chinese consumers are not just consuming more with ever larger Singles Day sales volumes. They are "trading up", and luxury brands should not fear that any Singles Day participation will necessarily lead to a decline in their closely coveted exclusivity.

Despite the phenomenal growth of Singles Day sales and the fact that those European companies that have participated in recent years have witnessed spectacular sales spikes on this day (in some cases as high as triple-digit percentage growth compared with the previous week) the annual event still appears to represent more of a major opportunity for domestic companies.

That said, leading UK fashion magazine Drapers estimates that a total of 130 UK retail brands will have participated in Singles Day this year.

So why do European companies fail to take advantage of the Singles Day shopping bonanza and the obvious opportunity this presents for speedy and relatively safe exposure to the Chinese mainland market?

The major reason appears to be the blind spot that Singles Day still represents for many European companies, and consumers for that matter, due to the fact that Nov 11 is Remembrance Day across the UK, Ireland, France and Belgium, where those who lost their lives in World War I are remembered. Furthermore, in Poland, Nov 11 is celebrated as Independence Day and is a public holiday. It is also a public holiday across France and Belgium, and every year up and down the UK a minute's silence is maintained by many at 11 am as a mark of respect.

But outside Europe, especially as far afield as Asia and China, the situation is different. Of course, consumers across Asia, and China in particular, also hold great respect toward Remembrance Day in Europe.

Clearly, Singles Day cannot, therefore, travel to Europe, but Europe can travel to China, and an increase in European business participation does not mean any loss in the deep emotional meaning held for Remembrance Day across Europe and beyond.

So how should European companies take full advantage of this once-a-year opportunity?

While Tmall and Tmall Global offer very convenient market entry platforms, increasingly sophisticated and discerning Chinese consumers could favor social media campaigns dedicated to Singles Day that could form part of a multichannel strategy.

For example, for Singles Day this year, online beauty retailer Feelunique created an even bigger buzz compared with previous years as a result of careful collaboration with selected, local e-commerce players. Many fellow upmarket European retailers can learn from Feelunique's approach, which is not simply aimed at a quick sales kill but rather at building a strong, price-insensitive brand image via educational e-commerce brand messages. Local e-commerce players that carried Feelunique's Singles Day campaign this year provided significant credibility in the minds of Chinese consumers.

European retailers should also be aware of the extended time period over which Singles Day is now scheduled to take place. The three day period - Nov 9 to 11 - over which the event took place last year was this year extended to seven days - Nov 6 to 12). The fact that Nov 11 fell on a Saturday this year also contributed to an even more buoyant bonanza.

In addition to social media campaigns, Singles Day this year attracted a record number of vloggers and key opinion leaders, something that European companies need to study in order to appreciate how modern marketing messengers are changing from the traditional stars of stage and screen and sport.

Finally, the current exchange rates between the Chinese yuan and the euro, and the yuan and the pound, should also prompt more European companies to take their online presence to China for a substantial Singles Day splash.

An increasing number of European companies are now participating in China's Singles Day, but even more need to do so, with carefully crafted multichannel strategies, while not forgetting that mobile phone purchase remains dominant with increasingly tech-savvy Chinese consumers. Alipay and WeChat Pay also remain dominant, by far the online payment systems favored by the typical Chinese Singles Day consumer.

Market penetration and brand building, rather than just discounting, should now dominate the European business landscape where Singles Day is concerned.

The author is a visiting professor at the University of International Business and Economics in Beijing and a senior lecturer at Southampton University. The views do not necessarily reflect those of China Daily.

(China Daily Africa Weekly 11/17/2017 page9)

Today's Top News

- Xi taps China's deep wisdom for global good

- New rules aim for platforms' healthy growth

- Chinese web literature grows overseas

- Postgrad exam trend points to thoughtful approach

- World's highest urban wetland a global model

- How China's initiatives are paving a new path to a better world