|

CHINA> Chinadaily.com.cn Exclusive

|

|

CPI rebounds to highest level in 11 years

By Dong Zhixin (chinadaily.com.cn)

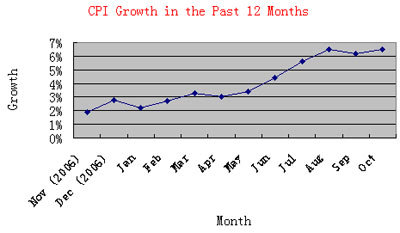

Updated: 2007-11-13 10:45 Consumer inflation in China rebounded to its highest level in 11 years on rising food prices, official figures released on Tuesday showed, increasing the possibility for the sixth interest rate hike this year. The Consumer Price Index (CPI) rose 6.5 percent in October from a year earlier, the National Bureau of Statistics (NBS) said in a statement on its website. The gauge eased to 6.2 percent in September from 6.5 percent in August. Facing rising inflation, the central bank may raise interest rate further, analysts said. "Another interest rate hike may come as early as this weekend," Professor Guo Tianyong of Central University of Finance and Economics told chinadaily.com.cn. Food prices were the biggest driver of the accelerating inflation, jumping 17.6 percent from the same period last year. Among food items, pork witnessed the biggest increase, shooting up 54.9 percent, while vegetable prices rose 29.9 percent, 17.9 percentage points higher than the previous month. Nonfood items rose 1.1 percent. Breakdown of food price increases in October

"The key reason behind the rapid growth lies in the increase in food prices, which has a heavy weighting in the CPI," Professor Guo said. Food accounts for 34 percent of the country's CPI. The consumer inflation for the first 10 months was 4.4 percent, above the official target of three percent, the NBS said. For the whole of 2007, the figure might be around 4.5 percent, the People's Bank of China (PBOC) estimated in a report last week. Another indicator of inflation, the Producer Price Index (PPI) increased 3.2 percent in October from the same period last year, the fastest growth in nine months, the NBS said on Monday.  Inflation may accelerate further "There is a lot of inflationary pressure," Guo continued. He expects the CPI to accelerate further, citing the increase in fuel prices and tighter grain supply. The National Development and Reform Commission (NDRC) raised the price of major oil products by 8 percent earlier this month in the face of surging prices of crude oil in the global market. That might force the transportation, service and other sectors to pass on the rising costs to consumers, Guo explained. "The CPI may reach seven or eight percent soon," he said. However, the surplus productivity in the manufacturing sector might help reduce the price pressure, Guo added. Interest rate hike He urged regulators to shun from frequent price increases, especially utilities, to prevent the further increased pressure. The central bank should use tightening measures to cool down consumers' inflation anxiety, Guo said. Their concerns could lead to a rush on consumer goods, thus pushing up prices. So far this year, the PBOC has increased interest rates five times, with the latest happening on September 15, when the one-year savings rate rose to 3.87 percent. However, the rate of return from bank deposits is still less than the inflation rate, suggesting an erosion of purchasing power for consumers. That sparked an exodus of money from banks to the stock market, whose index has almost doubled so far this year, even after a major correction in the past month. Money Supply Another factor that added to the pressure of another interest rate increase was the runaway growth in money supply and bank loans. In October, the country's broad measure of money supply, or M2, increased by 18.5 percent, while the banks offered 136.1 billion yuan in new renminbi loans. In theory, a rate hike could help curb the demand for loans as it increases the cost of capital, and in turn reduce the money supply. The rapid increase in money supply is due in part to the surging trade surplus, which forced the PBOC to issue more yuan to buy the foreign currency. Trade Surplus China's trade surplus in October jumped to an all-time high of US$27.05 billion, the General Administration of Customs said on Monday, bringing the total in the first 10 months to $212.37 billion. The previous monthly record of $26.9 billion was set in June. To mop up the liquidity, the central bank announced during the weekend the commercial banks must put 13.5 percent of their deposits in the PBOC as reserves. That marked the highest level ever and the ninth increase this year. The ratio might reach 15 percent in 2008, the Industrial and Commercial Bank of China (ICBC) said in a recent report. In addition to increasing the liquidity pressure, the booming trade surplus also gave more ammunition to other countries demanding faster appreciation of the Chinese currency. The European financial ministers urged China to allow the yuan value to rise faster in a meeting on Monday in Brussels, earlier reports said. They would raise the case during the European Union-China Summit in Beijing scheduled for November 28. On Monday, the PBOC set the yuan central parity rate against the greenback at 7.4140, the highest since July 2005 when China ended its peg to the dollar. The new midpoint marked an increase of 5.88 percent so far this year, and a rise of more than 10 percent in over two years. |

主站蜘蛛池模板: 国产蜜臀在线一区二区三区| 疯狂做受XXXX高潮国产| 久久国产精品老人性| 男人添女人下部高潮视频| 国产午夜精品美女裸身视频69| 美女禁区a级全片免费观看| 成人影院免费观看在线播放视频| 深夜福利成人免费在线观看| 丰满妇女强制高潮18xxxx| 国产精品v欧美精品∨日韩| 国产资源精品中文字幕| 欧洲精品色在线观看| 亚洲卡1卡2卡新区网站| 国产suv精品一区二区四 | 一区二区三区av天堂| 国产97人人超碰CAO蜜芽PROM| 人妻无码一区二区三区四区 | 亚洲AV毛片无码成人区httP| 久久综合给合久久狠狠97色 | 99久久激情国产精品| 成人无码AV一区二区| 国产一区二区日韩在线| 亚洲人成电影在线天堂色| 久久香蕉国产亚洲av麻豆| 综合色一色综合久久网| 婷婷色综合成人成人网小说| 国产WW久久久久久久久久| 国产av无码专区亚洲aⅴ| 少妇和邻居做不戴套视频| 中文字幕精品1在线| 亚洲欧美日韩综合久久久| 国产精品黄色片| 国产精品美女自慰喷水| 国产精品天堂avav在线| 三级三级三级A级全黄| 美女扒开内裤无遮挡禁18| 日本久久99成人网站| 精品精品亚洲高清a毛片| 九九在线中文字幕无码| 久热久热久热久热久热久热| 蜜臀98精品国产免费观看|