Chinese brands burst onto global stage

Labubu's success followed by surge in popularity of domestic products

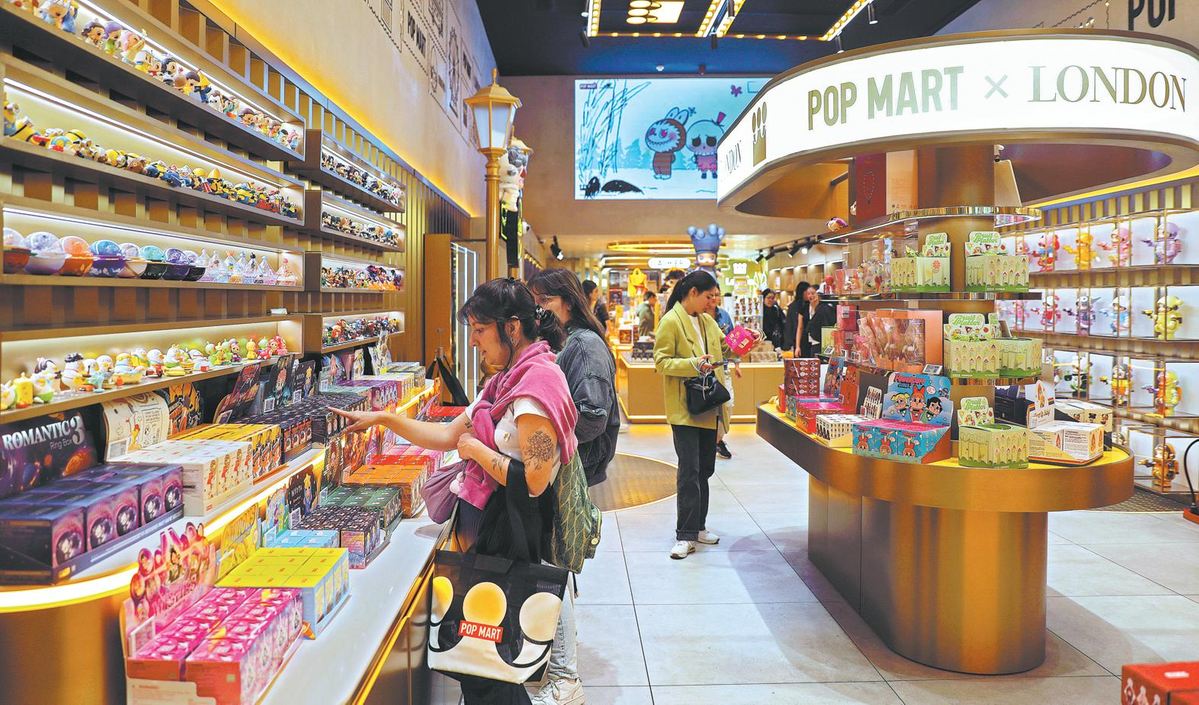

The global frenzy for the Labubu doll has shone a light on how Chinese brands are crossing borders and growing in popularity worldwide.

Domestic toy company Pop Mart's plush toys took off in 2024 after celebrities like Blackpink's Lisa and superstar Rihanna showcased their collections on social media. People now compete fiercely to buy the popular dolls, which have seen a significant increase in resale value.

Labubu's monster sales have helped Pop Mart, built on the concept of high-quality blind box toys, grow into a billion-dollar business. It now operates over 400 stores and 2,000 vending machines worldwide.

Meanwhile, other Chinese brands have either already proved to be an international success or are in the process of doing so.

Online stores Shein and Temu are both well-known for offering a vast selection of low-cost products shipped directly from China. While Shein has not publicly reported its global earnings, Reuters said the company was valued at $66 billion last year. Temu is owned by Pinduoduo, a major e-commerce platform. The company's market capitalization had reached approximately $184 billion as of Sept 19.

While the rise of e-commerce has caused a decline in many traditional retail stores, lifestyle retailer Miniso has defied the trend.

Miniso was founded in Guangzhou, Guangdong province, in 2016, with the philosophy of "quality, affordability and fashion".

As of 2024, the company had more than 7,500 stores worldwide. It offers a range of products including toys, beauty products, small electronics, stationery, snacks, and household goods. There are over 200 Miniso stores across 40 US states, with membership growing by 250 percent in 2024 to 2 million people, according to the company.

Miniso's global flagship store in New York's Times Square generated nearly $80,000 in revenue on its opening day on May 19, 2023, setting a single-day sales record among its stores globally, according to a media release.

The company is rapidly expanding, launching flagship stores in iconic locations such as Oxford Street in London, the Champs-Elysees in Paris, Seoul's Gangnam District and Tokyo's Harajuku. In July, it opened a 500-square-meter store in Melbourne, Australia.

The NYSE-listed company reported that its revenue last year reached $2.3 billion, a 22.8 percent increase from the previous year. Consumers say they love Miniso products for their cute designs, IP collaborations and affordable prices.

"Brands like Pop Mart have successfully created a 'collectible culture' around their products, using the blind box to tap into psychological drivers like scarcity and the thrill of discovery," Cornell University finance professor Will Cong told China Daily.

"They bypass traditional retail barriers by launching on e-commerce and social platforms like TikTok, building communities and generating viral, user-generated content that provides authentic marketing."

Cong added, "This digital fluency, combined with hyper-agile supply chains that enable rapid product iteration — a 'fast fashion' DNA seen in brands like Miniso and (fashion chain) Urban Revivo — allows them to respond to trends in near real time, keeping their offerings perpetually fresh and relevant."

Beverage bubble

The concept of bubble tea is being taken to the next level — with Chinese beverage companies including Heytea, Chagee, Coco Fresh Tea and Juice, Molly Tea, and Auntea Jenny now operating tens of thousands of stores worldwide.

Heytea can be seen not only in New York's Chinatown. It has outlets in other major traffic areas in the city such as Times Square, Soho, the East Village, and Herald Square, which attract a diverse range of consumers from all backgrounds.

Founded in Guangdong in 2012 by Nie Yunchen, Heytea lays claim to creating the first "cheese tea", which has a top layer of foamy cream cheese added.

Besides offering tea latte, Heytea created a range of beverages that mix fruit with green tea or dairy.

The company has over 4,000 stores worldwide. Its vice-president of overseas strategy and franchising, Yujia Gu, told the Los Angeles Times he believes the US market will be even bigger than China's, due to the rising appreciation of Asian culture.

Yang Jiawen, a professor of international business and international affairs at George Washington University, said Chinese brands are still at an early stage of recognition in the US market. Product quality, effective advertising, competitive prices, and services that emphasize health and safety features will be important for the development of markets in the US and globally, Yang added.

These brands have had huge success in China, and now they are trying to expand their market in the US.

Luckin Coffee is the biggest coffee shop chain in China with its 22,000 stores far surpassing the 6,500 of its US competitor Starbucks.

The company reported that its net revenue last year exceeded $4.7 billion, representing a 38.4 percent year-on-year increase, with much of it due to its rapid expansion. It opened 6,092 new stores, including 6,071 on the Chinese mainland, 21 in Singapore, and five in Hong Kong.

In June, Luckin Coffee ventured into the US and launched its first store in New York.

Sean Brassil, 28, who visited China in April, said he's excited to see the Chinese company in the US, after enjoying the convenience of ordering a beverage each morning from his hotel room and picking it up. "App and pay integration just feels very seamless and the way of the future," he said.

Cotti Coffee — founded by two former Luckin Coffee executives in 2022 — is also experiencing rapid growth with over 14,000 stores worldwide in more than 28 countries and regions.

Unlike Luckin, which is shifting from a price war to focus on quality and brand building, Cotti offers more competitive pricing to attract customers. In China, customers can buy a Cotti beverage for 10 yuan ($1.40). Although Cotti's pricing in the US isn't that competitive, it recently opened its second store in Manhattan.

"The success of the new wave of Chinese brands in the US is driven by a sophisticated playbook that moves beyond the old 'low-cost manufacturing' model. A primary factor is their innovative reengineering of the value proposition," Cong from Cornell University said.

"Brands like Luckin Coffee and Cotti Coffee exemplify a model of 'tech-enabled affordable convenience', using app-based ordering and small-footprint, grab-and-go stores to offer quality products at highly competitive prices. This isn't just a price war; it's a competition of operational efficiency, where technology drastically reduces overheads like rent and labor, allowing them to sustainably offer value that combines affordability with extreme convenience."

Popular clothing brand Urban Revivo, founded in Guangzhou in 2016, is often referred to as the Chinese version of Zara, the Spanish fashion giant.

Urban Revivo has annual sales of around $961 million with 400 stores in China and 19 across the world, mostly in Southeast Asia, according to Forbes. As a major fast-fashion player competing with brands like Zara and H&M, the store adds hundreds of new styles every week. In late February, it entered the US market with a store opening in New York's trendy Soho neighborhood.