Registration-based IPO a boon for smaller banks

Lenders boasting various advantages expected to make up main float force

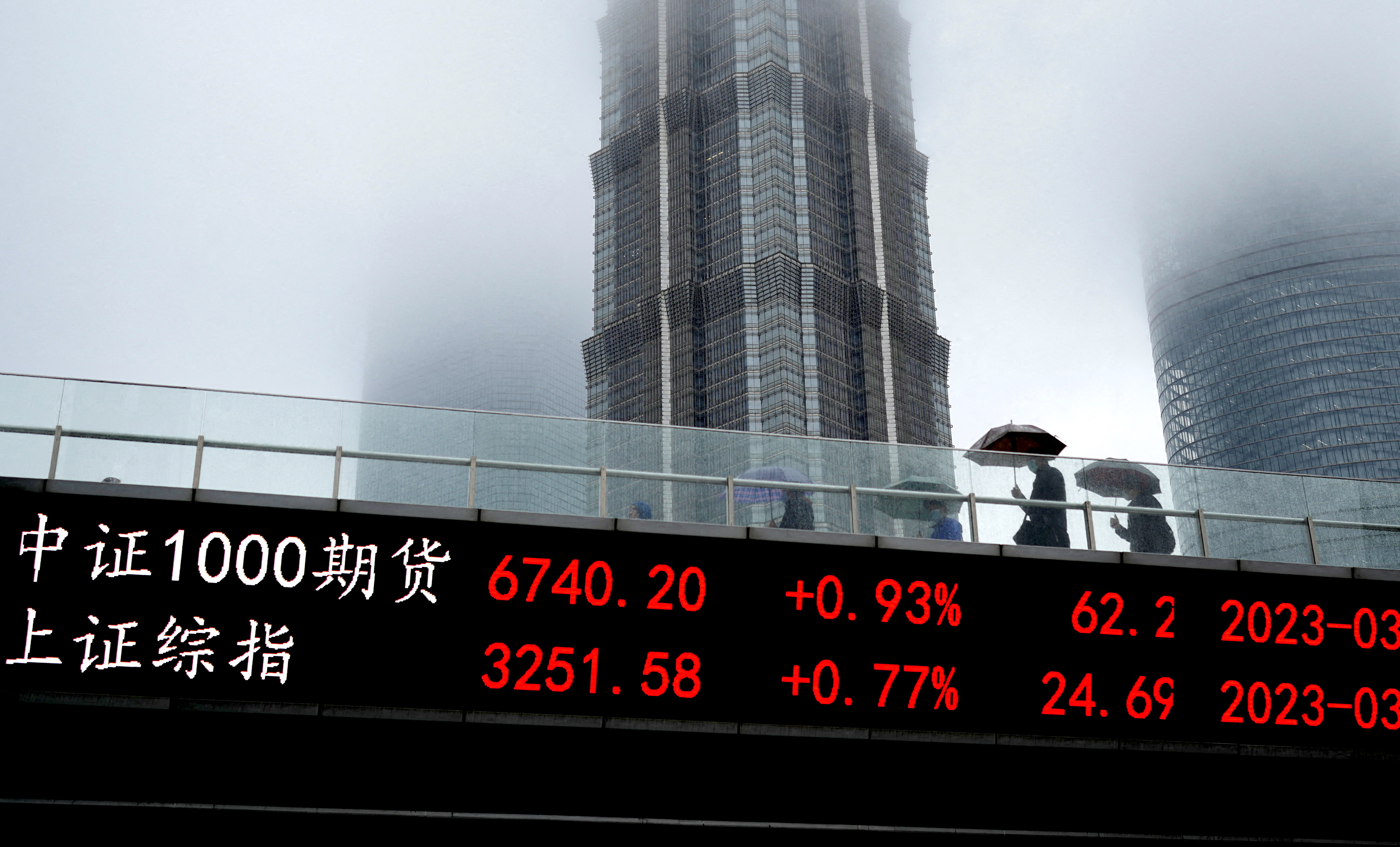

With the full implementation of the registration-based initial public offering system in the A-share market, the number of listed banks in China is expected to increase significantly and IPOs may speed up for small and medium-sized banks, experts said.

China is gradually advancing the transfer of IPO applications of candidates, which refer to companies in the process of examination and approval for listings on the main boards of the Shanghai and Shenzhen stock exchanges, from China's securities regulator to the bourses.

As of Monday, 10 of 11 small and medium-sized banks lining up for IPOs on the main boards of the two stock exchanges appeared on the list of companies being reviewed by the bourses.

China has officially rolled out its across-the-board registration-based IPO system with relevant rules coming into effect on Feb 17, according to the China Securities Regulatory Commission.

Under the new system, the listing review process is more convenient, which is more favorable for banks with excellent performance, and has obvious business advantages and unique development potential, experts said.

Liao Zhiming, chief banking analyst at China Merchants Securities Co, said after the country fully implemented the registration-based IPO system, the number of listed banks is expected to increase significantly and IPOs may accelerate for small and medium-sized banks.

As the difficulty of listing will be reduced, small and medium-sized banks should proactively improve information disclosure and regulate financial management in accordance with the requirements of the registration-based IPO system, in order to go public as soon as possible, Liao said.

Among the small and medium-sized banks, those with obvious localization advantages, clear development strategies, sound equity structures and strong digital genes will become the main force in going public, said Yang Haiping, a researcher with the Institute of Securities and Futures of the Central University of Finance and Economics.

Experts believe that the registration-based IPO system is indeed a boon to many small and medium-sized banks with the aim of replenishing capital through IPOs.

Zeng Gang, director of the Shanghai Institution for Finance &Development, said going public can broaden the capital replenishment channels of small and medium-sized banks and improve their capital adequacy ratios. It can also enhance banks' brand influence, thus improving their competitiveness.

In recent years, the capital replenishment needs of small and medium-sized banks have become urgent. As of the end of the fourth quarter last year, the capital adequacy ratio of China's city commercial banks was 12.61 percent, down by 0.47 percentage points year-on-year. During the same period, the CAR of rural commercial banks in the country dropped by 0.19 percentage points to 12.37 percent, according to the China Banking and Insurance Regulatory Commission.

The main problem currently faced by many small and medium-sized banks is the need to replenish core Tier 1 capital. Under the pressure, IPOs are an optional solution for these banks, said Wang Yifeng, chief analyst of the financial sector at Everbright Securities.

In addition, introducing strategic investors during the IPO process can further promote shareholder diversification and better corporate governance of banks, thereby preventing financial risks, said Lou Feipeng, a senior economist at Postal Savings Bank of China.

The China Banking and Insurance Regulatory Commission said at a meeting on March 13 that various risks and hidden dangers should be dealt with promptly, and the reform of small and medium-sized financial institutions should be deepened to continuously strengthen the security system, ensuring financial stability and holding fast to the bottom line of no systemic financial risks.

Bank loan quality will remain divergent in China over the next 12 to 18 months. Regional banks, including city and rural commercial banks, remain vulnerable to further deterioration in asset quality because of less diversified loan portfolios and higher exposure to weaker borrowers, said a report by Moody's Investors Service on March 15.

The government will remain keen on maintaining financial stability because of indications that security considerations, including banking system risk prevention, will feature more prominently in economic policymaking than before, Moody's said.