US tariffs on China unable to stop China trade growth

US president-elect Donald Trump has repeatedly pledged to impose high tariffs on imports from China, including revoking China’s permanent normal trade relations status, resulting in 32 percent tariff, an additional 10 percent tariff, on the basis of the average 19 percent tariff he imposed during his first term in the White House. If he really imposes the tariff after he returns to the White House in January 2025, the trade tension between the world’s two largest economies will escalate drastically, causing serious damage to bilateral trade and world’s multilateral trading system.

The fundamental narrative for unilateral tariffs is trade rebalance, which will cut down huge US trade deficits. It is a sheer wish. There is no such a theory, nor any proof by practice over the past decades. During the second term of Obama administration when no massive tariffs were imposed, the US’ global trade deficit only grew by $4.8 billion. During the first term of Trump administration when he imposed tariffs on over $400 billion goods, the US trade deficit soared by $166.2 billion. During the following Biden administration when Trump tariffs were maintained, the US trade deficit soared again by another $160.6 billion during 2021-23.

Hence, Trump’s real purpose is to cutting down tremendously imports from China, to quench China economic growth on the one hand, and to protect home manufacturers on the other.

The past 7 years practices have proved, however, just the opposite.

Two cycles of Chinese exports to the US show tariff effect only temporary

The massive import tariffs on over $370 billion imports from China, imposed during July 2018 to December 2019, did cause a straight fall in China’s exports to the US in 2019 and H1 2020. According to Chinese customs data, Chinese exports to the US fell 12.5 percent in 2019 to $418.67 billion, compared to $478.42 billion in 2018. However, Chinese exports to the US started picking during Q2 2020, ending the year at $451.81 billion, 7.9 percent over 2019, only 5.6 percent lower than the 2018 high. The recovery continued in 2021 and ended the year at $576.11 billion, 20.4 percent higher than 2018, or the pre-tariff high.

Chinese exports to the US resumed sharp fall again in September 2022, not because of tariffs, as there were no new tariffs imposed by the Biden administration, but by the high-tech ban or restriction policy, known as “small yard, high fence”. As a result, Chinese exports to US fell 13.1 percent again in 2023, to $500.29 billion. Even so, it started recovery again since the start of 2024. The first 11 months of 2024 saw Chinese exports to the US at $475.67 billion, 3.9 percent up a year ago, with exports in November at $47.31 billion, annualized at $567.71 billion, 97.6 percent of the 2022 high.

Considering the yuan depreciation to the dollar during the past year, we also compare them in yuan term, which shows that Chinese exports to the US reached 336.47 billion yuan in November, 2024, annualized at 4037.64 billion yuan for 2024, already 4.3 percent higher than the historic high of 3870.65 billion yuan in the whole year of 2022.

Export category examination shows US tariff unable to check Chinese global exports

According to US Department of Commerce trade data, during the period 2018-23, the sharpest fall in imports from China happened in computer and electronics, off 30.5 percent, apparel, off 40.6 percent, and furniture, off 51.7 percent. The falls also happened in machinery (off 20.9 percent), metal products (off 12.5 percent), rubber and plastic products (off 9.4 percent) and chemicals (off 1.7 percent). Only electric equipment kept a modest growth, up 3.2 percent.

Then we compare that with Chinese official global export data in the relevant product category. It shows that, during this period, Chinese global exports in mobile phones fell by 21.0 percent, and that of automatic data processors grew by only 9.0 percent, due to, partially, the sharp fall in the US market. On the other hand, apparel and furniture exports rose by 1.0 percent and 19.6 percent, respectively, due to increases in alternate markets. The exports of the broad category of machinery and electrical products increased sharply, by 35.5 percent. Among them, IC exports rose by 60.7 percent and automotives exports jumped by 584.1 percent. Total global exports during 2018-2023 increased by 36.3 percent.

As a result, Chinese export share in total world merchandise trade actually increased from 12.9 percent in 2019 to 14.2 in 2023. Among the major categories, computer and parts saw their global share fall 2 percentage points and that of mobile phones decline by 6 percentage points. However, the share of lithium batteries, IC for photovoltaic rose sharply by 15 and 16 percentage points, respectively. Textiles and apparel, and furniture, which saw their exports to the US fall during 2018-23, actually increased their global market share by 1 percentage point and 4 percentage points, respectively. China’s NEV share of world market shot up from 1 percent to 13 percent. The reasons are simple: increases in other markets and in new products have more than offset the fall in the US market.

Market diversification and diversion sidelined the US tariffs and other restrictions

During the 5 years 2018-23, the US share in China’s global trade fell by 2.5 percentage points, ASEAN increased its share by 2.7 percentage points, easily taking away the market yielded by the US, while the share of the EU and the UK combined remained at 14.8 percent unchanged. As the world largest merchandise trading power, China’s export market covers virtually all parts of the world. In 2023, China’s largest export market was Asia, accounting for 47.8 percent of its total exports, followed by Europe at 21.0 percent. The two continents on the East Hemisphere combined accounted for 68.8 percent, or over two-thirds of China’s total overseas market. Africa, Latin America and Caribbean combined accounted for another 12. 4 percent, and the US accounted for only 14.8 percent. During the five years of 2018-2023, China’s total GDP grew by an accumulative 27.4 percent. Apparently, new tariffs and other restrictions by Trump 2.0 cannot quench China’s growth in both global trade and domestic economy.

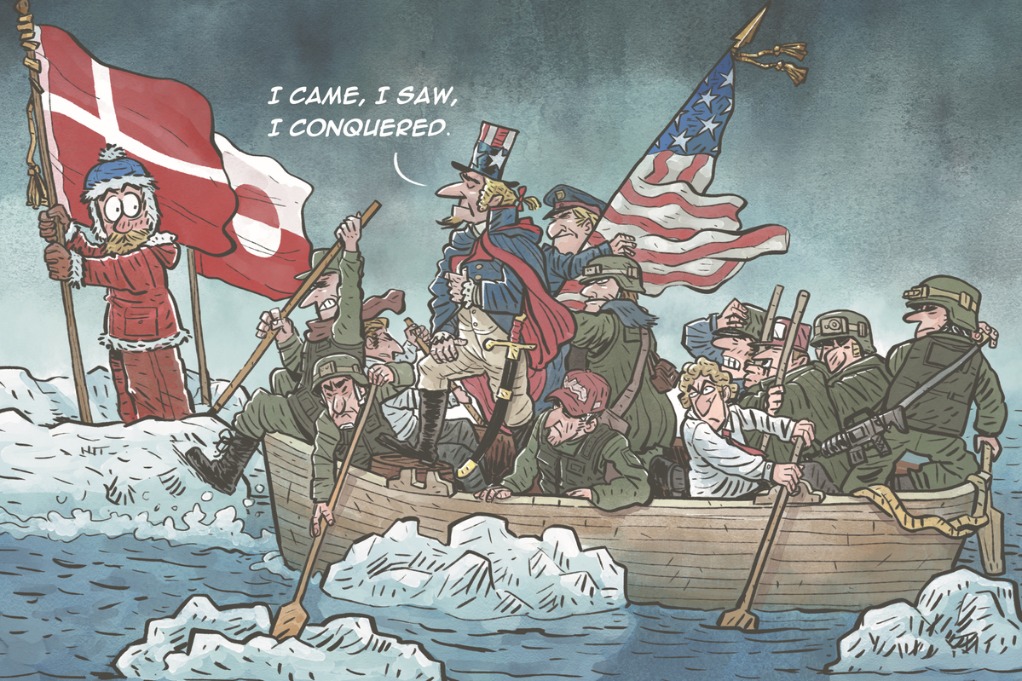

History is the best teacher for both China and the US. If Trump administration 2.0 imposes devastating tariffs and other bans and restrictions on China, three outcomes will definitely happen: First, the Chinese trade and economy will suffer greater difficulties; second, China will ultimately overcome most of them; and third, the US economy and households will suffer heavily. Hence, the correct choice for Trump administration 2.0 is just the opposite, to maintain and expand trade and technology cooperation with China, thus enhancing benefits for peoples of both countries. There is no future relying on tariffs, a wrong and outdated weapon.

The author is senior fellow, Center for China and Globalization, CCG.

The views don't necessarily represent those of China Daily.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.