Nasdaq Dubai is hoping to lure more bond listings from China, said the Gulf Cooperation Council's second-biggest trading partner after the bourse signed its first deal earlier this month with the emirate.

The exchange is in talks with several unidentified Chinese companies, including banks, about listing securities, Chief Executive Officer Hamed Ali said in an interview this week.

The value of bonds on Nasdaq Dubai almost doubled this year to $26 billion, according to a spokesman for the exchange.

Ali is pushing to add fixed income securities from China as the Nasdaq Dubai - set up nine years ago to be regulated to international standards and to mainly serve institutional investors - has struggled to attract equity listings amid low volumes.

|

|

|

|

"It's certainly a great idea" as it would diversify and add weight to the market, Apostolos Bantis, a credit analyst at Commerzbank AG, said by phone from Dubai on Tuesday. "I wouldn't expect that Dubai will become a major hub for Chinese issuers, but it would manage to grab some share."

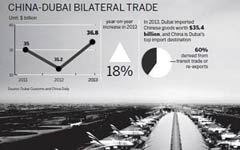

Chinese companies are boosting business in the six-nation bloc, which includes the United Arab Emirates and Saudi Arabia.

Agricultural Bank of China Ltd's 1 billion yuan ($163 million) bond this month became the first Chinese debt to be listed on the Nasdaq Dubai.

Two Dubai-based banks are helping a leasing unit of Industrial & Commercial Bank of China Ltd raise a $300 million loan in the Middle East, three people familiar with the matter said on Wednesday.

"Some of the banks may want to begin lending in the Middle East, and a listing will help investors get familiar with them," Deepti S M, a credit analyst at SJS Markets Ltd in Bangalore, India, said by phone. "There are many investment-grade Chinese companies listed in Hong Kong that may also want to tap the deep pool of Islamic liquidity in the Middle East," she said.

Nasdaq Dubai plans to hold meetings with prospective issuers from China later this year or early in 2015 and will discuss cross-listings as well as capital-raising opportunities, Ali said on Sunday.

There are currently about 40 bonds listed on the exchange, compared with 375 non-government bonds on the Borsa Istanbul in Turkey, according to data on the bourses' websites.

"We're very positive about the prospects of further listings from China, building on our success in attracting the ABC bond and Hong Kong's first sukuk," Ali said, referring to the Islamic equivalent of bonds in an e-mail from Dubai on Wednesday.

"Chinese companies, as well as those elsewhere in Asia, see the value of building links with a highly liquid and dynamic part of the world where trade and business links are increasing."

ICBC said in February it will consider acquisitions in the Middle East as part of its plans to boost earnings from the region by 50 percent this year.

The People's Bank of China and the central bank of the UAE entered a 35 billion yuan or 20 billion dirham ($5.4 billion) currency swap agreement, sources said.

"If trade transactions are increasingly dominated by the renminbi, then the Chinese banks may want to be part of it," Deepti at SJS Markets said.