Hong Kong is becoming a hub for greentech and green finance

Groundbreaking tokenized green bond issuance in February shows that SAR is at the forefront of new technologies and finance

Hong Kong Financial Secretary Paul Chan Mo-po made a strong pitch on Feb 22 to attract investments to Hong Kong, saying he hoped the city could become a regional hub for green technology and finance.

Hong Kong is already home to a burgeoning list of greentech firms, and it issued its first tokenized government green bonds - the first of their kind in the world - in February. Moreover, Hong Kong was also Asia's top issuer of green and sustainable debts last year, raising $80 billion. According to Chan: "Our aspiration is much higher and bigger. We are determined to position ourselves as the center of green tech and green finance".

To achieve that, Chan said Hong Kong will start by building its green-technology ecosystem and encouraging cross-sector collaboration to commercialize research and development. He said it will also ramp up innovations in green financing, help firms get funds faster and easier, and nurture and attract talent from around the world.

Hong Kong also aims to push forward the development of fintech and Web3, the latter of which Chan called an "important arena where financial innovation can harness enormous opportunities".

Hong Kong's interest in strengthening its position as a greentech and green finance hub is not new. As I mentioned in Hong Kong Rightfully Becoming a Green Finance Hub (April 23, 2021, China Daily HK Edition), by embracing green finance even more, Hong Kong would be consistent with China's goal of reaching its carbon emissions peak before 2030 and becoming carbon neutral before 2060, as listed in the 14th Five-Year Plan (2021-25) for National Economic and Social Development and Long-Range Objectives Through the Year 2035.

Both of China's objectives are crucial for achieving green development. As a comparison, the United States and the European Union aim to achieve carbon neutrality by 2050. If they meet their target, it will have taken the US around 45 years and the EU around 60 years to move from their carbon emissions peak to achieve neutrality, but China plans to do it in just 30 years, which is a very ambitious, albeit reachable, goal.

Therefore, Hong Kong tapping into green and sustainable finance is not only beneficial for the special administrative region, but also consistent with China's objective of paying enormous attention to sustainability and climate change.

Green bond markets have been increasing in size and value for more than a decade. Since the first green bond market opened in 2007, more than $1 trillion worth of green bonds have been issued globally as investors have identified a sustainable and profitable investment option. Oversubscription, where demand exceeds the number of green bonds available, has become the norm for green bond issuances.

Hong Kong is, thus far, quite advanced when it comes to embracing the opportunities offered by green finance and green bonds.

In June 2018, the Hong Kong Special Administrative Region government launched the Green Bond Grant Scheme to subsidize eligible green bond issuers in obtaining certification under the Hong Kong Quality Assurance Agency's Green Finance Certification Scheme. In September 2018, the Hong Kong Green Finance Association was set up, bringing together some 100 market practitioners and business front-runners to promote the SAR as a green finance capital.

Just three months ago, the Hong Kong Monetary Authority confirmed its first HK$800 million ($102 million) tokenized green bond issuance. The one-year bond was priced at 4.05 percent and distributed by a syndicate of four banks - Bank of China (HK), Credit Agricole CIB, HSBC, and Goldman Sachs. The bond used the Goldman Sachs Digital Asset Platform, which runs on a permissioned blockchain.

By doing so, the HKSAR became the first government in the world to issue a tokenized green bond, which shows once again that the city is at the forefront of new technologies and finance.

When issuing the tokenized green bonds, Paul Chan said, "Our Policy Statement on Development of Virtual Assets in Hong Kong issued in October last year sets out that we actively embrace financial innovations related to Web3 and promote steady and prudent market development. The successful issuance of this tokenized green bond marks an important milestone as it demonstrates Hong Kong's strengths in combining bond market, green and sustainable finance as well as fintech."

This tokenized green bond issuance, as well as the recent remarks about Hong Kong becoming a regional hub for green finance, follow the bet on virtual assets in Hong Kong.

On the first day of Hong Kong FinTech Week, celebrated in late October, the Financial Services and the Treasury Bureau made an important announcement regarding cryptocurrencies and other virtual assets: Hong Kong will allow exchanges and other intermediaries to sell assets directly to retail investors.

This change comes four years after the city limited exchanges to serving only those with portfolios of HK$8 million or more, who were considered professional investors, thus excluding retail investors. In this sense, the HKSAR's pivoting toward a friendlier regulatory regime for cryptocurrencies shows that Hong Kong is ready to become an even more important virtual-assets center/crypto hub.

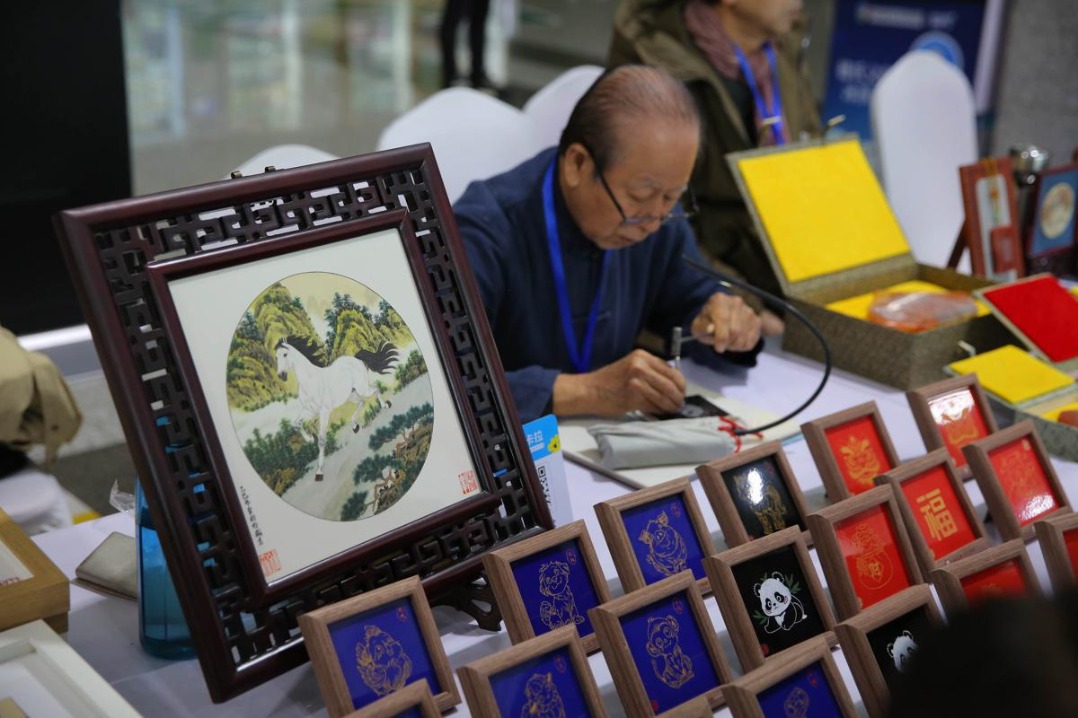

The Financial Services and Treasury Bureau, in its Policy Statement on Development of Virtual Assets in Hong Kong, recognizes the potential of distributed ledger technology (DLT) and Web3 to become the future of finance and commerce, and "under proper regulation they are expected to enhance efficiency and transparency, which in turn will reduce or resolve existing frictions across clearing, settlement and payments. Hong Kong shows signs of a vibrant virtual assets ecosystem, as demonstrated by NFT (non-fungible token) issuance in our market, presence of metaverse developers, and use of DLT in trade, finance, etc. Further opportunities can be realized if we cast our sight further on more use cases, e.g., trading arts and collectibles, tokenizing vintage goods, or in the case of financial innovations, tokenizing a wide spectrum of products such as debt securities".

More recently, in late March, the WOW (World of Web3) Summit Hong Kong 2023 was celebrated. The conference hosted over 5,000 attendees on March 29-30 at a world-class venue, AsiaWorld-Expo. WOW Hong Kong was supported by government institutions Invest Hong Kong and Hong Kong Tourism Board, and was co-hosted by the well-known blockchain ecosystem players Uvecon.VC and MaGESpire, organized by GuyWay, and powered by Market Making Pro. Leaving aside the important topics discussed during the conference, WOW Summit Hong Kong was the first full-scale Web3 event since the city's reopening after COVID-19.

Now that Hong Kong has fully reopened to the world and is maintaining its status as one of the world's most important financial centers, it seems the perfect time for the city not only to promote its role as a Web3/virtual assets hub, but also as a greentech and green finance hub. The investment will definitely pay off.

The views do not necessarily reflect those of China Daily.

- China's Xizang sees steady tourism growth in 2025

- First-of-its-kind pearl auction held utilizing Hainan FTP

- Agarwood exhibition steeps Shanghai museum in fragrance

- The Fujian Coast Guard conducts regular law enforcement patrol in the waters near Jinmen

- IP protection for new fields to improve

- Draft rules define premade dishes in consumer interest