Similar scenario, different consequences

US interest rate hikes unlikely to trigger another financial crisis in Southeast Asia

In the face of the soaring inflation, the US Federal Reserve has no choice but to raise its benchmark interest rate to control commodity prices. The consumer price index in the United States rose 1.3 percent in June, or aggregately 9.1 percent over the last 12 months to hit a 40-year high.

To achieve a so-called soft landing of the national economy, on July 28, the Fed increased its interest rate by 75 basis points and claimed that "another unusually large increase could be appropriate" in September. Over the past few months, it has raised its interest rate several times. Following a 0.25 percent rise in March, the interest rate amounted to a target range of 0.75-1 percent in May.

On June 15, the Federal Open Market Committee emphasized that it is "strongly committed to returning inflation to its 2 percent objective". Toward this goal, it decided to continue raising interest rates and reducing its holdings of Treasury securities, agency debt, and agency mortgage-backed securities.

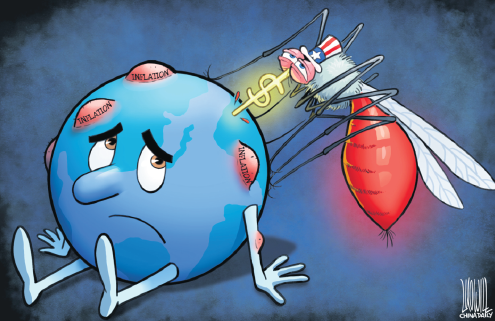

The Fed's hawkish position is a risky signal for others. Former US treasury secretary John Connally once said: "The US dollar is our currency but your problem." When one sovereign currency plays a dominant role in lubricating the global economy, accounting for about 90 percent of all foreign exchange transactions before the pandemic, tightening its supply will have profound implications on global capital flows. Specifically, when the value of the US dollar becomes the strongest it has been over the past decades, it inevitably devalues currencies worldwide. At the same time, as interest rates are now markedly higher in the US than elsewhere, investors are motivated to hold relatively conservative investments such as Treasury bonds to pursue higher returns.

Importantly, the risks derived from the raised interest rates are never equally shared. The last decades have witnessed several boom-and-bust cycles in emerging markets-global investors move into these economies during good times but will suddenly back out when the recipient countries expose deteriorations in the macroeconomy or when the US tightens capital supply. In other words, emerging markets often face more risks and vulnerability than wealth and prosperity when dealing with global finance.

This is why analysts also keep tracking the impact the recently raised interest rates will have on Southeast Asian countries. As they still have a loose peg to the US dollar, the primary challenge is that rising interest rate makes the payments to service existing debt more expensive, which may trigger an outflow of capital investment.

Historically, Southeast Asian countries experienced a similar episode 25 years ago. As the US economy recovered from a recession in the early 1990s, the Fed under Alan Greenspan began to raise the benchmark interest rates to head off inflation. Consequently, the strong dollar made the US a more attractive investment destination than Southeast Asia, which contributed to sudden capital outflows. While not denying the endogenous weaknesses within these economies, like large current account deficits, insufficient foreign reserves, and excessive exposure to foreign exchange risk, raising the interest rate in the US is indeed an indispensable trigger. Hence, in July 1997, when the Thai baht suffered sharp devaluation, a shock wave soon reverberated across the region. The Malaysian currency was devaluated dramatically, and the index of the Kuala Lumpur Stock Exchange went down from 1200 to 260 points. Southeast Asian countries paid heavy prices to recover from the turmoil.

However, even though it is necessary to be alert to the potential impacts, there is unlikely to be another full-blown financial crisis in the region. While pressure on exchange rates and bond yields is likely to persist over the coming months, some solid evidence indicates that many economies are better prepared. First of all, they have accumulated sufficient reserves to hedge the risks attributed to external debt. According to the World Bank, the international reserves to total external debt stocks in Thailand reached 126.4 percent in 2020, in contrast to 24.5 percent in 1997.Similarly, the total reserves equaled 111.7 percent of total external debt in the Philippines in 2020, in contrast to 17.2 percent in 1997. Hence, even though Sri Lanka recently announced national bankruptcy because of its inability to pay off external debt, it is more likely an outlier. Many countries in this region have learned from the painful experiences of the past to build resilience to buttress their currency and national economy.

In addition, many regional countries have also strengthened their current account and fiscal balances. The current account to GDP in Indonesia and Malaysia is 0.28 percent and 3.46 percent in 2021, respectively, in contrast to-2.26 percent and-5.93 percent in 1997.At the same time, the worldwide inflation wave can also benefit countries that export food and commodities.

Overall, despite the hike interest rate backdrop, Southeast Asia is in a relatively solid position. The overheated domestic economy may force the Fed to continue tightening the money supply, which triggers tensions and risks to emerging markets. Nevertheless, we should not overestimate the impacts this time.

The author is an assistant researcher of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at editor@chinawatch.cn