|

BIZCHINA> Review & Analysis

|

|

Stimulus package has started bearing fruits

By Winny Chen

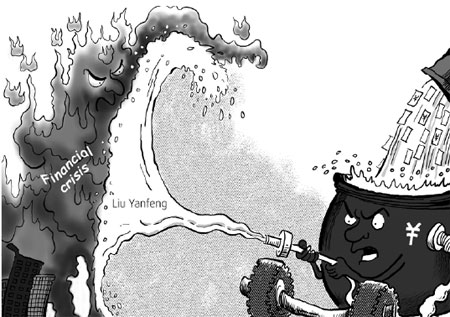

Updated: 2009-05-07 07:40 A growth rate of 6.1 percent in the first quarter of 2009, the lowest in a decade, has reaffirmed the Chinese government's commitment to stimulate its economy through massive domestic spending and targeted foreign assistance. The country's leaders are serious about pulling China out of the economic crisis and helping its trading partners in East Asia do so as well. America should applaud China's efforts.

Bank loans have touched a record high, with domestic loans growing 29.8 percent in March from a year earlier. The China Securities Journal and the Oriental Morning Post have reported that leaders are planning a second stimulus package that would issue guideline policies and continue to use fiscal and taxation measures to fuel growth, though similar rumors in early March turned out to be false. Whatever the case may be, macroeconomic indicators show that China's stimulus package is already having a significant impact. Car sales in March were up 10.2 percent from a year earlier, according to the official data of the China Association of Automobile Manufacturers.

Property sales in major cities are up too. And more importantly, the import of raw materials in March, including crude oil and iron ore, hit record levels in anticipation of greater demand. According to government data, the manufacturing sector in China grew for the first time in six months. The growth has led to speculation that China may have turned a corner, bottoming out from the global economic freefall of 2008. But bottoming out is not recovery. China will likely still take a long time to recover, and a number of daunting challenges remain. A Morgan Stanley report in March warned that the November stimulus may have helped maintain gross domestic product growth, but it is unlikely to deliver corporate earnings. Other critics note that the package has funded too many local pet projects, which could in the long run contribute to China's industrial overcapacity, poor rates of return - bad bank loans in future - and exacerbate China's environmental problems. Moreover, with global - particularly American - demand for Chinese exports declining, China must either lower its production levels or increase domestic demand for goods that were once consumed by foreign countries. Currently, China is doing neither. Instead, it has strengthened its export sector by lowering export taxes, constraining wage rises, and reducing interest costs. If this continues, a critic noted, there will certainly be a backlash from foreign leaders and their citizens. That's why the stimulus' focus on expanding the nation's social safety net is so important. It will directly tackle the primary cause of high savings rate in China and spur domestic consumption, which would offset export declines in the short term and generate sustainable, balanced growth in the long term. For China, the massive 850 - million -yuan healthcare plan, alongside better labor practices and pension plans, and more available public goods together constitute a significant step toward establishing the necessary services that Chinese citizens would need to stop stowing away contingency savings at such high rates. China is also looking to help its neighbors cope with the economic crisis. For starters, China plans to join Japan in contributing the bulk of the funds for the Chiang Mai Initiative, a $120 billion emergency fund dedicated to shoring up consumer demand in the East Asian region. Asian leaders are also talking about broadening regional free-trade agreements, which meant to be the main topic of conversation at the Association of South East Asian Nations summit before the conference was canceled due to protests in Thailand. China has pledged $40 billion to the International Monetary Fund, agreed to participate in a far-reaching cleanup of the global banking system, and committed to continue buying US treasuries, which would allow the US to maintain its stimulus spending so that the Obama administration can tackle today's economic crisis and lay the groundwork for long-term economic recovery and lower federal deficits. Furthermore, China is also laying the groundwork for a more stable trade and investment relationship with the US and its other trading partners. China unveiled plans last week to use its currency to settle foreign trade in five major Chinese cities, starting with Hong Kong. The new system will allow companies to avoid risks in foreign exchange fluctuations and transaction costs, and speed up settlements, according to the Bank of China. The move would also make the yuan gradually more useful across Asia and modernize China's currency system. Still, the most daunting challenge for China remains the collapse of its export industry. China saw its exports fall for the fifth straight month this year, dropping 17.1 percent in March compared to the same month last year. Whether the economy will be able to maintain the needed growth in the face of declining demand in Europe and the US remains the big question. Even with its hefty stimulus spending this year, China will need demand from the rest of the world to sustain its current recovery. That's why it has a vested interest in the buoyancy of its East Asian and western trading partners' economies. China's recovery and the development of a broad, prosperous middle class in the country will be good for the US. A more prosperous China and an expanded middle class provide an additional market for US goods and services, and will ultimately improve American living standards. The Center for American Progress terms it a "virtuous circle" of strengthening global living standards. The US leads the world in healthcare innovation, anti-pollution practices and technology, and green technology, all of which will be needed in any meaningful and sustainable recovery plan in China. As our paper "A Global Imperative: A Progressive Approach to US-China Relations in the 21st Century" notes, helping China help itself, protect its environment and care for its people is a win-win for the citizens of both countries. The author is a Research Associate for the National Security and International Policy team, the Center for American Progress. (For more biz stories, please visit Industries)

|

|||||

主站蜘蛛池模板: 国产极品精品自在线不卡| 成人无码潮喷在线观看| a午夜国产一级黄片| 99热精品国产三级在线观看| 人人妻人人玩人人澡人人爽| 蜜臀av片| 中文字幕亚洲国产精品| 波多野结衣中文字幕久久| 黄男女激情一区二区三区| 国产成人精品无码一区二区| 麻豆一区二区三区精品视频| 制服丝袜国产精品| 欧美大胆老熟妇乱子伦视频| 视频二区中文字幕在线| 无码日韩av一区二区三区| 特级无码毛片免费视频尤物| 精品一区二区三区不卡| 免费视频好湿好紧好大好爽| 熟女精品视频一区二区三区| 91区国产福利在线观看午夜| 国产毛片三区二区一区| 99久9在线视频 | 传媒| 一本久道久久综合婷婷五月| 无码专区 人妻系列 在线| 成 年 人 黄 色 大 片大 全| 久久久精品2019中文字幕之3| 成人做爰www网站视频| 一亚洲一区二区中文字幕| 国产成人一区二区三区免费 | 午夜一区二区三区视频| 成人亚洲欧美一区二区三区| 亚洲国产色播AV在线| 亚洲日本韩国欧美云霸高清| 婷婷国产亚洲性色av网站| 人妻换人妻仑乱| 精品国精品国自产在国产| 国产精品免费视频网站| 亚洲一区二区三区人妻天堂| 欧美大胆老熟妇乱子伦视频| 青草99在线免费观看| 精品亚洲国产成人av制服|