Banks still 'in good shape'

Updated: 2011-11-16 09:02

By Wang Xiaotian (China Daily)

|

|||||||||||

|

A China Construction Bank booth at the 7th Beijing International Finance Expo. The nation's banking system will be in good shape, analysts said, despite an IMF warning that lenders could face systemic risks. [Photo / China Daily] |

BEIJING - China's banking system will be in good shape as the government fine-tunes its macroeconomic policies, despite a warning from the International Monetary Fund (IMF) on Tuesday that lenders could face systemic risks if several major shocks took place simultaneously, said analysts.

Lu Zhengwei, chief economist at Industrial Bank Co Ltd, said that the probability of credit, property, currency and yield curve shocks occurring together is quite slim, and as liquidity is loosened next year, the risks could be contained.

"The whole system is still strong and healthy enough to counter major risks," Lu said.

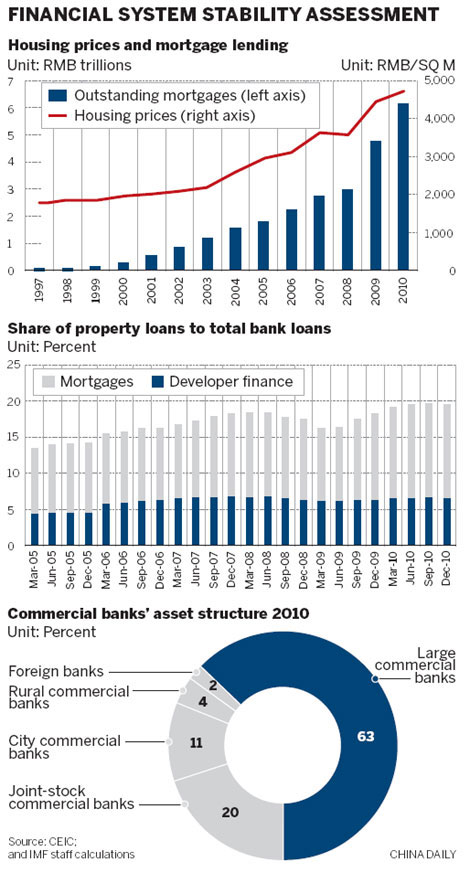

The IMF conducted joint stress tests with Chinese regulators of 17 banks that account for 83 percent of the commercial banking system, as part of a financial stability assessment program jointly developed with the World Bank.

This is the first time China accepted the assessment of financial vulnerability, as a commitment to the G20 Washington Summit in November 2008.

In a report, the IMF said that the assessment shows most "appear to be resilient to isolated shocks" such as exchange-rate changes and deteriorating asset quality in the property market and loans to local government financial vehicles that were set up to finance infrastructure projects.

"However, the system could be severely impacted if several major shocks materialized concurrently," the report said.

The main near-term domestic risks to the financial system include the impact of the recent sharp credit expansion on banks' asset quality, the rise of off-balance-sheet exposures and lending outside of the formal banking sector, relatively high real estate prices and the increase in imbalances due to the current economic growth pattern, it said.

"The risks are manageable and can be addressed by reforms that upgrade the country's capacity to respond to crises while continuing to support strong domestic demand," Bloomberg News quoted Jonathan Fiechter, deputy director of the IMF's monetary and capital markets department, as saying.

To contain risks, interest rates should be the primary instrument to govern credit expansion rather than administrative limits on bank lending, and China needs to overhaul the way interest rates are set and allow the yuan to trade more freely, according to the IMF.

China's banks had built up sufficient capital to weather even the worst-case scenarios in the real estate market and local government loan defaults, said former top banking regulator Liu Mingkang earlier this month.

The risks related to Chinese banks' property loans are "totally" controllable even in the worst-case scenario where property prices fall 50 percent, and the risk of lending to local governments is generally controllable, Liu said.

As of Sept 30, banks had checked and rectified 60 percent of the loans made to local governments through financial vehicles, Liu said.

However, he earlier cautioned that commercial lenders also face risks from "shadow" banking and private financing activities.

The IMF assessment came a day after Bank of America Corp said it will sell a second batch of shares valued at 10.4 billion yuan ($1.64 billion) in China Construction Bank Corp (CCB), the world's second-largest lender by market value, for an after-tax gain of about $1.8 billion.

The bank sold half of its CCB stake three months ago to reduce its holding to 5 percent. After the new sale, it will only hold about 1 percent of CCB's shares.

CCB said on Tuesday that Bank of America's plan to sell its shares would not affect its performance, as the operation reflected market behavior.

Last week, Goldman Sachs Group Inc raised $1.1 billion by selling shares of Industrial & Commercial Bank of China Ltd, the world's biggest lender by market value. It was the third time that Goldman has cut its holding in ICBC.

Lu said it is normal for foreign investors to worry about the asset quality of Chinese banks, after the government encouraged a credit boom during the financial crisis and later tightened liquidity.

But Chinese lenders are still a good bet, and international investors should remain optimistic about high returns, according to Elaine Wong, managing director and head of Professional Services Asia-Pacific at Moody's Analytics.