In their preoccupation with fiscal deficits, developed countries' policymakers continue to neglect a different, yet equally critical, shortfall: the trust deficit between advanced and emerging economies when it comes to global governance.

For decades, developed countries' shareholders in the International Monetary Fund and the World Bank used loan conditionality to spur economic reforms - often including contentious fiscal-austerity measures - in the so-called Third World. Through pragmatic, sustained reform efforts, countries like Brazil, China and India turned their economies around to achieve stunning increase in their GDP growth - from an average annual rate of 3.5 percent from 1980 to 1994 to 5.5 percent since then.

But, although developing countries now account for more than half of global GDP growth, advanced countries have yet to admit them to leadership roles that reflect their growing influence in the world economy.

The failure so far of the United States Congress to ratify the IMF reform package agreed to by G20 finance ministers and central bank governors in 2010 is the latest breach of trust - one that makes the promise of adequate representation for emerging economies seem like a shell game. The US' unwillingness or inability to ratify the package - which includes doubling the IMF's funding quota and shifting 6 percent of the new total, together with two directorships, to developing countries - undoubtedly contributed to the decision by BRICS (Brazil, Russia, India, China and South Africa) to establish their own development bank.

In fact, a backlash against Western hegemony in global governance has been brewing for years, with developing countries increasingly turning away from the IMF in favor of creating alternative, regional sources of funding. The Association of Southeast Asian Nations, together with China, Japan and the Republic of Korea, established the Chiang Mai Initiative in 2000, and Latin American countries launched negotiations on Banco del Sur in 2006.

The accelerating erosion of emerging economies' trust in the Bretton Woods Institutions is particularly problematic now, given slow growth and continued economic weakness in advanced countries. While the world economy is expected to grow by 3.3 percent this year, average annual growth in the advanced countries is projected to be just 1.2 percent.

Developed and developing countries alike would benefit from greater economic-policy coordination. While regional groups may obtain some short-run benefits by pursuing narrower interests outside of multilateral channels, neither emerging nor advanced economies can fulfill their long-run potential in an environment characterized by isolationism and a zero-sum mentality in areas like trade and exchange rate policy.

Policy coordination, however, depends on trust, and building trust requires advanced countries' leaders to keep their promises and offer their counterparts in developing countries opportunities for leadership. Instead, developed countries have been taking actions that compromise their legitimacy.

For example, after spending decades encouraging developing countries to integrate their economies into the global market, advanced countries now balk at trade openness. Indeed, despite pledges not to erect trade barriers after the global economic crisis, more than 800 new protectionist measures were introduced from late 2008 through 2010. G8 countries, the supposed champions of the global free-trade agenda that dominates the World Trade Organization, accounted for the lion's share of these measures.

Some question the leadership ability of the BRICS. But many emerging markets are already leading by example on important issues like the need to shift global financial flows from debt toward equity. Mexico, for example, recently adopted - ahead of schedule - the changes in capital requirements for banks recommended by the Third Basel Accord in order to reduce leverage and increase stability.

For too long, developed countries have clung to their disproportionately high influence in international financial institutions, even as their fiscal fitness has dwindled. By ignoring the advice that they so vehemently dispensed to the developing world, they brought the world economy to its knees. And now, they refuse to fulfill their promises of global cooperation.

Leaders of developed and developing countries alike must deepen their commitment to economic reform and integration. But only by giving emerging economies a real voice in global governance - thereby reducing the trust deficit and restoring legitimacy to multilateral institutions - can the global economy reach its potential.

The author is dean of New York University's Stern School of Business and the author of Turnaround: Third World lessons for First World Growth.

Project Syndicate

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

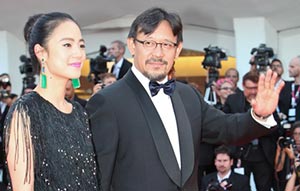

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant