Students failing to learn debt-control lessons

"Those reports shocked me," Feng said. "Despite being 18 and older, many students are similar to minors because they lack financial knowledge and are easily cheated."

She added that lax supervision has allowed the peer-to-peer loan market to run out of control.

The first attempt to address the problem came on May 27, when the China Banking Regulatory Commission, the Ministry of Education and Ministry of Human Resources and Social Security issued a notice banning unauthorized loan platforms from engaging in the business, especially those that target college students.

Yao Jianlong, a professor of law at Shanghai University of Political Science and Law, praised the regulation, but felt that it didn't go far enough. He said it is more important to improve standards in the industry and to design loan platforms that cater for the specific needs of college students.

Rapid growth

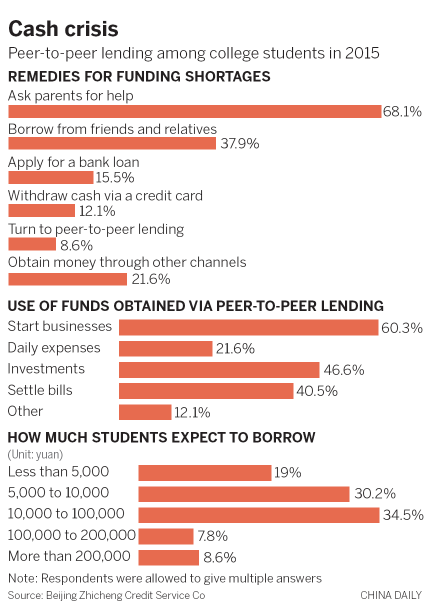

According to Xiong Bingqi, deputy director of the 21st Century Education Research Institute in Beijing, the growth of peer-to-peer platforms in colleges can be attributed to the rapid development of the internet and the decline in credit card use among students.

During the first 10 years of the century, less well-off college students usually turned to credit cards when they needed a source of extra finance, he added.

At the time, banks-most of them State-owned-regarded the student market as an important part of their business and competed to issue credit cards to them. The practice resulted in a situation where many students held several credit cards issued by a number of different banks.

Initially, business was good, but it quickly became mired in controversy after a series of headline-making stories about irrational consumption, swollen overdrafts and failures to repay debts. That resultant bad publicity led banks to become wary of issuing credit cards to students.

"However, as a young group with strong consumption demand, the students' needs were still there. Against such a backdrop, peer-to-peer lending, a substitute for credit cards to some extent, started to mushroom via the fast development of the internet," he said.

Yao said many peer-to-peer lenders specifically target college students, who usually have little money or unstable incomes but have great consumption potential.

Those factors have led to the growth of unscrupulous operators who are thirsty for profits, but lack standards or regulations.

"These platforms call themselves 'peer-to-peer lenders for campuses', but actually some are disordered and a large number have failed to obtain authorization from the banking regulators. That has resulted in tragedies for some students and pushed others to commit crimes, such as fraud," he added.

According to a survey by wdzj, a website that provides information about the peer-to-peer loan industry, there were about 3,000 such platforms in 2015, and 108 of them targeted students exclusively.

Statistics from Mingxiao Loans, a company that lends money to college students, show that from April last year to July, at least 41 cases of fraud related to on-campus peer-to-peer lending were reported at educational establishments in 22 provinces and regions.