With China's strong third-quarter economic showing reflecting a rapid recovery in China's economy, investors are listening closely to policy makers' comments for clues about whether the country is beginning to unwind its ultra-loose pro-growth policies.

The State Council, China's cabinet, gave its first clear signal on Oct 22 that it was considering a tighter monetary policy. The State Council said that policy should focus both on managing inflationary expectations, as well as securing steady economic growth, and that the recovery had been "consolidated".

The carefully chosen wording marks a slight shift from the cabinet's repeated insistence in recent months that the world's third-largest economy had to consolidate an economic recovery that was not yet solid, haunted by weak external demand.

|

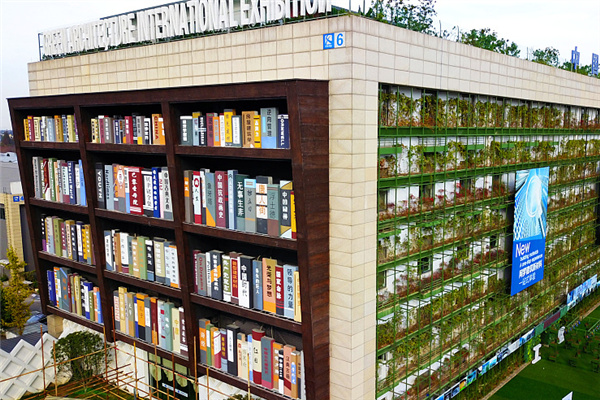

Beijing's bustling Central Business District reflects China's rapid economic growth. However, some experts question whether this growth is sustainable. Bloomberg |

The consensus among China's economy watchers is that China's economy is going to paint a rosy picture in the fourth quarter. Most economists expect even stronger growth in 2010, given this year's relatively low base of comparison.

According to the Lang Run Forecast released by Peking University's China Center for Economic Research (CCER), a major government think tank, China's economy is expected to grow by 10.6 percent year-on-year in the fourth quarter of this year, while its consumer price index (CPI) is expected to rise by 0.5 percent.

The Lang Run Forecast was based on the weighted average of projections from 21 institutions, including CCER, Morgan Stanley, the State Information Center, China International Capital Corp, Citigroup, CITIC Securities, HSBC and UBS Securities.

Of the 21 institutions surveyed, 19 predict an economic growth rate higher than 10 percent for the fourth quarter. Among those, Morgan Stanley has the most optimistic prediction of 11.6 percent.

Risks of inflation

However, behind the strong economic figures, some people have sensed rising risks of inflation caused by the country's bank lending spree and the liquidity in the Chinese market.

China has overseen a massive increase in lending this year. New loans in the first nine months totaled 8.67 trillion yuan, far exceeding the government's initial minimum target of 5 trillion yuan for 2009. The M2, or the broadest measure of money supply, is up 29.3 percent year-on-year.

A debate about the timing for China to switch to any monetary tightening is already in full swing among local researchers, economists and bankers.

Qin Xiao, chairman of the country's sixth-largest lender, China Merchants Bank, recently wrote in an article in the Financial Times that said China should adopt an "urgent" tightening of monetary policy to prevent the huge stimulus measures this year from inflating stock and property bubbles.

Qin added that the government should not be afraid of a "moderate slowdown" in the economy.

"Monetary policy must not neglect asset price movements," he wrote. "Therefore it is urgent that China shift from a loose monetary policy stance to a neutral one."

Fears of an asset bubble

Tomo Kinoshita, an economist at Nomura International, said in a recent report that China risked creating an asset bubble similar to that of Japan in the 1980s if it continued with aggressive lending at the same time it was deregulating its financial markets.

However, Wang Qing, chief China economist at Morgan Stanley, said he believes the inflation rate in 2010 will be a moderate 2.5 percent and will not be a big concern.

"But I understand that the policy makers had profound reasons to put inflation back on the government's agenda, as inflation still poses a potential risk," he said.

Wang said that the change in wording by the State Council does not necessarily suggest an immediate policy change.

"It is highly likely a foreshadowing of what is to come in the next year," said Wang, who ruled out possibilities of any increases in interest rates or changes in exchange rates in the first half of 2010. However, he added, there is a slight possibility for a reserve requirement ratio adjustment.

Policy makers in the United States and Europe have given no sign they are ready to raise rates. The US Federal Reserve said in September that it aims to keep the benchmark rate near zero "for an extended period".

Alex Weber, a member of the European Central Bank's governing council, said on Oct 22 that there is "surely no need to rush for the exit" of monetary stimulus.

The Reserve Bank of Australia raised its official interest rate by a quarter of a percentage point early in October. The move made Australia the first developed economy to raise rates since the global financial crisis began.

Despite concerns about whether China is going to sustain its unprecedented surge of bank lending, China's consolidated recovery also brought new concerns about whether the country will start to withdraw from further stimulus measures.

Remaining proactive

"China's 4 trillion yuan stimulus package is a three-year plan, and it is expected to spend another 500 billion yuan in some investment projects in 2010. Therefore, the country will stick to proactive fiscal policy in the coming year," Ba Shusong, a deputy director with the Development Research Center of the State Council, said last week at an international economic forum in Geneva.

Investment in the first half of the year was largely government-led, but now the sources of growth are more diverse, said Wang Qing from Morgan Stanley.

Capital spending by mostly private real estate developers is now surging in response to the ready availability of credit and growing confidence in the economy, he said, adding that the investment will come from more sources in 2010.

Investment growth

Lian Ping, chief economist at the Bank of Communications, said that investment is expected to grow by more than 30 percent in 2010, spurred by more central government-funded projects and higher business confidence levels.

"Adequate liquidity in 2010 will support rapid economic growth," Lian said, also predicting that credit expansion would not contract greatly next year.

New central government-funded projects, more confidence in the economic recovery and active housing and auto markets will contribute to a huge demand for new loans, he said.

Wang said he believes the government might limit new lending to a normal level, say 7 trillion yuan to 8 trillion yuan for all of 2010, since it is now anticipated that the current ultra-loose monetary policy will allow full-year lending in 2009 to reach 10 trillion yuan.

Some still argue that China's investment was lopsided, going largely to old-fashioned infrastructure projects. Critics said little of it was used to boost domestic consumption, a new growth engine following the collapse of China's export sector in late 2008.

Over the first nine months, the economy grew 7.7 percent. Of that, investment accounted for 7.3 percentage points and consumption 4 percentage points.

(China Daily 11/02/2009 page12)