Comprehensive way key to boosting effective demand

Advancing countercyclical policy support should have an even more crucial role to play in boosting China's effective demand and economic growth, as well as achieving long-term sustainability of the world's second-largest economy.

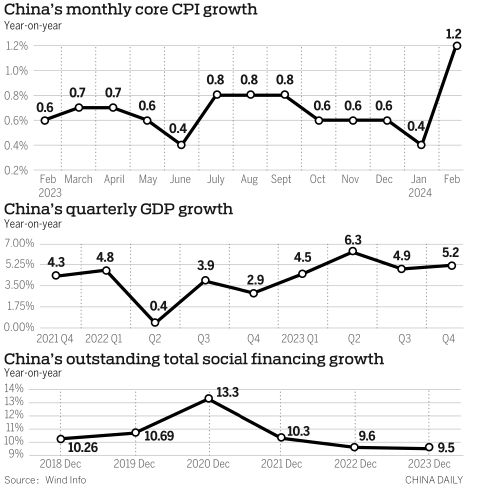

It is believed that major challenges faced by current economic operations are the result of insufficient effective demand. For example, based on our estimations, if effective demand reaches a reasonable level with the core CPI at around 2 percent, the nominal GDP growth rate in 2023 should be 3 percentage points higher than the current nominal GDP growth rate — an increase of 3.8 trillion yuan ($528.6 billion) in nominal GDP, with respective increases of 2.3 trillion yuan, 900 billion yuan and 600 billion yuan in household, business and government incomes.

In this regard, the numbers indicate what a significant role sufficient demand can play in backing employment opportunities, resolving excess capacity, boosting expectations, mitigating various risks and vulnerabilities, and addressing potential external risks.

A comprehensive approach is therefore needed to boost effective demand, which can be achieved through credit growth, which enables expenditures and incomes to rise, followed by profits and investments. To be specific, expanding credit mainly calls for intensified efforts vis-a-vis the following three aspects.

The first involves expanding government borrowing, which should necessitate a total borrowing scale of no less than 11 trillion yuan.

To achieve the 5 percent growth target this year, the required scale of broad fiscal expenditure — government spending and government fund expenditure — stands at about 40 trillion yuan.

Given the current reading, the government needs to borrow at least 11 trillion yuan to have a chance at achieving this goal, which is equivalent to 8.2 percent of GDP and will thus pose no threat to fiscal sustainability.

As domestic inflation levels are relatively low and private sector savings exceed investment, increasing government borrowing and boosting expenditure can more fully utilize economic resources that the private sector cannot fully absorb. In this sense, the move will not lead to inflation, but will inject, rather than squeeze out, private sector spending.

Looking ahead, if the country's ratio of broad government debt/GDP remains stable at the current level, the corresponding broad deficit rate will be 6-7 percent. With intensified implementation of countercyclical policies, the deficit rate is expected to exceed the current level and reach 8-9 percent — a mild increase that presents no harm to long-term fiscal sustainability.

Second, it is encouraged to further advanced monetary policy support by achieving a social financing scale growth of over 11 percent.

To achieve this goal, it is important to make the inflation target of around 2 percent in core CPI heard by all sectors in order to guide social expectations and increase consumption and investment. Lower actual interest rates are also required to create a favorable environment for private investment and consumption. In addition, the role of pledged supplementary lending policy tools should be fully leveraged to support construction of affordable housing, public infrastructure and urban village renovations.

According to our calculations, achieving the 5 percent GDP target requires additional social financing of about 44.8 trillion yuan, with a corresponding stock market growth of 11.4 percent, which also requires around 3 trillion yuan of PSL.

The last aspect calls for a further stabilized real estate market, which is crucial for overall economic stability. On the one hand, it involves assisting property companies to restore their financing channels through government support and regulatory policy adjustments. On the other hand, measures such as loosening purchasing restrictions, lowering mortgage rates and offering preferential loan rates to first-time homebuyers can help developers mitigate risks related to assets such as commercial residential buildings and parking spaces, and improve their cash flow.

The writer is deputy director of the Chinese Academy of Social Sciences' Institute of World Economics and Politics and a member of the 14th National Committee of the Chinese People's Political Consultative Conference, the country's top political advisory body.

The views do not necessarily reflect those of China Daily.