Policies expected to focus on bolstering demand, stability of yuan

China's monetary policymakers are expected to prioritize bolstering domestic demand while strengthening expectation guidance to prevent any sharp yuan depreciation in the coming year, economists and policy experts said.

Monetary easing will likely take precedence over short-term exchange rate stabilization, as steady economic growth will provide a stronger foundation in the medium and long term for the yuan, which may weaken moderately against the US dollar in the first half of 2025 and rebound later, they added.

Luo Zhiheng, chief economist at Yuekai Securities, said in an interview with China Daily that he anticipates China to increase the intensity of monetary policy easing in 2025 compared with this year — with scope for interest rate cuts of approximately 0.5 percentage point and room for reserve requirement ratio reductions of 0.5 to 1 percentage point — despite short-term pressures on the yuan exchange rate.

Luo said the yuan is facing headwinds from three directions — potential additional tariffs on Chinese exports to the United States, intensified geopolitical tensions, and the greenback's strength amid the elevated US-China interest rate differential as the US slows down interest rate cuts while China is poised for bigger cuts.

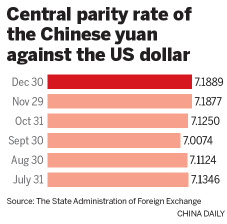

On Monday evening, the onshore yuan was trading at 7.2994 against the US dollar, weakening by 2.92 percent since the beginning of the year, according to market tracker Wind Info.

The ultimate buffer against the challenges for the Chinese currency will be improvements in economic fundamentals, which in turn rely on policy easing to expand domestic demand and additional actions to stabilize the property and capital markets, Luo said.

"The yuan exchange rate may face some depreciation pressures in the first half of 2025, but may rebound in the second half as the policy efforts take effect, experiencing fluctuations but remaining essentially stable," Luo said.

His comments echoed the reiteration from the People's Bank of China, the nation's central bank, to strengthen monetary easing and maintain market-oriented exchange rate policies while managing risks associated with exchange rate fluctuations.

PBOC Governor Pan Gongsheng said the central bank will "increase the intensity of monetary policy adjustments" and reaffirmed the scope for cutting banks' required reserves further, according to a People's Daily report on Sunday.

On Friday, the central bank, in a financial stability report, vowed to "enhance the resilience of the foreign exchange market, stabilize market expectations and keep the yuan exchange rate basically stable at a reasonable level", in line with the tone-setting Central Economic Work Conference.

Lu Ting, Nomura's chief China economist, said the yuan maintaining its general stability would bring more benefits than any substantial yuan depreciation as the former contributes to restoring confidence in the domestic stock and real estate markets, a key priority for China that ranks higher than boosting exports.

Liang Zhonghua, chief macro analyst at Haitong Securities, said that if weakening pressures on the yuan intensify, the central bank has ample policy reserves to achieve the goal of keeping it generally stable.

Potential policy levers include the countercyclical factor, offshore liquidity management, window guidance, which is also known as informal guidance, the risk reserve ratio for forward foreign exchange sales and macroprudential management of cross-border financing, Liang said.

He added that there are signs that the countercyclical factor, which adjusts the yuan's central parity rate, may have recently resumed its role in stabilizing the currency.