Japan luring Chinese property shoppers

Updated: 2010-05-11 07:37

By Oswald Chen(HK Edition)

|

|||||||

|

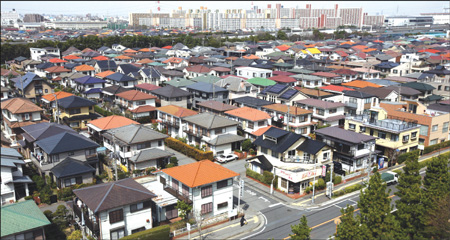

Sluggish property prices and extremely low interest rates are fueling overseas property investments in Japan. Tomohiro Ohsumi / Bloomberg News |

The year 2009 saw a rebound in various asset markets as ultra-easy monetary policies around the world have flooded financial markets with ample liquidity. Loads of cash is being poured into different assets to chase better investment returns. The Japanese property market is one of the hot picks as the market is offering good bargains to overseas investors again.

Global real estate solutions provider Cushman and Wakefield said in its latest global property market survey report that the Asian property market will be increasingly important in global property investments. China and Japan will be the two biggest property investment destinations for overseas investors, as the two markets offer ample investment opportunities.

Even Chinese property investors are now attracted by the potential of the Japanese property market.

Japanese media have reported that more Chinese property investors are scrambling for Japanese property. A Chinese buyer bought a property in the Tokyo Bay area for $1.07 million for investment or residential purposes. In another case, a Fujian tourist brought a 30-square meter small flat for $323,000 when she just spent her holiday in Tokyo. She does not think the investment is expensive and expects good return from it.

Business consultant Christopher Dillon who has extensive property investment experience in Japan and Hong Kong, has recently written a book titled Landed: The Guide to Buying Property in Japan. The book cited a series of financial and market factors to explain the increasing popularity of the Japanese property market to overseas investors.

Sluggish prices explain the attractiveness of Japanese investment properties. "Compared to the skyrocketing property prices in the Chinese mainland and Hong Kong, Japanese property prices are relatively reasonable. This can create returns in price appreciation," said Dillon.

Relatively high rental yields provide another source of investment returns. The average rental yields for residential properties in Japan hovered at around 5.5 percent in 2009, according to Global Property Guide research. As Japanese property prices fell at rates much greater than rentals did from 1995 to 2008, this helped push up rental yields.

The low interest-rate environment is another factor that encourages investors to buy Japanese properties. As the Japanese Central Bank maintains an extremely low interest rate, the financing cost is so low that overseas investors can consider Japanese property investment as lucrative, Dillon said.

He added that lending policies of the Japanese as well as of overseas banks are increasingly friendly to overseas investors, as they can access mortgage loans that equal 90 percent of the property prices, while they need provide only a 10 percent required down payment in making the property investments. This can leverage more returns for overseas investors.

In addition, the developed infrastructure and legal system in Japan, the unrestrictive policy on foreign nationals purchasing Japanese properties, and the pro-landlord nature of the Japanese rental market are also conducive to the appeal of the property market to overseas investors.

However, Dillon warned that Japanese property investments also entail several business risks.

First, investors should be aware that the main character of the Japanese property market is that the apartments have no appreciation value. It is the land that underlies the condominium units that creates appreciation values. This is because Japan is an earthquake-prone country, making the value of land more significant than the houses built on them. Currently, houses built more than 30 years ago will be demolished for reconstruction.

Second, information asymmetry in the property market creates market inefficiency in the sense that it is difficult for investors to access property pricing information, Dillon said.

Moreover, most of the information is in Japanese, meaning that overseas investors have to incur additional costs in doing document translation work, he added.

Third, property investments in Japan also face natural hazard risks such as earthquakes, and soil and water pollution caused by industrialization, he said.

China Daily

(HK Edition 05/11/2010 page2)