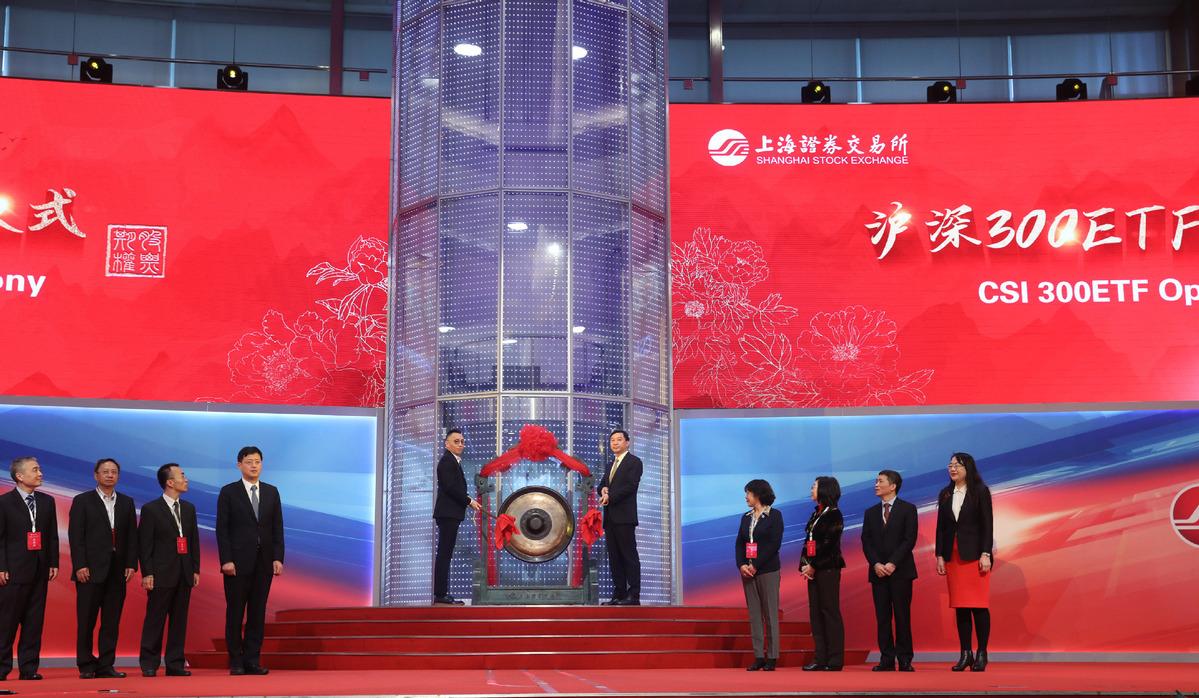

Trading in stock index options starts

Trading in China's first stock index options started on the China Financial Futures Exchange in Shanghai on Monday, further enriching the derivative products in the market and offering more risk hedging tools for investors.

The underlying asset of the option contract is the CSI 300 Index which tracks 300 large-cap and most liquid stocks traded on the Shanghai and Shenzhen stock exchanges. The two bourses also launched trading in CSI 300 exchange-traded fund option contracts from Monday.

The introduction of the three option products came after China launched trading in the country's first equity option contract, the SSE 50 ETF option contract, in 2015.

Monday's listing of the new products highlighted the steady development of China's financial derivative market since the country first introduced stock index futures in 2010. The development also underscored the regulatory intent to provide more trading products and risk management tools to attract long-term and sophisticated institutional capital in the Chinese equity market which is still dominated by retail investors.

Fang Xinghai, vice-chairman of the China Securities Regulatory Commission, said the launch of the equity and stock index options holds far-reaching significance for China's efforts to improve the fundamentals of its capital markets and expand product coverage.

"The simultaneous launch of the CSI 300 stock index option contract and CSI 300 ETF option contracts will help optimize the market mechanism, improve the multilayered capital market and promote its healthy development," Fang said at the launch ceremony in Shanghai.

The trading in option contracts will help draw more overseas institutional investors as it offers them an important risk management tool and allows them to enrich their trading strategies and adjust their investment portfolios with greater flexibility, analysts said.

Under the current regulations, individual investors must have at least 500,000 yuan ($71,300) in their stock accounts to be qualified for the trading of the options contracts. They are also required to have past experience in financial derivatives trading.

Analysts at Industrial Futures Co Ltd said in a research note that Monday's listing is an indication that China's financial derivative market has entered a new stage and investors could obtain more risk hedging tools and risk management services which will substantially boost their long-term confidence in the nation's stock markets.

The trading of the new products also means more business opportunities for the country's securities and futures companies and will boost their earnings through their brokerage and market-making services for clients, analysts said.

Wang Jianjun, chief executive and president of the Shenzhen Stock Exchange, said the bourse has been researching and studying derivatives since 2004 and the CSI 300 ETF option, as the bourse's first derivative product, plays a significant role in its development.

Wang said the option trading will strengthen the exchange's direct funding capacity and improve its asset allocation and risk management abilities.