Will China have its debt crisis?

The Chinese central government's debt ratio was 25.8 percent in 2011 according to the State audit office. Yet, it is estimated that the general debt ratio of the Chinese government, if local governments are counted in, is about 59.2 percent. The most important thing about the debt is not the debt ratio but the government's ability to pay it, said an article in the Economic Information Daily. Excerpts:

Some government's debt, or gray debt just like gray income, is not counted in the statistics. There is an extreme estimate that says that the Chinese government's general debt now accounts for 75 percent of China's GDP or even more.

The State audit office's figure means that the Chinese government has another 10 years to expand its debt. It took about 10 years for the government debt ratio of the United States, Japan, Germany and many other countries to rise from 60 to 80 percent. The Chinese government needs to be vigilant to avoid its own debt crisis and manage its debt crisis risks in the next three to five years.

It is too optimistic to put hope on the huge State-owned properties owned by governments at various levels. Positive net assets don't mean that risk doesn't exist, like negative net assets do not mean debt risk either. The Chinese government's debt risks mainly lie in the lack of transparency of its assets and the overdraft of local governments' credits. The alliance between local governments and financial organs covers up China's debt crisis.

No Chinese banks have gone bankrupt due to the government's support. This system does not solve the potential risk for a debt crisis but dilutes the crisis and prolong the risk in a broader scope.

The international conventional system of evaluating the government's debt levels is not applicable to China, because the economic and financial systems are different. The Chinese government can resort to inflationary measures to gradually relieve the debt risks.

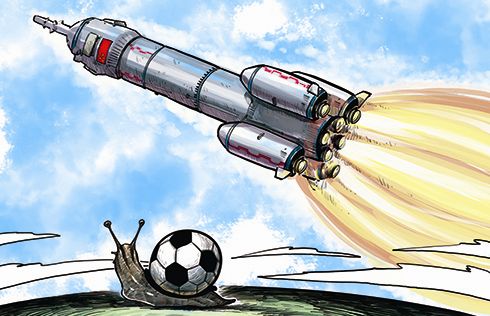

The Chinese government is running a race with its debt accumulation. As long as its digesting of the debt is faster, or conveniently slower, than the debt growth, the Chinese government can effectively control its debt risks, even if its debt will continue to rise.