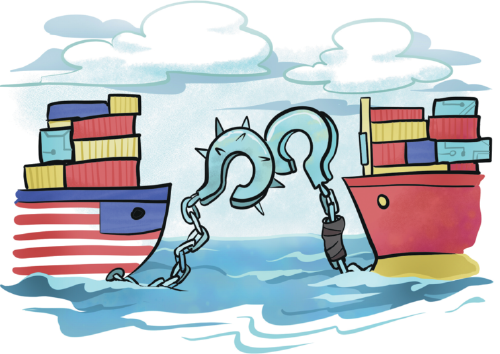

Ballast stone break-up

Economic and trade ties are stabilizer for China-US relationship but these are being eroded by Washington

Editor's note: The world has undergone many changes and shocks in recent years. Enhanced dialogue between scholars from China and overseas is needed to build mutual understanding on many problems the world faces. For this purpose, the China Watch Institute of China Daily and the National Institute for Global Strategy, Chinese Academy of Social Sciences, jointly present this special column: The Global Strategy Dialogue, in which experts from China and abroad will offer insightful views, analysis and fresh perspectives on long-term strategic issues of global importance.

Economic and trade ties have long played the role of the "ballast stone" in the relations between China and the United States. The declining share of Chinese products in the US imports as well as the decoupling in the high-tech area and the breaking of the industry chains of the two countries should sound alarm bells on bilateral economic cooperation.

According to the data published by the US Department of Commerce, the value of the goods trade of the US reached $5.4 trillion in 2022, and China-US trade reached a record high of $690.6 billion, up 5.2 percent year-on-year, maintaining the momentum of growth despite the punitive tariffs and the clamor in the US for the "decoupling" of the two economies. The US' exports to China increased 1.6 percent to $153.8 billion, while its imports from China jumped 6.3 percent to $536.8 billion, which indicates that trade and economic ties remain the "ballast stone" of bilateral relationship.

To break down the data, organic chemicals and pharmaceuticals contributed to the rebound in bilateral trade in 2022, although the trade in mechanical equipment saw a dip. In addition, the US' exports of agricultural and textile products to China have increased.

Chemicals and some electrical equipment were the major drivers of the growth in the US' imports from China in 2022. According to the US International Trade Commission, pharmaceutical products and organic chemicals pushed the US' total imports from China up by 1.3 percent and 0.7 percent respectively, and electrical equipment and automobile and components contributed 2 percent and 0.5 percent respectively to the growth. In comparison, mechanical equipment and rubber products dragged down the US' imports from China by 0.5 percent and 0.4 percent.

The growth of the US' exports to China was boosted mainly by agricultural products and chemicals. Cereals such as soybean and corn, as well as cotton, contributed 2.5 percent and 1 percent to the increase in US' total exports to China; while pharmaceuticals and organic chemicals pushed the exports up by 1.7 percent and 0.6 percent respectively. In comparison, electrical equipment, mineral fuels and mechanical equipment dragged down the US' exports to China by 2.3 percent, 1.6 percent and 1.2 percent respectively.

It should be noted that the strong domestic demand of the US and rising prices are the primary reasons behind the rebound in the China-US trade, while the declining share of Chinese products in US imports shows China's competitiveness in the US is declining.

First, the buoyant domestic demand of the US has led to an expansion in its foreign trade. The bailout and stimulus policies rolled out during the COVID-19 pandemic, the retaliatory rebound in consumption after the easing of control measures, coupled with the lagging impact of the tightened monetary policy, have boosted demand in the US. In addition, the Ukraine conflict has caused shortages in the supply of energy and metals in Europe. As a result, the US has profited from increased exports to Europe, which shored up the robust domestic demand. Thanks to the strong demand at home, the US reported double-digit growth in imports in 2022.

Second, since 2022, major economies have been plagued by rampant inflation, with the prices of key commodities soaring high in a short period of time before falling back gradually. The high prices of raw materials have added to the costs of export enterprises, and pushed up the prices of exports and imports. According to statistics of the International Monetary Fund, the US' import price index rose from 78.9 in 2021 to 95.1 in 2022; and during the same period, the export price index jumped from 91.6 to 108.1. As for US-China trade, according to data from the US International Trade Commission, among all products US imported from China, around 62.4 percent have been purchased at higher prices in 2022; and 56.4 percent the products the US exported to China have higher prices in 2022.

Third, the drop of China's share in US trade has reflected the declining competitiveness of Chinese products in the US, with more market share shifting to the US' neighboring countries such as Canada and Mexico, and so-called friend-sourcing partners such as Vietnam. Data shows that China's share in the US goods trade fell from 14.8 percent in 2020 to 12.9 percent in 2022, while Canada's share grew from 13.9 percent to 14.8 percent. In terms of US imports, China's share saw an even steeper decline — decreasing from 21.4 percent in 2017 to 16.4 percent in 2022, while Vietnam's share nearly doubled from 2 percent to 3.9 percent.

In addition, the past few years have witnessed more signs of China-US decoupling in the high-tech field and industry chains.

On the one hand, China-US trade in high-tech products has performed worse than other categories of products or compared with other countries. In 2022, the US' imports of high-tech products from China decreased by 34.4 percent year-on-year, with China's share in the US' high-tech imports dropping from 31.2 percent in 2021 to 22.6 percent. In comparison, US imports of high-tech products from other countries grew by 2 percent. As for exports, US high-tech products sold to China decreased by 25.7 percent in 2022, and China's share in US high-tech products exports declined from 14.2 percent to 11.6 percent. The US' exports of non-high-tech products to China rose by 5.5 percent in the same year.

On the other hand, China's share in the US' trade of capital goods and intermediate goods has also declined, and China's position in the industry chains has been partly replaced by the US' nearshore-sourcing and friend-sourcing partners. Trade in capital goods and intermediate goods is an important way for a country to take part in the global division of labor and industry chains, and the decline of this indicates the risk of decoupling. According to statistics of the US International Trade Commission, since the onset of China-US trade frictions and the COVID-19 pandemic, China's share in the US' intermediate goods and capital goods trade has decreased remarkably, with the share of China in US exports dropping from 10.6 percent in 2020 to 9.3 percent in 2022, and the share of China in US imports falling from 17.6 percent to 12.1 percent.

This is a signal of the increasing "decoupling" of China-US industry chains.

Despite the turbulence caused to bilateral trade by the political tensions, China-US trade rebounded strongly in 2022, which is in the fundamental interests of the two countries and the two peoples. But, the Joe Biden administration is seeking to build a "small yard with high fences "in the high-tech sector and shift supply chains to its nearshore-sourcing and friend-sourcing partners in a bid to decouple from China in the high-tech area and industry chains.

Competition and cooperation will be the two parallel themes in the China-US relationship for the foreseeable future.

Ni Shuhui is an assistant research fellow of the Institute of World Economics and Politics and the National Institute for Global Strategy at the Chinese Academy of Social Sciences. Cui Xiaomin is an associate research fellow of the Institute of World Economics and Politics and the National Institute for Global Strategy at the Chinese Academy of Social Sciences. The authors contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at editor@chinawatch.cn.