|

BIZCHINA> Top Biz News

|

|

China's foreign exchange assets safe

(China Daily/Agencies)

Updated: 2009-02-23 08:01 China's foreign exchange assets were safe and some were even profitable last year despite the global financial crisis, but Chinese regulators and economists are already concerned about the "grave challenges" ahead and will actively manage the country's huge forex reserves. Fang Shangpu, a deputy administrator of the State Administration of Foreign Exchange, told reporters last Wednesday that China's forex reserve assets were safe as of the end of 2008. "We provided abundant liquidity (for the country) to cope with the crisis and at the same time we also made some profits," he said, without elaborating.

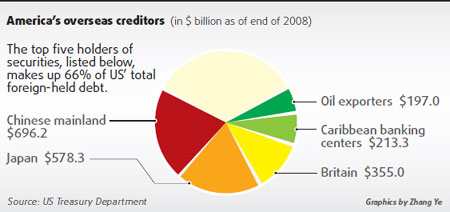

Asked whether China will continue to buy US treasury bonds after President Barack Obama signed a $787-billion bill to rescue the US economy, Fang did not say yes or no, but called for measures to protect such investments. "We hope major reserve currency economies will take active steps to effectively tackle the financial crisis and economic recession ... and protect investors' rights and interests and boost their confidence," he said. China overtook Japan as Washington's biggest foreign creditor in September and as of October held $652.9 billion in US treasury bonds. Its forex reserves reached $1.95 trillion by the end of 2008. Analysts say Beijing is likely to shift its strategy from passive to active reserve management and that such a change is especially urgent and an obvious response to the financial crisis. "The government has sent clear signals it will manage the reserve more actively," said Yin Jianfeng, a senior finance researcher of the Chinese Academy of Social Sciences. Chinese Premier Wen Jiabao said earlier this month China was exploring more efficient ways to use its reserves to boost domestic development. "We hope to use the money to buy equipment and technology, which are urgently needed for the country's development," Wen told the Financial Times. He said the forex reserves must be spent on foreign trade and overseas investment. China's massive reserves have put it in a good position to increase imports to meet domestic demand, which will likely be one of the main ways to use the money, said Yin. The United States and China signed an agreement in January that allows US exporters to sell certain dual-use items to China without acquiring permission from the government. Dual-use products are those that have either civilian or military uses. "China should find new ways to use these funds more efficiently, get a higher return and support domestic development," said Yin. Zhao Xijun, deputy director of the Institute of Finance and Securities at Beijing's Renmin University, said China could also use its forex reserves to make direct investments through commercial banks or support State companies' overseas acquisitions. "Buying more strategic assets, energy and resources is also an important way to efficiently use the reserves. It would help preserve and enhance the value of the reserves," said Zhao.

(For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 一本一本久久A久久精品综合不卡 一区二区国产高清视频在线 | 欧美性猛交xxxx富婆| 草草ccyy免费看片线路| 十八禁国产一区二区三区| 久久精品国产只有精品66| 成人亚洲一级午夜激情网| 狠狠综合久久久久综| 4hu四虎永久免费地址ww416| 亚洲精品一区二区麻豆| 国产在线精品欧美日韩电影| 亚洲日本韩国欧美云霸高清| 免费a级毛片无码专区| 精品人妻少妇嫩草av系列| 污网站在线观看视频| 国产二区三区不卡免费| 尹人香蕉久久99天天拍欧美p7 | 91老肥熟女九色老女人| 日本A级视频在线播放| 国产精品人成视频免费国产| 亚洲人成电影网站 久久影视| 精品www日韩熟女人妻| 亚洲欧美日韩综合久久久| 国产三区二区| 福利一区二区在线播放| 熟妇啊轻点灬大JI巴太粗| 国产亚洲一在无在线观看| 亚洲人成小说网站色在线| 国产激情精品一区二区三区| gogogo免费高清在线| 日韩无专区精品中文字幕| 亚洲午夜理论片在线观看| 久久99日韩国产精品久久99| 国产精品av免费观看| 亚洲精品久久久久国色天香| 被喂春药蹂躏的欲仙欲死视频| japanese人妻中文字幕| 国产偷国产偷亚洲清高APP| 日韩不卡免费视频| 免费人成在线观看成人片| 日韩在线播放中文字幕| 亚洲成人av免费一区|