China in top 5 of global ODI table

Updated: 2011-07-27 10:11

(China Daily)

|

|||||||||||

Country now placed higher than Japan and the UK, UN body says

BEIJING - China climbed up the world rankings to fifth-largest outbound direct investor last year and there is still huge potential for a higher placing, the United Nations Conference on Trade and Development (UNCTAD) and economists said.

The World Investment Report released on Tuesday also said that China will continue to remain the top destination for foreign direct investment (FDI) over the next two years, despite growth in this sector declining over the last six months.

|

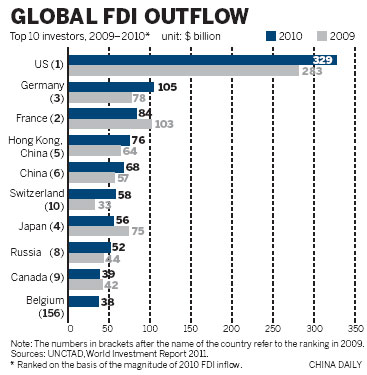

China rose one place to fifth in terms of overseas direct investment (ODI) volume, passing Japan and the United Kingdom, according to UNCTAD.

The top four investing nations and regions are the United States, Germany, France and Hong Kong.

The report showed China's ODI grew by 17 percent over the year to $68 billion, but statistics by the Ministry of Commerce said China's ODI in 2010 surged by 36.3 percent year-on-year to $59 billion.

"China's ODI grew rapidly last year," James X. Zhan, director of the Investment and Enterprise Division of UNCTAD, said.

Mergers and acquisitions played a vital role.

In 2010, China came fourth internationally in volume of overseas deals made through M&A, with the figure reaching $29 billion, following the US, Japan and the UK. This accounts for 43 percent of China's total last year.

"From the perspective of growing momentum and continuously rising GDP, there is amazing potential for China's ODI to grow," Zhan said.

The Ministry of Commerce figures showed Chinese ODI grew by 34 percent to $23.9 billion in the first half of the year. A report by the International Monetary Fund predicted domestic GDP would grow by 9.6 percent in 2011.

The report said global FDI rose by five percent to $1.24 trillion in 2010, 15 percentage points lower than the pre-crisis average.

Developing and transitional economies, including China, outperformed others in outward investment, with a record high of $388 billion in 2010. Their outflow FDI rose by 21 percent year-on-year, accounting for 29 percent of global FDI outflow.

Xian Guoming, senior expert on investment issues at Tianjin-based Nankai University, sees a strong impetus behind China's overseas investments.

"It (going overseas) is a major part of national strategy over the next five years, and ODI is still at a fledgling state."

Although China's accumulative ODI by 2010 grew tenfold from a decade ago to $300 billion, in terms of volume the nation ranked 17th worldwide, lagging far behind many regions and nations, including the US whose accumulative ODI was $4.8 trillion.

According to UNCTAD, the current ODI growth is more "quantitative, than qualitative".

"The majority of Chinese companies with operations overseas have neither real global production systems nor a complete industry chain," Zhan said.

The transnationality index for Chinese companies, an indicator of overseas assets, staff and sales, is far lower than developed nations and many emerging markets, the report said.

"Considering China's large volume of foreign exchange reserves, diversification of investment and its target of transforming the economic and industrial structure, there will be an improvement in the ODI quality over the next decade, and ODI will pass FDI," Zhan said.

Much of China's ODI has gone to the Asia-Pacific region, with the remainder going to Latin America, Africa and the European Union. By 2009, 75.5 percent of China's accumulative ODI went to Asia and 12.5 percent went to Latin America, according to the Ministry of Commerce.

"Asia and Latin America will continue to be the engines driving the growth, and Africa will be the new hotspot," Xian said.

Since China-ASEAN economic cooperative framework agreements were signed in 2002, China's ODI into the region increased 13-fold from 2003 to 2009.

Gao Hucheng, vice-minister of commerce, said at a news conference on Tuesday that China's investment into ASEAN will see a rapid increase and hit a new peak in the years ahead.

Currently, China has five economic and trade cooperative districts to promote its investment in the region in four of the ASEAN nations, and in the next five years, China will have one in each ASEAN nation.