Tariffs could double US' trade losses

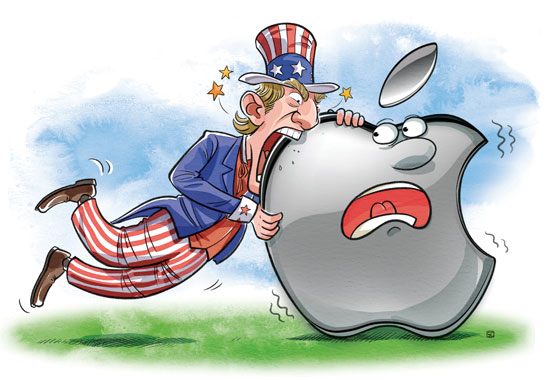

US President Donald Trump's tariffs are based on flawed doctrines, which could penalize the US' economy as much as the trade deficits.

On Friday, Trump threatened to impose tariffs on $267 billion worth of Chinese goods, on top of the additional tariffs on $200 billion of Chinese imports that he said could take effect in a matter of days.

If the tariff stakes increase to $500 billion, it could reduce China's GDP by 1 percent. But for the United States, whose economy is more vulnerable than that of China, the GDP reduction could be 2 percent. In dollar terms, the consequent tariff damage could be even higher than the current US trade deficit with China and thus cause double the damage.

In the pre-World War I era and during the protectionist interwar period, global integration activities plunged. As major corporations competed largely in home markets, their value activities were mainly domestic. After the end of World War II, the US-led Bretton Woods system ensured a greater degree of internationalization, including systemic US trade deficits since 1971, decades before it had deficits with China.

'Made in China' doesn't capture value added

Besides, US multinational companies have cut costs through offshoring-transferring large chunks of productive capacity to emerging markets, especially in Asia-since the 1980s. So today the "eco-systems" of the US multinationals are increasingly global.

Here's Trump's dilemma in a nutshell: While tariff wars were typical to the era of domestic competition a century ago, they do not work in a more global trade environment. Even "made in China" products feature diverse value-added inputs by multinational companies producing in, exporting from and selling in China.

Since iPhone alone accounts for some $16 billion of the US trade deficit with China, let's use it as an example. According to IHS Markit and Reuters data, the initial sale price of Apple's iPhone X (64BG) was $999. The Trump administration's tariffs are based on the idea that since they are made in China, all value-added is captured in China and thus China must be penalized by heavy tariffs.

The breakdown of the iPhone X costs comprises both manufacturing costs ($378.25) and the value shared between distributors and Apple ($620.75), which accounts for almost two-thirds of total. Another fourth of the total cost consists of various components made in the Republic of Korea, Japan, the US, the United Kingdom, Switzerland and Singapore.

Share of manufacturing cost is insignificant

China's key contribution is in the basic manufacturing cost ($8) plus battery packs ($6), which is less than 4 percent of the manufacturing cost and 1.4 percent of the total price of iPhone X.

Is the iPhone X an exception? Hardly. Before the fall of Nokia, Europe captured 51 percent of the value-added of the Nokia N95 smartphone, even when it was "made in China", because the final assembly (in China) involved only 2 percent of the overall value-added.

Obviously, the share of China's value-added differs by industries and companies. Yet it tends to be very low in the case of multinational companies operating in China, particularly in advanced technology. The same goes for such companies operating in India or other emerging markets.

That's precisely why the Chinese government seeks the country's rapid transition from exports and investment toward innovation and consumption. After all, like Apple and Nokia, Chinese industry giants-from Huawei and Xiaomi to Oppo and Vivo-capture far more of the value-added in China. As Vice-Premier Liu He has urged, China must innovate if it wants to be a world leader in science and technology.

There is one critical difference, however. Through taxation, Nokia's success benefited Finnish taxpayers and its European investors. In contrast, Apple's success does not necessarily accrue to American taxpayers because many US multinationals, unlike their European counterparts, rely on creative tax accounting or tax havens.

Theoretically, Apple should be the largest taxpayer in the world and pay $38 billion to the US Treasury in taxes brought home from overseas and "create"20,000 new jobs. But as Fortune has reported, that's all spin.

Apple, according to reports, plans to collect a huge windfall from the Republican Party's corporate tax handout. Currently, it holds about $252 billion-more than 90 percent of its total cash-in profits offshore, where it can avoid paying US taxes.

The true dilemma for Washington

Before Trump's tax code overhaul, Apple would have paid $79 billion in taxes if it had brought the money home. But it didn't. Instead, it let the cash sit offshore for years. So its offshore profits will be taxed at a one-time 15.5 percent repatriation rate. All other corporate profits will be taxed at 21 percent (down from the previous rate of 35 percent).

In the postwar era, the old adage was "What's good for General Motors is good for America". What Apple and many other US multinationals are doing today may not be illegal, but it is part of a broader problem associated with the US' decline. Which makes Trump's tariffs a misguided solution to a wrong problem.

Here's the bottom line: Chinese share of 2 percent or a little more of the value-added pie is not the problem.

The real question is why US companies' lucrative profits yield so few benefits to ordinary Americans but great benefits to a few corporate insiders.

The author is the founder of Difference Group and has served at the India, China and America Institute (USA), the Shanghai Institutes for International Studies (China) and the EU Centre (Singapore).