Talk about China's long-awaited NASDAQ-style Growth Enterprise Board (GEB) is heating up among Chinese investors, but most of them have adopted a wait-and-see approach.

Like many small traders, Zhang Ming, a 57-year-old investor in Beijing, recently opened an account just to try his luck at new share subscriptions. But he has no intention to trade after the board opens.

"I'll wait for at least one or two months after the board starts trading," said Zhang, who has played the stock market for 15 years.

"After all, it is a new thing in China and there are a lot of uncertainties," he said.

|

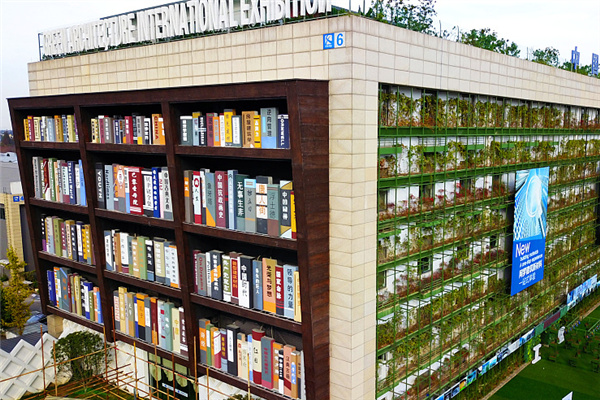

A brokerage in Foshan, Guangdong province, promotes China's new Growth Enterprise Board. CFP |

The high price earnings (PE) ratios and issue prices of the GEB companies are the main reasons for concerns about speculation and scaring away new investors.

The average PE ratio of the 28 firms listed on the new board has reached 60, with two of them even hitting 80 - compared to the average ratio of about 40 on the main board.

The Shenzhen Stock Exchange, which will operate the GEB, said that it would set an 80 percent limit on share-price movements during a stock's first day of trade to curb potential risks.

Money game

But investors still worry that they might end up being victims of the money game.

"The shares of those startup companies seem to be overpriced, and the valuation seems not based on performance," Zhang said.

"I worry that the new board might end up being a money game for us small investors," he said.

More than 9 million investors have opened accounts on the GEB, accounting for just 15 percent of all 60 million qualified investors in China, according to the China Securities Regulatory Commission.

The strict de-listing rules of the GEB have added to worries by small investors.

"It could mean losing all of my money overnight," said Liu Min, a 40-year-old investor in Beijing.

"I'm not going to take risks on a second board, since the main board is already risky enough," she said.

Liu said she is worried that stocks on the GEB could perform like PetroChina, which slumped even below the initial public offering (IPO) price last year and resulted in heavy losses for investors like her.

"I'd rather wait and see how it develops before making any move," she said. "I need to have a sober mind this time."

Chinese regulators and experts have repeatedly warned investors about the risk of putting too much money in small and startup companies and the high possibility of breaking the IPO prices.

Not in a hurry

"We advise our clients not to invest in the GEB too soon," said Fu Yifan, a sales manager with CITIC Securities in Beijing.

Fu said that about 30 percent of his customers opened an account on the GEB, most of whom are only interested in applying for new issues in the hope of selling immediately and reaping a quick profit.

"It is right for investors to take a cautious approach," said Chen Dongwei, an investment consultant with CITIC Securities.

"We have seen unsuccessful examples of similar boards in foreign stock markets and the GEB is likely to be quite speculative at the beginning, so investors should have a long-term strategy," Chen said.

Chen said it is possible that the GEB will see more accounts opening a few weeks after the new board begins trading.

"When the share prices start to rally up, the investors' sentiment will be boosted up, and we will see more investors entering the market," he said.

The NASDAQ-like growth enterprises board, officially called ChiNext, opened trading last Friday. The first batch of 28 selected firms made their debut on the Shenzhen-based exchange with opening prices at 44.57 yuan on average. The first trading day was closed with an increase of 81.02 percent.

(China Daily 11/02/2009 page1)