|

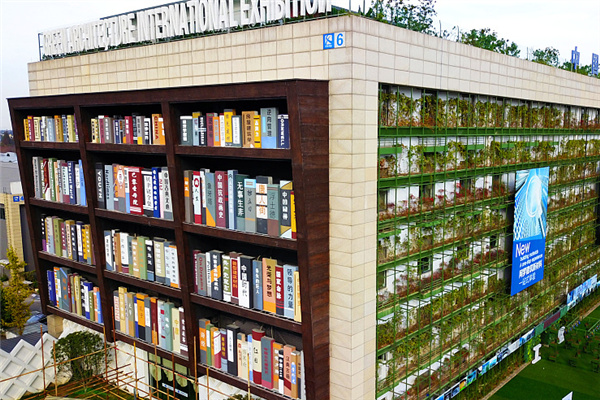

The railway between Chengdu and Dujiangyan under construction in Sichuan province is an example of massive infrastructure projects often funded with?government stimulus money or bank loans. But Chinese banks are being warned to be prudent when lending money to local government-led fundraising operations. Chen Kai |

A top Chinese banker warned domestic banks to control the pace of lending flowing to infrastructure projects backed by local governments, citing concerns about the safety of massive loans being poured into public works construction projects nationwide this year.

Xiao Gang, head of the Bank of China, the country's third-largest lender, said in a recent article published in China's official newspaper, People's Daily, that some of the local government-led fundraising enterprises were borrowing beyond their repayment capacity, which could create "systemic risks" for the Chinese banks.

The enterprises are known as local government financing platforms that seek funding for projects like transportation, water and electricity supply and environmental protection.

"Chinese banks should rein in extending loans to the local government financing platforms," Xiao wrote, but added that the controls should not be realized by putting a sudden brake on such lending.

The Bank of China chairman's remarks came as doubts were mounting about local governments' fiscal capacity to repay the massive funds they borrowed to finance various local infrastructure projects.

At present, local governments are not officially allowed to issue bonds to finance their public works building projects, making bank loans main source of capital for these projects.

"Many such loans were huge and were usually funded by several banks together. If default happens, it will affect the nation's banking industry extensively," Xiao said.

A big chunk of the giant 8.37 trillion yuan in loans extended by the Chinese banks so far this year have been poured into infrastructure projects backed by local governments.

The total debts owed by local governments' financing platforms has surged to more than 5 trillion yuan in the middle of this year from about 1 trillion yuan at the beginning of 2008, according to a research report by Ba Shusong, deputy director of the financial research institute, Development Research Center.

The institute is affiliated with the State Council.

In his estimation, there are more than 3,000 such fundraising platforms nationwide, with 70 percent of them backed by local governments at county levels.

Liu Shiyu, vice president of the central bank, had warned in September that the rapidly growing debts of local government financing platforms could pose a threat to local governments' repayment capacity.

His comments signaled the first sign of official concerns that this year's lending spree might have planted the seeds for long-term problems for the Chinese banking sector.

Chinese banks advanced a walloping 8.67 trillion yuan in new loans in the first quarters this year, more than doubling the amount it gave out during the same period last year in answering the nation's call to shore up the slowing economy.

The rapid loan expansion effectively helped boost the nation's economic growth to 8.9 percent between July and September, but it also caused wide concerns that such a lending spree might help push up asset price and lead to a quick pileup of bad loans in the future.

"These local government-led projects are absolutely not risk-free," Fu Lichun, a banking analyst at Southwest Securities, said.

Fu said the operation of such projects "is quite opaque", which can mean a lack of accurate and sufficient information to identify potential risks.

"Some local officials are taking a gamble to seek financing for all kinds of projects simply for the purpose of enhancing their political achievements and brightening their career path, rather than for the city's development in the long run," Fu said.

She Minhua, an analyst with Haitong Securities, said many of these local government projects are heavily depending on future returns to guarantee loan repayments, such as the highway construction projects, but that some of them might not generate enough cash flow to repay the loan.

Bank chairman Xiao said it is critical to scrutinize where these loans end up to ensure they are not misused.

"It is also important to evaluate the projects' future cash flow situation and safeguard banks' returns by finding multiple sources to guarantee loan repayment," Xiao said.

(China Daily 11/09/2009 page4)