EU's EV tariff a political and economic gamble

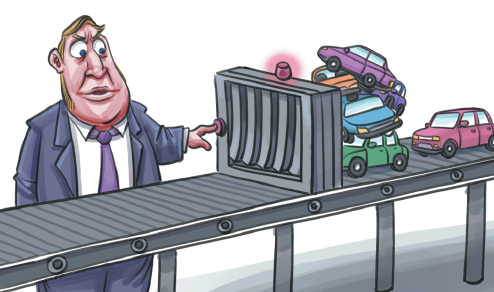

Tariff impositions represent more than just economic conflicts; they embody political and diplomatic confrontations as well. Axiomatically, in June the European Commission announced provisional tariffs on electric vehicles imported from China, ranging from 17.4 percent to 38.1 percent, on top of the existing 10 percent tariff. This move by the European Union could severely deteriorate Sino-EU trade relations.

The European Commission has said that if an agreement with China is not reached, the provisional tariffs will take effect in early July. According to the EU, the tariffs will be imposed on the products of "sampled" companies such as BYD, Geely and SAIC at rates of 17.4 percent, 20 percent and 38.1 percent respectively. Non-sampled participating manufacturers will face an average tariff of 21 percent, while the tariffs for non-cooperating manufacturers will be as high as 38.1 percent. Tesla cars imported from China, too, might be subjected to a separate rate of tariff.

It is reported that China and the EU have agreed to start consultations on the EU's anti-subsidy investigation into Chinese electric vehicles, but the prospects are not optimistic. The EU's motive behind announcing tariffs is clear: to protect its domestic electric vehicle (EV) market and expedite local production, aiming for over 50 percent localization in the supply chain under the European Critical Raw Materials Act. The move is in response to the rapid growth of Chinese-made EVs in the global market.

According to General Administration of Customs, China exported 5.22 million vehicles in 2023, surpassing Japan as the world's largest auto exporter, with the EU being the primary destination for Chinese-made EVs.

In 2023, SAIC sold 330,000 vehicles in the EU, which made up a significant portion of its overseas sales. In contrast, both Geely and BYD sold about 20,000 vehicles each in the EU, representing a smaller percentage of their total overseas sales. A Rhodium Group study shows that SAIC vehicles face the highest import tariffs among all EV imports into the EU, and the third-highest countervailing duties ever imposed by the EU. This tiered tariff strategy is evidently a targeted strike against leading Chinese EV-makers.

The high provisional tariffs will hinder the export of Chinese-made EVs to the EU. The EU-China Chamber of Commerce in China survey indicates that tariffs above 10 percent are considered high and will negatively impact most Chinese car manufacturers' exports to the EU. The current range of 17.4-38.1 percent tariffs are a significant market entry barrier.

The EU's tariff measure against China is not unexpected. In recent years, the EU has increasingly supported industrial policies with stronger government intervention, essentially engaging in strategic protectionism under the guise of industrial policy. In fact, the 2021 EU trade policy paper, "Open, Sustainable and Assertive Trade Policy", said the EU will resolutely use trade defense tools while reforming competition law to align external economic policies with its interests and values, linking economic and security policies more closely.

This signals a trend toward protectionism in EU industrial, competition and trade policies. With China's strong emergence in the EV market challenging the EU's auto industry, the EU has been contemplating severe measures to protect its auto industry.

The recent election to the European Parliament and elections in several European countries show Europe's political landscape is shifting, posing new challenges for China-EU cooperation. And given the rise of right-wing forces, the new EU policy — and decision-makers might intensify their geopolitical maneuvers, potentially reinforcing economic security strategies against China. This could result in increased tariffs and export controls, escalating trade frictions between China and the EU.

Besides, the high tariffs might be the first step in the EU's strategy to counter Chinese-made EVs. More policy tools will likely be used to blunt China's competitive edge in the EV market. Chinese EV investments in the EU, too, will face regulatory constraints, including the EU's recent Net-Zero Industry Act, Critical Raw Materials Act, new Batteries Regulation, Foreign Subsidies Regulation, and the Carbon Border Adjustment Mechanism. These acts and regulations demand tough requirements of local manufacturing proportions in terms of clean technologies and reliance on specific critical materials from abroad.

However, sharpening an economy's competitiveness by resorting to protectionism is counterproductive. The EU's trade barriers will only make EVs more expensive in the global markets, slowing the transition from petrol-powered cars to EVs and undermining the efforts to combat climate change. As such, the tariff war will alter the global trade system, disrupt the global EV supply chain, and undermine innovation and cooperation in the global EV market.

The author is deputy director of the Institute of American and European Studies at the China Center for International Economic Exchanges.

The views don't necessarily reflect those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.