E-town enterprises snap up capital market

Six companies enter the new over-the-counter market in six months

August 19 was a red-letter day for Jin Gong, chairman of Zhong’ao Huicheng Technology. The company officially made its way to the new OTC market, with stock code 833351.

In the Beijing Economic-Technological Development Area, also known as E-town, six companies have landed in the new OTC market this year, including Pureach Filtration and Purification, Ifdoo Education and Zhong’ao Huicheng. They were the only E-town companies to enter the new OTC market during 2006-2014. More importantly, more companies are already in line to get into the market, which has become very popular among enterprises in the town and acts as a springboard to the capital market.

Why choose the new OTC market?

The new OTC market was founded on Jan 23, 2006. It was approved by the State Council and initiated and organized by the China Securities Regulatory Commission and Ministry of Science and Technology. The market offers share transfer services for unlisted companies in national scientific and technological parks.

Originating from Zhongguancun, the market mainly served four national high-tech parks until 2013, when the Regulatory Commission announced that it would become nationwide. Since then, the market evolved into a national securities trading platform and was named the “NASDAQ of China.”

However, companies were not interested in the new OTC market, due to liquidity restrictions. Now, things are different and companies can get more financing channels and opportunities at the market.

"There's no profit threshold for companies to enter the market, the application process is short and financing is flexible," said an analyst with the Guotai Junan Securities. The OTC market can quickly solve financing problems and act as a spring board into other sectors, the analyst said. "It only takes about one to three months for most companies to get onboard the OTC market and the process is simpler than the main board and growth enterprise markets."

The quick way to get liquidity is transfer to a more liquid market. Seen from China's support for the internet, those companies at the new OTC market will be the first to transfer to the growth enterprise market, experts said. At the moment, the OTC market liquidity is not enough for some companies' financing and future development. The market transfer rules are expected to come out soon.

More importantly, the market hierarchy will make substantial progress in 2015. Companies will need 500,000 yuan instead of one million to open an account at the market after the hierarchy is in place, according to the supervising bodies, which will trigger brisk trade, shorten the gap in company values between the new OTC and growth enterprise markets, and change the image and influence of the new OTC market.

What companies can get in the new OTC market

"Only by listing can enterprises have more financing and acquisition opportunities and realize wealth growth," said Tang Mingquan, general manager of Beijing Ekang Technology Co, which is working to get into the new OTC market. "Getting listed can also upgrade management and brand value."

Stargroup Research & Integration has benefited from the OTC market since it got listed in 2011. The company has not only solved problems for its expansion but also standardized its management.

"If we stick to old ways, our companies will suffer," Tang said. Finding banks and relying on policies were the main financing approaches in the past. Small and medium-sized businesses have difficulties in presenting collateral security and converting the value of their stock rights. So, those companies can't turn their fixed assets into liquid capital. But, getting listed will help them, which not only improves a company's financing capacity and liquidity but also helps to improve its capital structure, standardizes its development and paves the way for future capital operations.

The State Council has launched a series of policies to solve financing difficulties , but the problem is still persistent, said an analyst from Guotai Junan. Indirect financing resources are very limited and cost higher, and only direct financing can bring down costs. Therefore, getting listed is the way to go. Companies need to raise their credibility if they want to get attention and direct financing. To date, emerging and high-growth businesses are a major force in the new OTC market.

E-town encourages companies to get listed

E-town is actively encouraging enterprises to enter the capital market. It has held many trainings on the new OTC market this year. Those trainings have helped to greatly increase the number of local companies getting in the new market.

So far, a total of 13 companies in the town have made it to the market, including Beijing Sunho Pharmaceutical, Golden Spring Internet of Things Inc and Stargroup Research & Integration Co.

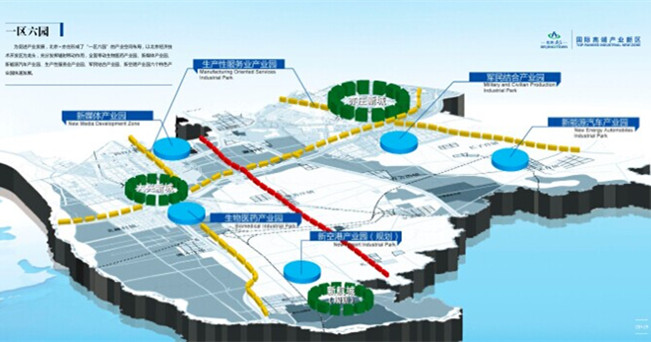

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500