Forex reserves rise in June

Increase due to growing global confidence in nation's economy and opening-up

China's foreign exchange reserves rose to a 14-month high in US dollar terms at the end of June, amid higher asset values and generally balanced foreign exchange supply and demand, the top foreign exchange regulator said on Monday.

Analysts said the foreign exchange reserves are expected to remain stable in the coming months, but cautioned on the need to improve the efficiency of money supply that has been injected into the economy to avoid capital outflow risks.

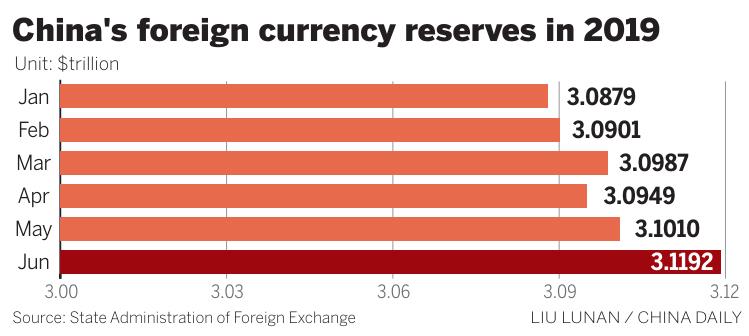

Foreign exchange reserves increased for the second consecutive month to $3.1192 trillion in June, up $18.2 billion or 0.6 percent from a month earlier, Wang Chunying, spokesperson of the State Administration of Foreign Exchange, said in a statement on Monday.

The rise was mainly attributable to changes in asset values, including a weaker dollar and an uptrend of global financial asset prices, Wang said.

As market expectations grew over an interest rate cut this month by the US Federal Reserve, the US dollar index dropped by nearly 1.7 percent in June to 96.2, boosting the value in US dollar terms of reserve assets denominated in other currencies, said a report from China International Capital Corp Ltd.

Global stock and bond markets also gained amid expectations of an easing monetary environment in June, the report said.

During the January-June period, China's foreign exchange reserves went up by $46.5 billion or 1.5 percent, with every month except April registering a rise, according to the SAFE.

Foreign exchange reserves have been stable with a moderate rise since the beginning of the year, with an overall balance between supply and demand in the foreign exchange market and positive changes in cross-border fund flows, Wang said.

"A rising foreign investment inflow, including direct investment and securities investment, should be the major driving force of the uptrend of foreign exchange reserves this year," said Liu Chunsheng, an associate professor with the Beijing-based Central University of Finance and Economics.

"Behind the increase was foreign investors' confidence in China's growth prospects as well as the country's accelerated opening-up, especially for the financial sector," Liu said.

During the first quarter, net inflow of direct investment stood at $26.5 billion, while net inflow of securities investment was $19.5 billion, according to the SAFE.

For the second half of the year, foreign exchange reserves are expected to remain basically stable and above $3 trillion, given stable economic fundamentals and regulators' ability to counter cross-border flow risks, Liu said.

"Developments in Sino-US trade frictions may cause fluctuations in cross-border flows, but the influence should be limited as market participants have got used to twists and turns in trade talks," Liu added.

According to the SAFE, China will continue promoting high-quality development and all-round opening-up, which will cement growth momentum and provide a solid basis for the stability of foreign exchange reserves.

Yang Weiyong, an associate professor at the University of International Business and Economics in Beijing, said regulators need to rise to potential capital outflow risks associated with further opening-up.

"China should refrain from monetary overflow in the face of downside risks, as this could cause long-term capital outflow pressure," Yang said. "Instead, the monetary authorities should focus on re-channeling money supply occupied by low-efficiency sectors into more vibrant private enterprises."