For the United States, regulation has been tightened to address things such as differing mortgage practices and products and improving supervision methods. In the global financial industry, standards need to be set on risk-weighted assets and how capital rules apply, according to Cavanagh.

"Hopefully, we will continue to see more consistency and less opportunity for regulatory arbitrage than existed previously," he said.

New changes occurred among the big multinational financial institutions, Cavanagh said. "Banks are adapting to changes in liquidity and capital requirements, learning how to set up subsidiaries operating around the world and new rules related to certain products and services."

In the meantime, many European banks have been de-leveraging because of the stresses brought about by persistent slow economic growth, tightening regulatory requirements and sovereign debt concerns.

"For global wholesale banks like JPMorgan, we benefit from a very significant economy of scale," Cavanagh said. "We spend approximately $21 billion a year on our resources, people, technology and new products while absorbing the higher cost of regulations."

"JPMorgan has also always been very client-focused and we know that our clients need a global partner," the CEO reiterated.

During last year, this financial giant provided credit and raised capital of more than $1.8 trillion for their clients. The company earned a record $21.3 billion in net income as well as $97 billion in revenues in 2012.

Jamie Dimon, CEO of JPMorgan, wrote in a letter to the company's shareholders in the 2012 annual report: "We are doing big things at a time that calls for just that. We will continue to do so."

However, one thing occurred last year that Dimon is "not proud of" or even "embarrassed" about. It was the "London Whale", a big mistake that created up to $6.2 billion of losses from a complex derivatives trade out of JPMorgan's London offices.

Cavanagh, who can directly report to Dimon as one of the members of the company's operating committee, was appointed leader of a special team of senior bankers and traders to investigate the event that exposed the financial giant to severe criticism.

He was named "Mr Fix It" by The Wall Street Journal.

"Many of the lessons we learned were actually very simple: In businesses where you are taking market risks it's essential to have granular limits set around those activities. Controls weren't in place that should have been," Cavanagh told China Daily.

"More generally, it's important to eliminate activities that aren't core to your bigger mission."

Both talented executives and a tight regulatory system are crucial to running a company that undertakes great risk management and requires controls, said Cavanagh. "But most important is a culture of caring about those things."

"While we have made mistakes, it doesn't change the fact that our culture and the processes around the controls are strong. We are only making them stronger."

He believes that a great company is one that can make a mistake and then fixes it so it doesn't happen again.

Cavanagh said: "We need to eliminate the idea of 'too big to fail', meaning that the objective should be to ensure that if management of any bank fails to do its job, that bank should be allowed to fail in a way that doesn't hurt society."

It requires policymakers and banking executives to work together, he added.

The Federal Deposit Insurance Corp has shut down hundreds of banks over the past several years. The costs associated with the failed businesses are charged back to the banking industry, not to taxpayers, so it does work, said Cavanagh.

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

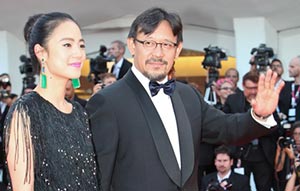

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant