Getting a grip on shadow banking

Over the last five years, there has been a boom in wealth management products and trust business, as the higher interest they offer has attracted more and more individual investors. With the rapid growth, regulators are paying greater attention to the potential risks arising from shadow banking, and tighter controls are likely to be introduced in the near future.

Shadow banking is a relatively new trend in China. In a broad sense it refers to the financial intermediaries, such as trust companies, hedge funds and underground finance sources that are outside traditional banking activities, and to the unregulated activities of regulated institutions, such as the off-balance-sheet lending of banks.

Yan Qinming, assistant to the chairman of the China Banking Regulatory Commission, revealed on Jan 29 that the book balance of wealth management products reached 7.61 trillion yuan ($1.2 trillion) at the end of 2012, up from only 500 billion yuan in 2007. And according to statistics from Wind, a financial database service provider in China, the total assets management scale in trust companies exceed the scale of the insurance industry, reaching 7 trillion yuan at the end of 2012, up from less than 1 trillion yuan in 2007.

The boom has not only been supported by individual investors, the bond portfolios meet the needs of corporate borrowers, especially those private companies who find it difficult to get loans from banks. In fact, to some extent shadow banking has been a positive development since traditional bank loans are no longer the only source of capital in China.

In December 2012 bank loans fell to their lowest level ever as a share of total social financing in the economy, to around 55 percent, down from 90 percent a decade ago. Total social financing for the economy was up more than 20 percent in 2012, and is set to exceed 30 percent of GDP for the fourth year in a row.

Wealth management products and trust business, with some characteristics of shadow banking, actually undertake the function of direct finance for the real economy in China, said Ba Shusong, director of Financial Research Institute with the Development Research Center of the State Council.

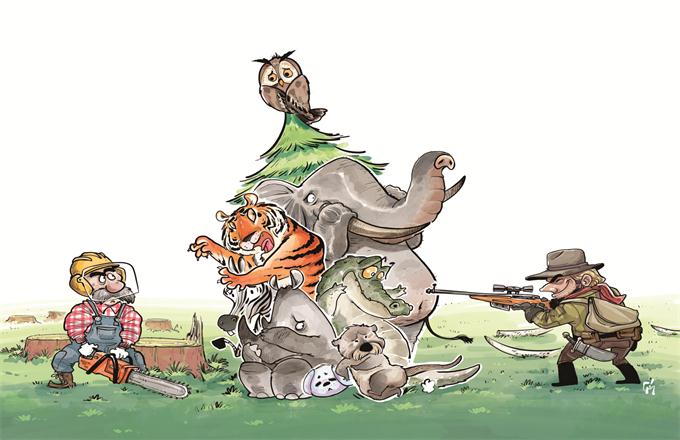

However, shadow banking is not without potential risks and regulators are now paying close attention to it.

Shadow banking offers higher returns based on high leverage ratios and it is less regulated. For example, with off-balance-sheet lending, banks can lend their deposits out with higher interest rates since there will be fewer worries about financial indicators such as the loan-loss provisions required by the central bank.

But the high-risk assets underlying many of these products mean "to some extent, this is fundamentally a Ponzi scheme," as Xiao Gang, chairman of the Bank of China, cautioned in October. "Under certain conditions, the music may stop when investors lose confidence."

If more debts rely on non-transparent, supposedly high-yield and off-balance-sheet investments, there are growing fears that problems in the "shadow banking system" may be transmitted to the formal banking system and China may be facing the type of credit crunch that brought the US economy to its knees in 2008. "In such situations there is a possibility of a liquidity crisis being triggered if the markets were abruptly squeezed," Xiao said.

Specifically in China, there is a mismatch of high-risk products with conservative individual investors. In general, high-yield products are of high risk and designed for wealthy investors who have the funds to accept the risk of default.

However, nowadays in China, as lots of the wealth management products are sold by commercial banks in their branches, it is not just wealthy investors that are buying the products, but also ordinary investors and pensioners, who often use all their savings and who don't have enough financial literacy to realize the high-risk nature of the products.

Besides, as banks have historically been the main players in China's financial market, some investors rely on a bank's reputation when buying a wealth management product and believe that banks are "guaranteeing" their investment, which is not the case. The recent default of a wealth management product for which the seller, Huaxia Bank, took responsibility has just increased their blind confidence that banks will bail them out if things go wrong.

As China's financial market is still in a nascent stage, more needs to be done to boost its competitiveness. The advantages of regular banking and shadow banking can both be developed with good regulation. China's regulators are fully aware of the potential risks and the shadow banking system will be regulated to a greater extent, such as putting all banks' lending on the balance sheet and increasing the risk control policies in trust companies.

However, in tightening their control over the shadow banking system both the government and the financial institutions need to ensure that they protect the interests of common investors, especially by informing them of the underlying risks of high-return products that can be bought in commercial banks.

The author is a journalist with China Daily. E-mail: zhujin@chinadaily.com.cn

(China Daily 02/05/2013 page8)