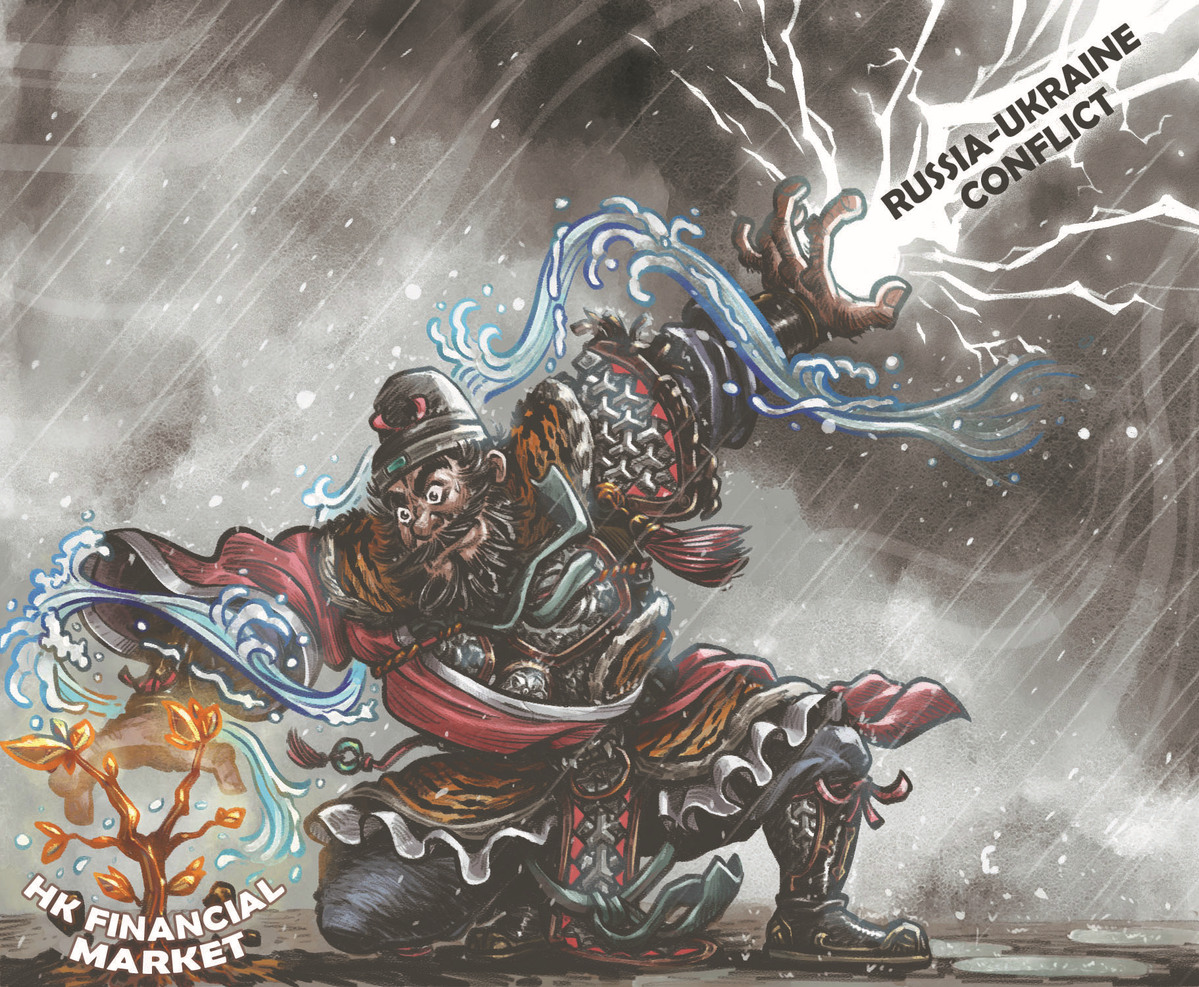

HK may see Russia-Ukraine impact, but limited

Ever since the Russia-Ukraine crisis broke out, risk aversion sentiment has drastically escalated worldwide. Hong Kong saw dramatic fluctuations in share prices, bonds and foreign exchange. But the overall impact has been limited, as there has been no significant capital outflow or liquidity shortage.

The balance of Hong Kong's interbank market has remained stable at around HK$337.5 billion ($43.1 billion), which is down by 0.5 percent compared to data collected before Feb 24. The overnight Hong Kong interbank offer rate, or Hibor, is only down 1 percentage point to 0.02 percent and the one-month Hibor now stands at 0.32 percent.

The Hong Kong dollar has slightly depreciated by 0.3 percent against the US dollar since late February, which is still in line with the overall depreciation trend started one year ago.

Shares in the Hong Kong stock market and the Chinese mainland corporate bonds denominated in US dollars saw their prices nosedive ever since tensions between Russia and Ukraine worsened. But the geopolitical crisis is not the only cause. The plunge was mainly due to China's weakening major economic indicators, several defaults of Chinese mainland property corporate bonds, US securities regulator's tightening grip over US-listed Chinese companies, and the spread of new COVID-19 variants in some parts of China.

The above causes cannot be quantified. But their impact on Hong Kong's stock and bond markets is more significant than the Russia-Ukraine crisis, which can be seen by capital flow data.

According to Bloomberg, the exchange-traded fund monitoring Hong Kong financial assets recorded four weeks of net capital inflows since Feb 24. During the same period, the southbound capital buying into the Hong Kong bourse via the stock connect mechanisms between Shanghai, Shenzhen and Hong Kong also reported net capital inflows of HK$61.1 billion. No capital outflow has been caused by the Russia-Ukraine crisis.

Past experience shows that geopolitical issues only had a temporary impact on the Hong Kong stock market. The performance of the Hong Kong stock market is more determined by fundamentals and other global macroeconomic factors. The impact of military conflict has so far been short-lived and minor.

Hong Kong's correlation with Russia in terms of direct trade is quite low. The city's demand for energy, industrial, metal and agricultural products is relatively small. Therefore, the impact of the Russia-Ukraine conflict on Hong Kong's energy and agricultural products supply is limited.

Similarly, rising energy prices will exert little impact on Hong Kong residents' daily commutes. The food consumer price index in Hong Kong is more affected by rental and services prices rather than grain prices.

Although the direct impact from the Russia-Ukraine crisis is limited, its indirect impact on Hong Kong's economy and financial markets should not be overlooked.

As a highly-open international financial center, Hong Kong is vulnerable to various elements, including the global economic growth rate, inflation, currency policies adopted by different central banks, capital flows, financial system stability and geopolitical patterns.

The conflict between Russia and Ukraine, followed by successive waves of sanctions, further disrupted the already tense global commodities supply chain. Central banks in Europe and the United States have to speed up and tighten their monetary policies to curb rising inflation caused by soaring commodities prices.

Global liquidity may further contract. Capital will flow out of the emerging markets, resulting in higher financing costs and threatening the stability of Hong Kong's financial markets.

This is especially true if the US Federal Reserve accelerates its pace of interest rate hikes, as liquidity in Hong Kong's money market will consequently contract, which may result in negative impact on Hong Kong's property market and the banking system.

The rise in US Treasury yields may also exceed market expectations if inflation worsens. As the benchmark rate is elevated, companies' financing costs will be raised if they wish to issue more bonds. This may bring more trouble to the US dollar-denominated Chinese corporate bonds. If geopolitical tensions worsen and the liquidity of offshore US dollars deteriorates, bond issuances may be held up this year, similar to the stagnancy of bond issuances seen from March to May 2020. Chinese corporate bonds will be thus pushed into a more difficult situation.

Concerning the huge ups and downs in commodity prices, or the severe sanctions that Europe and the US have imposed against Russia, companies and financial institutions will be affected. As a global financial hub attracting numerous branches of financial institutions from Europe and the US, Hong Kong may not be immune if the crisis escalates.

As Chinese mainland companies now make up more than half of the Hong Kong bourse's total value, the Russia-Ukraine crisis will only indirectly influence the Hong Kong stock market via its impact on the Chinese mainland's economic growth.

In the short term, the Russia-Ukraine crisis may impact China's international trade and domestic economic activity due to the impact on the global supply chain. This will indicate more challenges for the Chinese economy which is already confronting contracted domestic demand, supply-side shocks and weakening growth expectations.

In the mid to long run, the Russia-Ukraine conflict may reshape the global industrial structure and geopolitical relations. China's further reform and opening-up will continue. Some major strategies including the Belt and Road Initiative, the internationalization of the renminbi and dual-circulation may encounter more uncertainties.

Under such drastic changes globally, multinational companies and financial institutions with operations in the US, the Chinese mainland, Europe and Hong Kong will reevaluate their global mapping, asset security, supply chain arrangement, settlement and clearance choices under the different international relations.

Hong Kong's role as an international financial center where global capital is allocated highly efficiently could be dented due to the ongoing "deglobalization" trend.

But on the other hand, individuals and institutions that highly value asset security will show more inclination toward Hong Kong where assets are protected and much convenience is provided for business operations. Such systematic advantages cannot be found in any other financial center.

Hong Kong's investment banks, asset management firms, wealth management companies and other financial institutions may find unprecedented opportunities in terms of mergers and acquisitions, investment and financing. Hong Kong will thus stand out amid the changing geopolitical patterns to become the world's most important asset and wealth management center.

The writer is chief economist at Haitong International Securities. The article is a translated version of an op-ed piece by the writer, together with his colleagues Yang Yixuan and Liu Jing, for the China Finance 40 Forum, a Chinese think tank.

The views don't necessarily reflect those of China Daily.