|

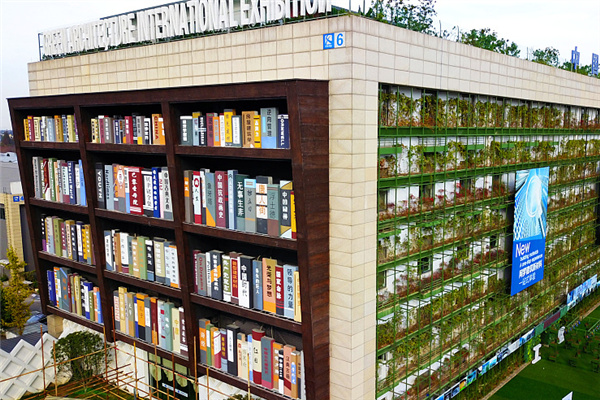

Individual investors buy bonds at a Guotai Jun'an brokerage in Pudong district, Shanghai. Commissions are up for Chinese brokers. CFP |

Riding on the bullish run of the Chinese stock market this year, domestic brokerage houses have pocketed fat commissions. They expect even faster profit growth ahead, betting on the possible debut of stock index futures, margin lending and short-selling next year.

According to figures compiled by Shanghai Securities News, the total commissions earned by 102 domestic brokers amounted to 136 billion yuan from January to November, up 80 percent from a year earlier.

Commission fees doubled for 30 percent of those brokers, led by China Galaxy Securities with commission earnings of 7.53 billion yuan, Guotai Junan Securities with 6.9 billion yuan in commission earnings and Guosen Securities with 6.4 billion yuan.

The hike in commission income, which led to recent rallies in the securities sector, was largely attributed to the ballooning turnover on China's two stock exchanges, buoyed by investors' investment enthusiasm, analysts said.

The benchmark Shanghai Composite Index has climbed more than 80 percent within the first 11 months of this year to become one of the world's best performers. The combined turnover on Shanghai and Shenzhen stock exchanges surged to a record high of 4.8 billion yuan as of the end of November.

Wang Songbo, an analyst from China International Capital Corp, estimated that securities firms will reap around 158.5 billion yuan in income from their brokerage business this year.

But he cautioned that the commission ratio will see a persistent drop, given the expanding number of outlets, even though the turnover hike remains sustainable going forward.

Luckily, brokerage houses are still expected to have rosy earnings in 2010 in anticipation of the introduction of the much-talked-about financial derivatives, which have been discussed by top authorities in recent weeks.

Song Liping, general manager of the Shenzhen Stock Exchange, said on Dec 2 that domestic stock index futures (SIF) and the margin lending and short selling are poised to launch, while applications for the first cross-border exchange traded fund (ETF) has been sent to the top authorities for approval.

The launch of SIF, for instance, has been talked about in the market for three years, but the global financial crisis has placed the products on hold.

The China Financial Futures Exchange (CFFE), on which the stock-index futures will be traded, published rules in June 2007 saying that investors would be required to put up 10 percent of a contract's value to buy, sell or short-sell futures based on the CSI 300. But there was no date given for when the products would start trading.

The debut of such new derivatives is likely to propel significant stock and valuation gains for securities firms, analysts said.

"The rollout of SIF and margin lending and short-selling will contribute as much as 20 percent net profit to brokerages," said Liang Jing, an analyst at Guotai Junan Securities.

Liang added that firms like Haitong Securities, GF Securities and Everbright Securities, which have large assets and high innovation capabilities, will benefit the most from the new products.

Shares of Haitong Securities, for instance, jumped 12.6 percent during nine consecutive trading days starting on Nov 25, when it resumed trading after announcing that it would purchase a 52.9 percent stakes in Taifook Securities, owned by Hong Kong's property developer NWS Holdings, for HK$ 1.82 billion.

"Haitong's bid for Taifook will boost its brand in Hong Kong and help build up its team to have international expertise in operating innovative financial products," said Hubert Tse, managing director and head of international business at Yuan Tai, a Shanghai law firm.

Tse said it's the first such takeover by a mainland securities house, and probably will lead more domestic brokerages to follow suit to turn to their Hong Kong or overseas peers for partnerships going ahead to strengthen their foothold in China.

With cash in hand, it's a good opportunity for Chinese firms to acquire Hong Kong financial institutions to expand their businesses, said Jin Xiaobin, secretary of the board at Haitong Securities.

(China Daily 12/14/2009 page5)