Lack of confidence a drag on global recovery

At the latest G20 meeting in Washington, Singaporean Finance Minister Tharman Shanmugaratnam, chairman of the International Monetary and Financial Committee of the Board of Governors of the International Monetary Fund, succinctly summed up the global economic problem at a news briefing.

"The commodity that is in shortest supply now is confidence," he said, referring to the failure of aggressive monetary policies adopted by some major economies, notably the United States, Japan and Britain, to spark a reliable recovery that creates jobs and boosts government revenue.

Global financial officials who attended the meeting agreed "there is no single bullet that will get us to normal growth and some normality with regard to jobs," said Tharman. So the overriding question is what else needs to be done to kick-start a sustainable recovery other than flooding the economy with cash.

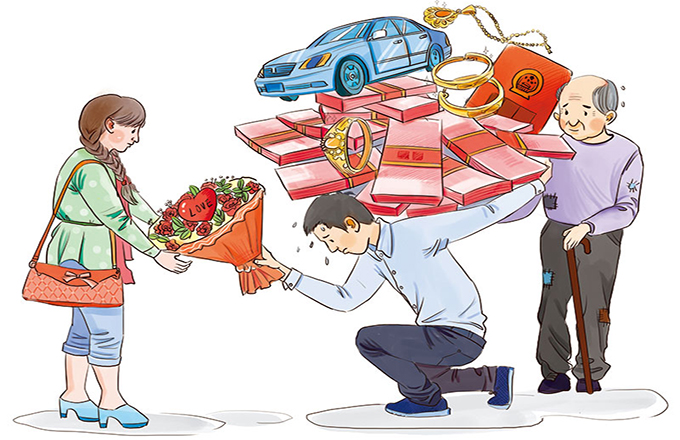

The sharply conflicting answers to that question put forward by economists have further sapped public confidence in the capability of governments to solve the problem. Those economists who are often branded as liberals contend that loose monetary policy can only work if it is accompanied by an expansive fiscal policy, while those in the conservative camp insist on doing the opposite to reduce national debt levels. Other than a few right-wing extremists, most everybody else seems to have come around to the view that central banks of the US, Japan and some other economies are doing the right thing in boosting money stock to stimulate investment and consumption. The problem is that a significant portion of the liquidity created by the central banks of those countries has flown out of the country in search of higher returns in emerging markets, particularly Brazil, Mexico and some Southeast Asian economies.

For example, Reuters reported that days after the Bank of Japan announced it would pump a total of $1.4 trillion into the Japanese economy, the Mexican peso appreciated 2.5 percent against the US dollar to its strongest level in 20 months. The Institute of International Finance has estimated that about $3.3 trillion in total has flowed into the various emerging markets in the three years since the Federal Reserve of the US began its quantitative easing program. The Japanese version of the program is expected to make a similar impact, especially on the developing economies in the region.

Of course, the depreciation of the yen against most other major world currencies resulting from the sharp growth in money stock is expected to help enhance Japan's export competitiveness. Unsurprisingly, prices of shares of many Japanese enterprises that derive a large portion of their income from overseas sales have been doing well. But there is no indication of a strong uptake in domestic investment and consumption.

Some economists believe that the spending initiative will have to come from the government. But the Japanese government debt already exceeds 90 percent of GDP. Many economists believe beyond this level the debt will be a progressive drag on economic growth. Although that hypothesis has been disputed, economists belonging to the conservative school of thought maintain that it would be imprudent for the Japanese government to pursue an overly expansionary fiscal policy and push its debt to a level that could unnerve the market.

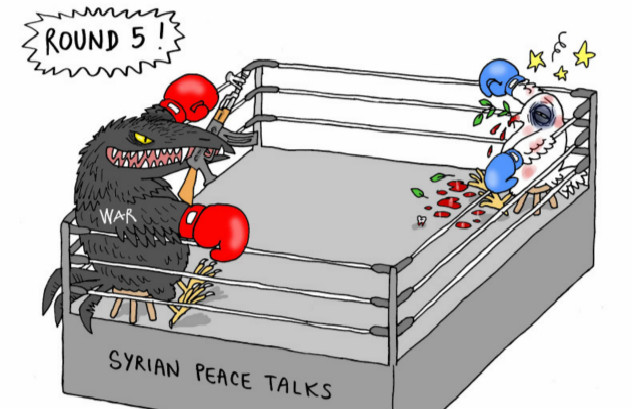

In the past several years, debt reduction has taken precedence over growth and job creation in many European Union countries. This is understandable because the EU problem was mainly triggered by the outbreak of the sovereign debt crisis in Greece. The austerity programs imposed on several EU economies are faltering. Instead of boosting confidence and, therefore, economic growth, as the budget hawks had hoped, austerity has only deepened the recession, reduced government revenue and, as a result, widened the budget deficit.

But don't expect finance officials presiding over seemingly failed economic policies to make a swing to the other end of the pendulum anytime soon. In classic diplomatic talk, an unnamed German official at the G20 meeting was quoted by Reuters as having said: "The goal is and remains sustainable debt levels. Some believe you get this with consolidation, others say growth. We say growth-friendly consolidation." That's hardly confidence inspiring, is it?

(China Daily 05/07/2013 page8)