Tianjin Updates

2026-02-10

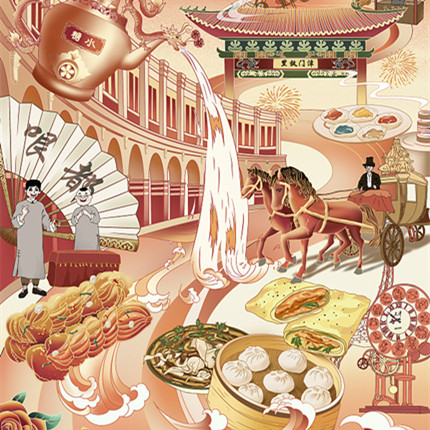

Third Tianjin Student New Year Painting Exhibition set to open

When the rich cultural heritage of Tianjin meets the creativity and craftsmanship of young students, a dialogue between tradition and innovation unfolds. This festive cultural and visual feast, infused with the spirit of the Lunar New Year of the Horse, is set to open in Tianjin.

read more- 'Protein factories' linked to age-related infertility

- Over 300 athletes from 35 countries and regions kick off Asian championships in Tianjin

- Policies concerning expats, foreign enterprises in January 2026

Copyright ©? Tianjin Municipal Government.

All rights reserved. Presented by China Daily.

京ICP備13028878號(hào)-35

Why Tianjin

Why Tianjin Investment Guide

Investment Guide Industry

Industry Industrial Parks

Industrial Parks

Health

Health Visas

Visas Education

Education Sports and recreation

Sports and recreation Adoption

Adoption Marriage

Marriage