Venture capital and private equity firms have begun to find some new thirst for investment on the mainland after several months of inactivity, the market researcher Zero2ipo said in a recent report.

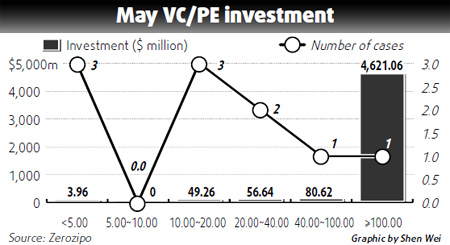

Twenty-six venture capital (VC) and private equity (PE) companies invested $4.81 billion in 15 deals in May after a cautious April that registered only $156 million in total investment, the report said.

The financial services industry attracted by far the most investment in May, some $4.64 billion, or fully 97 percent, of the total.

It was one big deal in the finance sector that dramatically changed the investment mix toward financials. On May 12, PE funds led by Hopu Investment Management invested about $4.62 billion to buy 8.53 billion H shares of China Construction Bank.

Traditional industries had been the recipient of the most investment in the first four months, yet only $100 million in new capital was directed to the sector in May.

The report said initial public offerings (IPOs) in overseas markets have begun to recover as well.

According to Zero2ipo, three Chinese companies were listed in May with a combined capital of $1.35 billion, up 431.7 percent from April. All were manufacturing companies that raised an average of $449 million.

HK-listed Liaoning Zhongwang Group Co, the country's largest aluminum extrusion products manufacturer and the third-largest in the world, raised about $1.3 billion on the main board in Hong Kong, the most among Chinese companies listed in Hong Kong since April of 2008. It was also the world's largest IPO since the beginning of the year.

The other two Chinese companies were listed on the Korea Stock Exchange and Korea Securities Dealers Association Quotations, South Korea's counterpart to the NASDAQ. Six Chinese companies have now been listed in South Korea since August of 2007.

While new capital rose, merger and acquisition (M&A) activities shrank in May, the report said.

The number of M&A deals dropped 27.8 percent from a month earlier to 13 with a total value of $516 million, down 76.4 percent from April. Three M&A deals backed by VC and PE totaled $107 in the IT, traditional and healthcare industries.

M&A deals in traditional industries, including manufacturing, energy, real estate and agriculture, comprised about 82 percent of M&A total in May.

There were three cross-border M&A deals in May, two in mining in which Jilin Jien Nickel Industry Co invested $3.79 million to acquire Australia's Metallica Minerals Ltd and $40.38 million for Canada's Liberty Mines Inc.

Due to the sustained impact from the global financial crisis, total capital raised by VC and PE funds to invest on the Chinese mainland had been in a free fall since the beginning of 2009.

According to Zero2ipo, the total investment by VC companies dropped 71.2 percent year-on-year to $320 million in the first quarter, while the investment from PE funds declined 82.5 percent year-on-year to $2,687 million.

Zerio2ipo showed in another report that a number of renminbi PE funds, represented by a green energy technology fund and an army civilian industrial fund, are preparing to raise capital.

The number of industrial and equity investment funds that have been approved or recorded by the National Development and Reform Commission has reached 20, which together plan to raise 200 billion yuan.

(China Daily 06/15/2009 page4)