Continually Implement Moderate Monetary Policy and Guard against Excessively Rapid Growth of Investment and Credit Loans*

2006-06-01

By Ren Xingzhou

Research Report No 093, 2006

I. The Overall Trend and Features of the Economic Performanceduring the First Quarter

1. During the first quarter of 2006, GDP continued to increase and economy kept rising

(1) GDP continued to grow rapidly. During the first quarter of 2006, the national economy continued to maintain a momentum of fast development. The Gross Domestic Product (GDP) amounted to 4331.3 billion yuan, up 10.2% year-on-year, being faster than the growth rate of 9.9% in the same period of last year, which had been the highest growth rate of GDP since the second quarter of 2003 (See Graph 1).

Graph 1 GDP Growth Rates in Various Quarters Since 2004

Source: China Monthly Economic Indicators

During the first quarter, growth of industrial production was accelerated and the economic benefit continued to improve. Industries above designated size throughout the country fulfilled an added value of 1782.2 billion yuan, showing a year-on-year increase of 16.7%, 0.5 percentage points faster than the same period last year. Meanwhile, profits of the industrial enterprises still maintained a fast growth. Profits realized by industries above the designated size increased by 21.3% year-on-year; sales rate for the products of the industrial enterprises above the designated size reached 97.10%, falling 0.27 percentage points year-on-year.

(2) Fixed asset investment continued to increase rapidly at a higher level. During the first quarter, the fixed asset investment of the whole society amounted to 1390.8 billion yuan, up 27.7% year-on-year (an increase of 4.9 percentage points). Of which, fixed asset investment in cities and towns increased by 29.8% year-on-year (an increase of 4.5 percentage points) (See Graph 2).

Graph 2 The Year-on-Year Growth Rates of the Fixed Asset Investment from January 2005 to March 2006

Source: China Monthly Economic Indicators

(3) Sales on Chinese domestic market grew in a stable and fast way and the household consumer prices rose in a mild way. In the first quarter, the total retail value realized for social consumer goods amounted to 1844 billion yuan, rising 12.8% year-on-year, with the price factor being deducted, rising actually 12.2%, an increase of 0.3 percentage points compared with the same period last year. The overall household consumer price index for the whole country (CPI) scored an accumulated increase of 1.2% year-on-year, dropping 1.6 percentage points compared with the same period of last year. The producer price index (PPI) for industrial products climbed 2.9%, and the purchase prices for raw materials, fuel and motive power jumped 6.5%.

(4) Foreign trade continued to grow rapidly, and utilization of foreign investment kept rising. In the first quarter, total import and export value increased by 25.8% year-on-year, an increase of 2.7 percentage points compared with the same period of last year. Of which, export rose by 26.6%, dropping 8.3 percentage points; import rose by 24.8%, an increase of 12.6 percentage points. With the import offsetting export, the surplus amounted to 23.3 billion US dollars. In the same period, the actually used amount of direct foreign investment amounted to 14.2 billion US dollars, up 6.4%. At the end of March, the national foreign exchange reserve amounted to 875.1 billion US dollars, an increase of 56.2 billion US dollars over that at the end of the previous year.

(5) Money supply and the balance of loans all increased at a double-digit speed. By the end of March, 2006, balance of the broad money supply (M2) amounted to 31050 billion yuan, up 18.8% year-on-year, being 4.7 percentage points higher than the same period last year and 1.2 percentage points higher than the end of the previous year. Balance of the narrow money supply (M1) amounted to 10700 billion yuan, up 12.7% year on year, being 2.8 percentage points higher than the same period last year and 0.9 percentage point higher than the end of the previous year. Balance of the market money in circulation (M0) amounted to 2300 billion yuan, jumping 10.5% year on year.

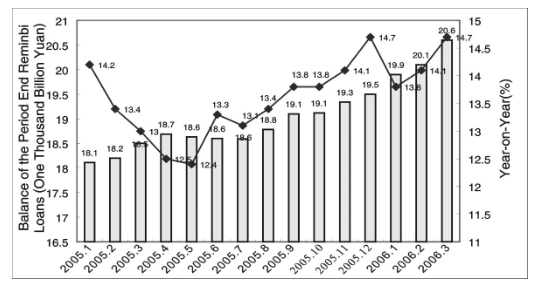

From January to March, balance of various Renminbi loans among all financial institutions amounted to 20600 billion yuan, soaring 14.7%, year on year, rising 1.8 percentage points compared with the end of last year. Renminbi loans increased by 1260 billion yuan. Of which, short-term loans and note financing increased by 632.1 billion yuan, with an increase of 320.9 billion over last year; medium and long-term loans increased by 440.4 billion yuan, with an increase of 191.1 billion over last year. Meanwhile, household loans increased by 166.9 billion yuan, with an increase of 4 billion over last year (See Graph 3).

Graph 3 End-of-period Changes in Balance of Chinese Renminbi Loans from January 2005 to March 2006

Source: Data released by the People's Bank of China

2. Market operation of the major trades and professions was relatively smooth and stable and the trends of price changes varied

(1) Supply and demand for major products on energy market took a turn for the better and prices kept the high place

In the first quarter, due to the increase of power generating and the good water storage of the main reservoirs, the tense supply and demand for electric power were evidently alleviated, leading the growth of power prices to a slowdown. From January to March, the producer prices of power industries rose 3.64%, 3.26% and 3.22% respectively, year on year, with a slowdown in the price increase. Supply and demand for oil products turned out to be normal as a whole throughout the country. In terms of the apparent consumption, crude oil increased by 10.62%; gasoline increased by 7.47%, being apparently accelerated; diesel consumption increased by 5.83%, showing some drop compared with last year. Gasoline and diesel stocks picked up compared with the year beginning. Under the influence of the high-level fluctuation of the world crude oil prices, in January and February, price increase of the crude oil and finished oil in China always remained at a higher level, and the price increase of the crude oil saw evident decline in March. Increase of the producer prices for gasoline and diesel witnessed a slight drop.

Output of natural gas saw a year-on-year increase of 31.3% in the first quarter, being the highest rate of increase over recent years. But as gas demand increased faster, supply was unable to meet the demand on the whole. Affected by the reform of the pricing mechanism for natural gas carried out by the National Development and Reform Commission as well as by the policy of raising the producer prices in a proper way, increase in natural gas prices enlarged obviously in the first quarter. The month-on-month increase were 3.1%, 1.4% and 2.2% respectively.

Coal supply and demand remained basically stable in the first quarter, with the stocks standing at the highest level over 4 years. It was mainly because the growth of the production of the high coal-consumption industries slowed down, thus leading to a slowdown in the demand for coal. Meanwhile, under the control of the relevant policies, coal export declined obviously and import of coal grew rapidly. In addition, as coal production grew fast, supply and demand on the coal market remained balanced as a whole. As of the end of March, coal stocks across the country had reached 130 million tons, being apparently higher than the level in the same period of last year. Under such circumstances, growth of coal prices declined evidently in China over last year. In the first 3 months, producer prices of the raw coal saw a year-on-year increase of 12.4%, 8.8% and 7.6% respectively, being notably lower than the same period of the previous year and showing a steady downward trend. In January and February, the month-on-month price increase for raw coal transactions on the market were 0.1% and 0.1% respectively, and dropped 0.2% in March.

…

If you need the full text, please leave a message on the website.

--------------------------------------------------------------------------------

*This paper is the general report by the Institute of Market Economy of DRC on "The Analysis of Market Performance and Development Trend of China’s Market in the 1st Quarter of 2006".