Property: Industry hopes for a breather

Curbs on real estate sector may stay for some more time

Over the last two years, the real estate sector has been a barometer of the buoyant growth in China. Such has been the runaway growth that policymakers are struggling to keep the sector from bursting it seams with tightening policies.

But with fresh signs of an economic crisis in the US and Europe brewing, experts believe that the more loosening policies for the sector are on cards.

|

"For a populous nation like China, the first and foremost task in a financial crisis is to maintain stable growth and ensure sufficient employment," he says.

Property purchase often involves huge spending and hence is viewed as a fast way to shore up consumption and boost the economy.

"It was a silver bullet during China's fight against the financial crisis," he says.

Yu Bin, director of the Department of Macroeconomic Research at the State Council Development Research Center, had in 2009 indicated that the real estate sector was a lifeline to the Chinese economy as it has direct links to 60 industries like steel and cement.

Back then, the Chinese government rolled out stimulus policies such as easy credit and tax concessions that helped fuel the growth of the real estate sector. Before that, the sector had seen a price correction of more than 40 percent especially in cities such as Beijing and Shanghai.

The rising property prices forced policymakers to come out with a slew of policies to keep a lid on home prices since April last year. Such actions saw the industry, which accounted for about 10 percent of China's GDP in 2009, go into a lull, with price growth slowing and transactions declining.

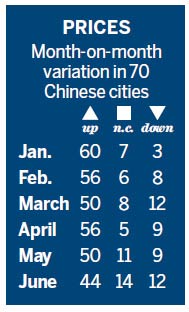

Figures from the National Bureau of Statistics showed that in June, property prices fell in 12 of the 70 major cities monitored, and remained unchanged in 14, when measured against figures in May.

Wang Wei, a director of Beijing Gold Time Realty Development Co Ltd, a real estate developer in the Chinese capital, says financing and sluggish sales are the two major issues for the real estate sector.

"We are facing a hard time. We hope there will be some loosening," he says.

Wei Dong, head of research for North China at DTZ, a global real estate advisory, headquartered in London, believes the government will not loosen its grip until the end of 2012, when the first batch of newly built affordable homes are allocated. China plans to construct 36 million affordable flats for low-income groups from 2011 to 2015.

Some analysts believe the government will stay away from stimulating the property market unless China's economy is facing a difficulty as huge as the 2008 financial crisis.

"The government has realized the risks of an excessive reliance on the real estate market, and I don't think it is going to give up the current tightening just because of a mild slowdown," says Zhou Feng, an independent financial analyst based in Shanghai.

Using the property market as a stimulant for the economy has also several side effects such as over-reliance on land sales for government revenue, lack of funding for creative industries and growing public concerns.

"The property market will be the last thing the government will resort to in reviving a flagging economy," he says. "If there is a Plan A, property market will always be the Plan B."