Most thriving foreign companies in HK staying put

Foreign companies that have flourished in Hong Kong have no doubts about staying in the city, prizing it as a prime site for developing a strong Asian presence despite talk it is supposedly losing its luster as an international business and trade hub.

The raging pandemic led to rigid travel restrictions and quarantines, prompting some foreign companies to leave Hong Kong. Some designer brands and international banks did indeed transfer their regional operations out of the city.

The question of moving never crossed the mind of Alexander Steinkuhl, general manager of SellerX Asia, a German company that has warehouses and offices across the Guangdong-Hong Kong-Macao Greater Bay Area and opened its Hong Kong office in 2019.

"We want to set the base in Hong Kong because the Chinese mainland is where 90 percent of our products hail from," said Steinkuhl, attributing Hong Kong's proximity to a reliable product source and strong consumer market as the best place for his company to anchor itself and thrive.

Founded in 2012 in Berlin as KW Commerce, the company started selling a range of accessories for consumer electronics, with Amazon and eBay being its first online marketplaces. It quickly took off, turning itself into a top Amazon seller within a short time.

In 2014, it opened its first subsidiary in Dongguan, Guangdong province, serving as a primary warehouse before expanding and developing into an independent logistics location in 2016.

Waking up to the challenge of recruiting a diverse group of young professionals in China, the company decided to set up a "bridge" with a Hong Kong office in 2019. That is when Steinkuhl came on board.

It was acquired by SellerX, a leading European aggregator of e-commerce businesses, at the end of 2021. The newly merged company was rebranded as SellerX Asia. Since its creation, the company has secured over $750 million in financing from leading venture capital funds.

Speaking of foreign companies exiting the Hong Kong market or moving their Asian headquarters elsewhere during the pandemic, Steinkuhl said, "I think they had already contemplated moving before the pandemic started."

The pandemic may have hastened the decision-making process. The new normal of remote and hybrid work has reduced the office as a less relevant factor for operations, Steinkuhl said.

"We didn't ask ourselves this question of moving out of Hong Kong before the pandemic, and even during the pandemic, because all the reasons why we were here are still here," Steinkuhl said.

While some banks opted to move, other foreign banks are ramping up their manpower to support their Hong Kong operations.

The size of assets under management in Hong Kong, one of the major wealth management centers in the world, reached HK$34.9 trillion ($4.46 trillion) by the end of 2020, having risen 21 percent year-on-year, according to a survey published by the Securities and Futures Commission of Hong Kong, which regulates financial markets in the city.

The large potential of the Greater Bay Area's wealth management business is enticing more foreign banks to expand their business in Hong Kong, industry analysts said.

"With the launch of the Wealth Management Connect last year and various Greater Bay Area initiatives on the horizon, opportunities are strong for further client-led growth in Hong Kong wealth management," Citibank said in an interview with China Daily.

The US bank plans to triple the number of its wealth clients and double its assets under management in Hong Kong by 2025. To achieve that, it announced last year that it will increase its employees by more than 1,000 across its wealth management business in the city, including over 550 relationship managers and private bankers over the next five years.

For commercial banking business, the lender announced earlier this month that it will hire almost 350 people in the Asia-Pacific region in a move to accelerate growth globally. About one-third will be hired in Hong Kong, the second-largest market by revenue for the company's commercial banking business after the United States.

While the likes of the German company SellerX and Citibank are unequivocal about staying put, some foreign enterprises have withdrawn from Hong Kong.

According to the Hong Kong Census and Statistics Department, the number of US companies headquartered in the city dropped by nearly 10 percent to 254 at the end of June, the lowest number in 18 years.

Ben Simpfendorfer, chair of the Greater Bay Area Council at the American Chamber of Commerce in Hong Kong, does not consider that number a harbinger of Hong Kong's diminished allure for overseas business.

"In our survey of our members about why they consider Hong Kong competitive, three things stand out: the free flow of capital, simple tax regimes and low taxes, and international connectivity," said Simpfendorfer, who is a partner at management consultancy Oliver Wyman.

Despite COVID-19, the first two elements in the survey response-the free flow of capital and taxes-remain unchanged, except for concern about travel restrictions in the region, he said.

"I believe Hong Kong remains an international business hub, with most of its appeal for overseas companies ... for a treasure trove of opportunities staying true," said Simpfendorfer, who underlined the urgency and priority of resuming travel to and from the city.

"The role of Hong Kong may change accordingly. The role is already changing," he said.

But it is the ever-changing nature of Hong Kong that "makes us excited by the new opportunities constantly emerging from the change," Simpfendorfer added.

Contact the writers at jenny@chinadailyhk.com

- China's Global Governance Initiative receives positive feedback at forum

- China's Xizang sees steady tourism growth in 2025

- First-of-its-kind pearl auction held utilizing Hainan FTP

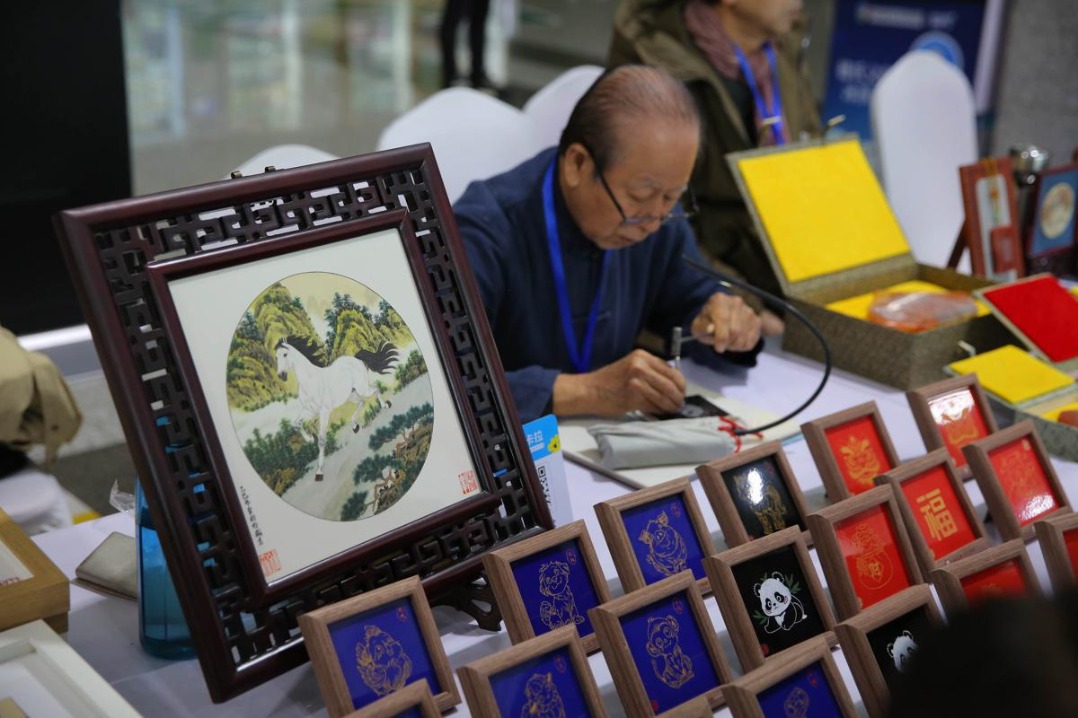

- Agarwood exhibition steeps Shanghai museum in fragrance

- The Fujian Coast Guard conducts regular law enforcement patrol in the waters near Jinmen

- IP protection for new fields to improve