China's social financing volume has increased rapidly in the past 10 months, but it has not been transferred to the real economy for several reasons. Factors such as high financing costs and rapid currency appreciation have made banks and businesses lose confidence in the real economy and thus obstructed the circulation of money. Also, rampant arbitrage has resulted in over-estimation of the social financing volume and thus the growth rate.

Moreover, the "net increase" in the flow of money into the real economy through social financing has also been overestimated, because some enterprises and local governments use it to get additional loans to repay old loans.

Premier Li Keqiang has said the stock of money and credit has been unleashed and activated in response to the recent decline in circulation of money, which can be attributed to investors' and consumers' lack of confidence in the real economy.

If the "cash crunch" in inter-bank loan market cannot be overcome soon, enterprises, banks and other financial institutions will start hoarding more liquidity, which, in turn will further obstruct the circulation of money, creating larger amounts of idle funds. As experts will tell us, considering a cash crunch to be a constant risk, banks tend to invest more funds in high-liquidity assets in order to prevent abrupt liquidity squeeze in the future.

Also, a lingering cash crunch will make it difficult for enterprises to get financing and prevent them from starting new projects in the real economy. Consequently, the demand for loans from the real economy will fall.

The cash crunch has substantially increased the yields of some short-term wealth management products, enticing some financial institutions into indulging in arbitrage. Quite a few financial institutions and enterprises have dropped their plans to issue bonds, which will cause a decline in the flow of funds from the bond market to the real economy.

Many people fear that the cash crunch will stem the growth of bank credit, projecting a gloomy outlook for enterprises as far as new orders are concerned - which again will slow down the circulation of money.

Given the current volume of money supply, some analysts believe the government ought to tighten the monetary policy to drive up economic growth. Others think that the government should raise inter-bank interest rates to punish financial institutions and enterprises indulging in excessive arbitrage, and force capital to flow into the real economy by issuing more money. But neither argument appears effective. A prudent monetary policy is bound to backfire. For one, such a policy cannot boost the stock of money and thus will further reduce the circulation of money. So the central bank has to ultimately change its policy and issue more money to maintain economic growth.

A moderately loose monetary policy will boost banks' and businesses' confidence, and increase the circulation and supply of money. In contrast, a tight monetary policy will result in sluggish economic growth and reduce the circulation of money. In other words, the supply of money cannot be increased amid an economic slowdown.

A moderately loose monetary policy is needed to solve three major economic problems. These problems are: the downward trend of the real economy, the much lower growth of capital in the real economy than that suggested by the volume of social financing, and the floating of the producer price index in deflation territory and the consumer price index in a region just below the government's inflation target.

Perhaps China's policymakers could do with the suggestions that follow.

First, the central bank should make it clear that it is committed to stabilizing inter-bank interest rates in order to restore the confidence of banks and businesses. If commercial banks are convinced that the cash crunch is over, they will no longer hoard liquidity.

Second, interest rates have to be further liberalized by expanding the range of deposit and loan rates, and allowing banks to issue negotiable certificates of deposits.

Instead of focusing on the volume of social financing, China should increase the new credit, say, by 300-500 billion yuan ($49-81 billion) in new bank lending in the second half of the year. But it should refrain from increasing the effective exchange rate of the yuan during the rest of the year.

Instead of allowing signs of a deepening deflation and growth slowdown to become obvious, the authorities should adopt more relaxed credit policies to show their commitment to steady growth in order to boost banks' and businesses' confidence in the real economy.

They also need to differentiate between effects of structural reforms and trade cycles. Structural reforms, such as channeling social capital into various fields, are conducive to medium- and long-term economic growth. But they cannot produce tangible results in some areas, especially in boosting investors' confidence. So in the short term, the authorities should not expect to see steady growth by simply pinning their hopes on reforms while delaying the opportunity to issue macro regulations to counter the trade cycle.

The author is chief economist, Deutsche Bank, Greater China.

(China Daily 07/18/2013 page9)

Models at Ford pavilion at Chengdu Motor Show

Models at Ford pavilion at Chengdu Motor Show

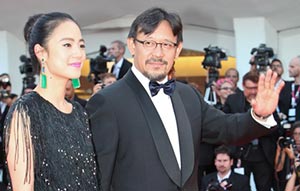

Brilliant future expected for Chinese cinema: interview

Brilliant future expected for Chinese cinema: interview

Chang'an launches Eado XT at Chengdu Motor Show

Chang'an launches Eado XT at Chengdu Motor Show

Hainan Airlines makes maiden flight to Chicago

Hainan Airlines makes maiden flight to Chicago

Highlights of 2013 Chengdu Motor Show

Highlights of 2013 Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

New Mercedes E-Class China debut at Chengdu Motor Show

'Jurassic Park 3D' remains atop Chinese box office

'Jurassic Park 3D' remains atop Chinese box office

Beauty reveals secrets of fashion consultant

Beauty reveals secrets of fashion consultant