Equity release plans aid aging society

The Chinese Dream has become a buzzword in Chinese and international media. While there are various interpretations about the origins and exact meaning of the Chinese Dream, it is quite obvious from the billboards and the articles that it mainly addresses the aspirations of the young. But if the younger generation are to realize their dreams, China has to overcome the problems posed by being the fastest aging society in history. An aging society offsets the demographic dividends, (potentially) burdens the public budgets and makes elderly care a big socioeconomic challenge.

The population of senior citizens in China is projected to increase from 194 million at the end of last year to 243 million by 2020 - and by 2050 China's elderly population is expected to reach 440 million, that is, close to the current population of the European Union. Despite taking many fruitful measures, especially the expansion of the social insurance and pension programs in the past decade, China is yet come to terms with the aging problem on the cultural and policy levels.

The State Council, China's Cabinet, did issue a document on elderly care in September. But despite having plenty of policy suggestions on developing community-based eldercare, pension service points, care insurance and the like, the document is short on real details.

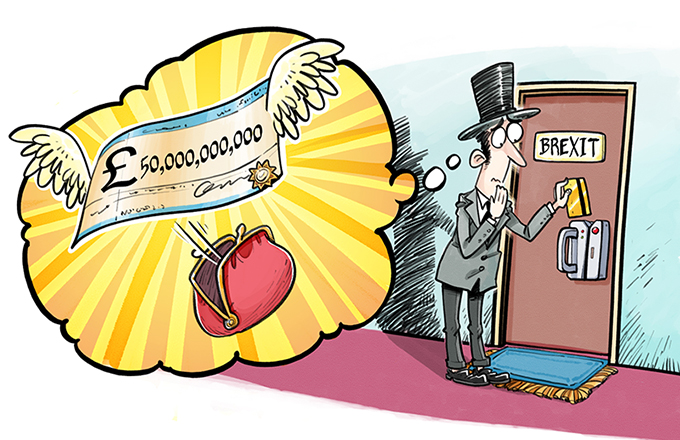

However, one relatively small proposal - a pilot plan for so-called reverse mortgages - caught the eye of social media, sparking a heated public debate based on the common public misperception of senior citizens exchanging their homes for financing their beds in nursing homes. Before making an assessment if the policy is relevant and appropriate for China, we should first contribute to a better understanding of what the policy entails.

In Western countries, particularly the United States and the United Kingdom, which have a high percentage of home ownership, reverse mortgage or equity release plans has been around for at least 25 years. The idea is relatively simple based on the lifecycle theory of consumption.

People accumulate assets during their working lives. After retirement, however, most people de-cumulate assets as their incomes fall. But the biggest asset that people have is a house or apartment, which cannot be easily turned into cash. Many senior citizens try to reduce their expenses by selling their house and moving to a smaller one only to realize that the transactional costs of shifting are high and the property market is crowded with individuals and young families desperate to buy a house. Under such circumstances, the elderly may not be able to make significantly large capital gains.

Above all, a person's home is often important to his/her emotional health and stability. There are many examples of even physically fit people dying within a short time of moving out of their home or community.

Equity release plans are aimed at preventing such outcomes. In much the same way that pension companies provide annuity in exchange for a pot of liquid assets, a lender (usually a bank or insurance company) provides regular annual income to the homeowner (both spouses in most cases) which is recovered with interest upon the homeowner's death. Like annuity payments, such plans have the element of uncertainly in terms of time because nobody can tell the age at which a person or couple will die or predict the real value of the property in order to fix the right amount for annuity. With financial assets, banks have flexibility with their decisions on how to manage and liquidate their asset portfolios. But in equity release plans, they cannot exercise such flexibility because they can liquidate assets only upon the death of the borrower/s, which could be further complicated by adverse market conditions.