No let up in home price rises

|

|

|

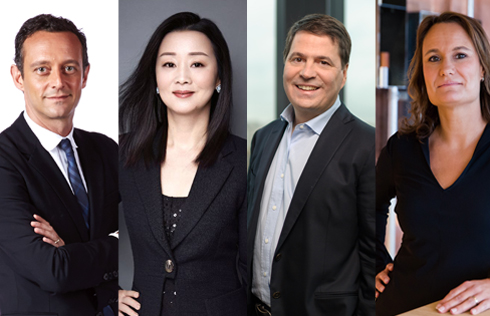

A housing fair in Shanghai. Experts said a 20 percent income tax on capital gains from property sales may push up housing prices. JING WEI / FOR CHINA DAILY |

Tax on secondhand house sales may be transferred to buyers, experts say

Housing prices face significant upward pressure in 2013 due to the possible effect of the current policies and the authorities may tax owners of multiple properties to guard against further price hikes, a top think tank said.

"The tendency of housing prices this year depends on policy selection (by the authorities)," said Li Enping, a property market researcher with the Chinese Academy of Social Sciences, who is also an author of the academy's annual report on the country's real estate sector, which was released on Thursday.

Li said that if local governments decide to strictly implement the tax on secondhand home sales, the prices will inevitably rise because the extra tax will be transferred to buyers, as it is still very much a seller's market.

Meanwhile, Li added, regarding surging secondhand home prices, new properties will also lift their pricing objectives.

In the latest effort to cool the property market, local governments were urged to implement a 20 percent personal income tax on capital gains from property sales, if a homeowner sells the property within five years of its purchase and the property is not the only one owned by the seller.

The authorities in major housing markets such as Beijing, Shanghai and Guangdong said in late March that they would implement the policy, which led to a sharp decline in secondhand home sales in those markets.

Although Li said that other local authorities are only expected to carry out the personal income tax policy on a "selective" basis, he pointed out that the country may tax the possession of multiple properties in the second half, if current policies continue to push up housing prices and worsen the market environment.

"The mismatch between supply and demand has been growing for years," Li said.

He added that the taxes on multiple properties might boost supply and keep overall housing prices at a stable level or even lead to a slight decline.

The tax has been tested in Shanghai and Chongqing since the beginning of 2011, but mostly for buyers of second homes or owners of high-end property.

This week, the State Administration of Taxation denied that the pilot program will be extended to other cities, such as Hangzhou, adding that there is "currently no timetable for a national expansion".

But, according to Li, the property tax pilot program may be accelerated in major cities, and levies will not only be on new homes but also on existing units at all levels.

Meanwhile, he suggested that the current land transfer mechanism, which charges a one-off fee to use the land for 70 years, could be changed to rents paid annually.

The move "could ease financing pressure for developers and provide long-term fiscal revenue for local governments", he said.

Zhang Hanya, a researcher at the Institute of Investment of the National Development and Reform Commission, said the government has been focusing on curbing speculative demand, while a more urgent issue is to add more supply.

"The government should reduce its administrative measures in the housing market and let the market play its role," Zhang said.

This view was echoed by Zhao Song, director of the land price division of the China Land Surveying and Planning Institute, who said that the marginal effect of administrative measures has been declining, and many, such as purchase restrictions, have proven to have brought a negative impact.

Wang Juelin, former deputy director of the Policy Research Center of the Ministry of Housing and Urban-Rural Development, said the market is under the spotlight this year mainly because of the overheated market in first-tier cities.

"However, the property markets in central and western regions remain stable, and some even reported price declines. Such regional differences should be taken into consideration when formulating new policies," he said.