Strict realty rules can curb speculation

|

|

LIU XINYI/CHINA DAILY |

The Chinese economy has stepped into a new normal, as a result its GDP growth declined to 6.5 percent in 2016. But contrary to popular belief, the main driver of China's economic growth over the past few years has been the real estate sector, not the high-technology or manufacturing industry.

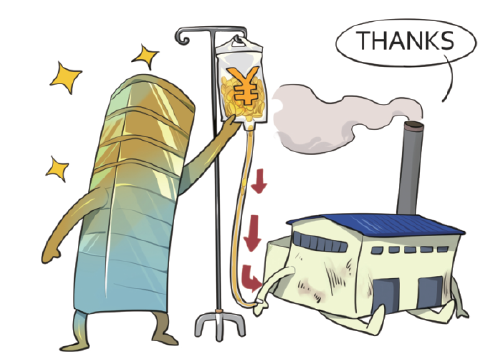

Although the real estate sector contributed about 10 percent to China's GDP in 2016, it created some problems, such as bubbles and financial risks, for the national economy. If the major part of a country's resources is concentrated in the real estate or stock market, its real economy could face an economic downturn. For example, some listed companies have sold the properties they owned in first-tier cities and earned far more money than they made from their main businesses.

And this is how soaring housing prices distort China's real economy, and capital flows rapidly into the asset market, further inflating the real estate price bubble.

The main reasons for the abnormally high housing prices are local governments' over-dependence on the sale of land-use rights for revenues and the almost zero real estate holding tax.

Speculation in the real estate market has prompted some people and organizations to use the housing sector as a tool to make exorbitant profits. This not only distorts the normal relationship between supply and demand in the housing market, but also deviates from the original goal of building housing units to improve people's livelihoods.

At the end of last year, the Central Economic Work Conference said "houses are built to be inhabited, not for speculation". The policy's aim is to eventually establish a long-term mechanism to regulate the real estate market through financial, taxation, investment and legislative measures in accordance with not only China's actual situation but also market rules.

The policy also aims to "de-finanicialize" the real estate sector, in an effort to strengthen the real economy. By curbing the asset bubble and abnormally high housing prices, the authorities intend to facilitate the healthy and stable development of the real estate market and add fresh vitality to China's real economy.

The key to the realty market's stable development lies in the stabilization of the market expectations, because it can curb market players' illegal behaviors. But in reality, it is difficult to solve all the serious problems the real estate sector faces, such as the contradiction between supply and demand, through short-term administrative control measures, because once such a policy is loosened or withdrawn, housing prices will rise abnormally again.

Therefore, the establishment of a long-term and effective property market control mechanism is crucial for stabilizing market expectations. And this is exactly what the Central Economic Work Conference decision is aimed at. Besides, a series of policies, including those on land supply, housing financing, real estate taxation, are expected to be launched in the future.

In the next stage, the authorities should actively promote deleveraging in the real estate sector. And first- and second-tier cities where housing prices are abnormally high should implement policies to control housing loans.

After that, the authorities should take measures to strengthen the real estate transaction tax. They should then increase the supply of land in some hotspot cities and better use urban spare land, in order to curb soaring housing prices in these cities.

The authorities should also use a "metropolis circle strategy" to improve infrastructure construction and the education and medical treatment systems in third- and fourth-tier cities to promote the healthy development of the real estate market.

And finally, property tax legislation should be accelerated to curb speculation in the real estate market to reduce local governments' dependency on the real estate industry for revenues.

The author is a researcher at the Institute for Urban and Environmental Studies, Chinese Academy of Social Sciences.