Finance expert warns against the pressure for increased access

China should not be under any pressure to open up its capital markets, according to a leading finance expert.

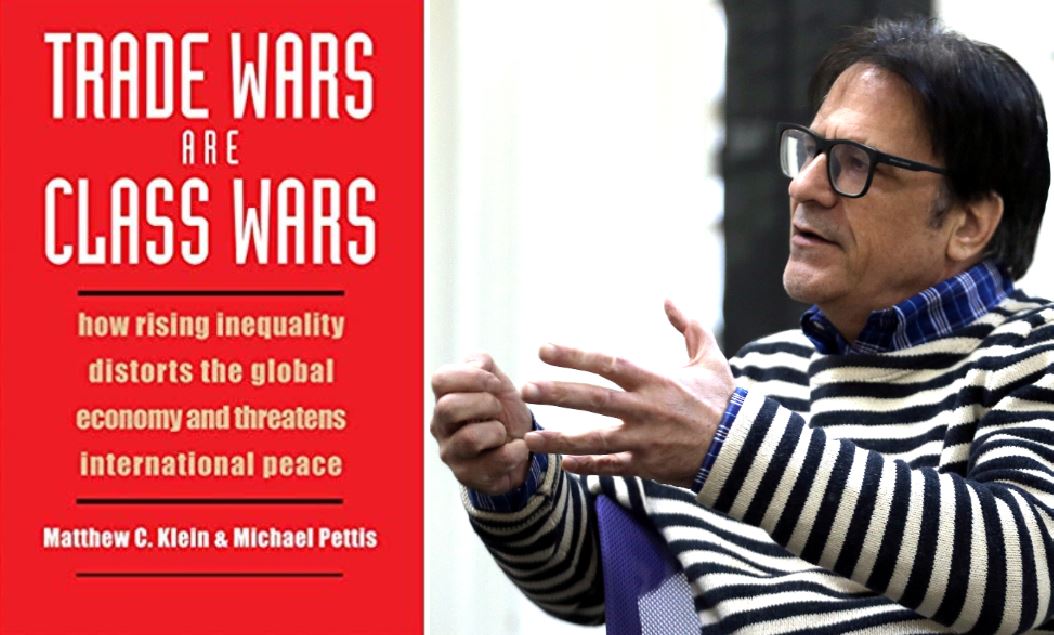

Michael Pettis, professor of finance at Peking University, said it is a fallacy that when an economy reaches a certain size it has to be financially open to the rest of the world.

"There is no evidence that large economies really need to open their capital markets. It helps bankers and it helps the owners of capital, but there is nothing to support it helping producers, businesses or workers. On the contrary, there is considerable evidence it does not," he said.

Pettis, 61, who is a frequent commentator on the Chinese economy, writing for publications such as the Financial Times, was speaking at his home near Houhai Lake in Beijing.

He said he has a different perspective on the Chinese economy than economists because of his financial specialization and his experience as a Wall Street trader-h(huán)e headed Latin American capital markets for global investment bank Bear Stearns before coming to China in 2002.

"I'm a Wall Street guy and used to do all this stuff. When you have done that, it is hard to argue that you really need it to increase the productivity of the economy," he said.

He believes one of the problems for some Western economies is that they are too reliant on their financial sectors, and therefore he does not feel that this is an example China should follow.

"The financial services sector in the US-and the UK also-as a share of GDP is the biggest it has been since the 1920s. Is that really such a good thing? I think the answer is no. You need a certain level of financial sophistication, but when you go beyond that, the benefits aren't clear."

Pettis also said that Shanghai or Shenzhen, Guangdong province, do not have to become major international financial centers for the Chinese economy to develop further.

"To have an international financial center, you obviously have to have open capital markets. I would argue that in the period of greatest economic growth in the United States (the late 19th and early 20th centuries) New York was only a local financial center, along with those in San Francisco, Boston and Philadelphia. It seemed to do perfectly well without one," he said.

Pettis believes the Chinese financial authorities need to be careful about opening up capital markets.

"One of the reasons put forward for doing this is that it creates pressure to speed up reform of the banking system. I think this is very risky because it does indeed raise the pressure, but the reason it does so is because if you don't reform the banking system, then inflows and outflows (of capital) can be quite devastating," he said.

In a relatively closed system such as China's, the authorities have a lot of control and can prevent runs on local banks, but this would not be the case if there were many foreign banks and institutions operating in the country, as they would not be able to control their activities in the same way, Pettis said.

"Only countries with very sophisticated well-functioning financial systems can tolerate open capital markets."

He said that having a strong and solvent economy would not prevent a financial crisis when there are open markets.

"South Korea had a crisis in 1997 and it wasn't insolvent at all. The problem comes when your liabilities do not match your assets; they might be long term, while your assets might be short term; they might be in different currencies or structured in ways that don't match, and you find yourself suddenly not being able to meet your liabilities."

Pettis said that while China might be looking to open its markets, the debate in countries such as the US is about closing them.

He pointed out that the architects of the postwar Bretton Woods financial order, John Maynard Keynes and Harry Dexter White, were in favor of free trade but opposed free capital flows, and that the US did not have completely open capital markets until the 1980s.

"In theory, capital flows are the result of money leaving the UK to go to Mexico or the US because of better investment opportunities. In reality, however, that is not why money flows around the world. Most of the money flowing around the world is actually speculative."

Pettis' new book, Trade Wars Are Class Wars: how rising inequality distorts the global economy and threatens international peace, which is relevant to the current US-China dispute, will be published next year. He wrote it with economics commentator Matthew C. Klein.

"The book argues that trade wars are not really wars or conflicts between countries, but between economic sectors in these countries, and often serve the wealthy elites and not the workers," he said.

Pettis, who is also well-known for promoting independent rock music in China and has his own record label, Maybe Mars, has written extensively about China's debt.

He has argued that it is wrong to view urbanization as driving the country's growth, because it would only build up debt if it did not produce economic returns.

"The argument was that urbanization creates good jobs. But no, it doesn't. Urbanization is a cost and it is only worth paying if productivity goes up. Otherwise, it just creates debt," he said.

As far as opening up capital markets is concerned, Pettis is wary of the thinking that foreign institutions would be the catalyst for reform in China.

He cites the work of Belgian economic historian Raymond de Roover.

"He concluded that the reason the Canadians failed to get rich in the 19th century, as opposed to the Americans, is that they had a financial system imposed on them by the UK, which was only suitable for a developed economy," he said.

"The American financial system was a scandal, with regular bankruptcies, but it sort of fumbled its way into the right financial system for it. It was a scandal, but it worked."

He said the Chinese really need to address the benefits of opening up.

"They should not just have an open system because other countries do. They have to ask themselves what the economic advantages are and whether, in fact, there are any," he said.