Tax cuts to boost SMEs' R&D spend

|

|

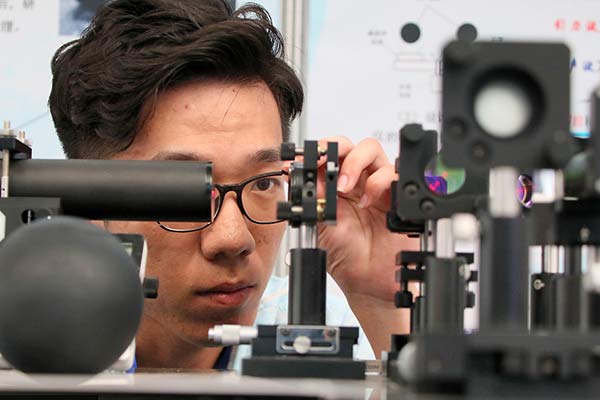

College students test their artificial intelligence devices in their new tech startup in Xi'an, Shaanxi province. LIU XIAO / XINHUA |

Editor's Note: More than a year ago, China extended value-added tax reform to all industries, a measure that may have lessened corporates' tax burden by a staggering 680 billion yuan ($98.7 billion) by April-end. The State Council-mandated latest tax cuts and related benefits seek to give a leg-up to even startups and smaller innovation-driven businesses. For instance, the deductible share of R&D expenditure is up from 50 percent to 75 percent. Reforms will continue. This would mean still lower taxes-and a financially stronger industry can boost the economy. In this special report, China Daily captures the potential impact of the tax measures on various businesses.

Small firms set to underline human resources, innovation, new products

With tax liability lower now, small and medium-sized technology companies in China will likely increase their spending on human resources and research and development, thereby facilitating innovation and stabilizing growth, observers said.

According to a recent statement by the Ministry of Finance, the State Administration of Taxation, and the Ministry of Science and Technology, pre-tax deductions for small and medium-sized tech companies, which were 50 percent of R&D expenditure last year, have been raised to 75 percent from Jan 1, and will remain till Dec 31, 2019.

Seblong Technology (Beijing) Co Ltd, a tech startup engaged in intelligent sleep products, said it supports the lower-tax policy. Gao Song, its CEO and founder, said: "The savings will be used for R&D, team expansion, purchase of top-end equipment and launch of new products."

Founded in 2011, Seblong has launched an app-controlled smart pillow that records sleep data and helps improve the quality of sleep.

"In the past several rounds of financing, the salaries of our employees haven't increased much as we wanted to control the wage bill," Gao said, adding most of the capital goes to R&D.

"Tax cuts are of great significance to SMEs as the latter are less profitable than large enterprises. Tax incentives are good. But what's more important is that we should curtail expenditure and reduce resource consumption, to increase profitability."

Tax burden on businesses would be reduced by around 350 billion yuan ($50.7 billion), a goal set forth in this year's Government Work Report in March. This was further emphasized by Premier Li Keqiang at a news conference on March 15, when he said the country would strive to reduce taxes and charges by about 1 trillion yuan this year.

"We welcome this policy. We'll beef up our R&D efforts, considering that we've excellent engineering talent and strong government support for enterprises," said David Zhu, founder and CEO of Vinci, a smart headphone manufacturer.

The Beijing-based firm has about 60 employees-80 percent are in R&D. Most of them graduated from top universities and had worked at big tech companies such as Baidu Inc and Huawei Technologies Co Ltd for five to 10 years.

"Thanks to tax cuts, our budget allocation will change correspondingly. We will put more money into machine learning algorithm and data processing, which will enhance the company's R&D further from the current level of more than 70 percent of total expenditure.

"We will continue to increase investment in R&D," Zhu said, adding Vinci will put emphasis on artificial intelligence-related areas and the recruitment of talent in key areas. Some expenditure will be for the development and application of intellectual property.

Ni Meng, founder and CEO of Xi'an-based Wingspan Technology, said tax cuts would mean the company could save 1 million yuan and spend it on experts and R&D.

Founded in 2009, Wingspan's businesses cover third-party medical imaging diagnosis and treatment, related R&D, and applications of AI technology.

"The most important thing for the continuous development of high-tech enterprises is talent. We tap into the medical diagnosis sector by virtue of AI technologies, and our urgent need is a large number of professionals who can carry out R&D work," Ni said.