Reform aims to make SOEs more efficient

( China Daily )

The government has pledged to move swiftly to advance the reform and restructuring of State-owned enterprises.

The reform will promote mixed ownership and encourage the inflow of foreign capital to foster more world-class, globally competitive companies.

"China welcomes all types of businesses, including foreign ones, to participate in the ownership reform of SOEs," said Xiao Yaqing, chairman of the State-Owned Assets Supervision and Administration Commission, at a media briefing on the sidelines of the 13th National People's Congress, the top legislative body, on March 10.

"We would be delighted to see foreign companies taking part in the mixed-ownership reform. China remains committed to opening up."

Xiao said the diversification of the ownership structure of SOEs is considered a key part of the reform, and emphasized that the rights and interests of all participating investors would be protected.

Since 1998, China has introduced three rounds of mixed-ownership reform-including one focusing on China Unicom-mainly through share issuance, to bring in private investment.

SOEs hold a strategic position in the national economy, so the government will undertake equity diversification at the group level at selected centrally administered companies and explore the release of special rights shares to deepen the reform and bolster State capital.

Xiao said the government will systematically assess the experiences of pilot programs related to the granting of equity stakes to employees in mixed-owned SOEs, in addition to expanding the coverage of the pilots and establishing long-term incentives and restraining procedures.

Li Jin, chief researcher at the China Enterprise Research Institute, said the moves could be mutually beneficial.

"Foreign capital holding shares in SOEs can benefit both sides. With the breakthroughs made in the reform, the country now has conditions that can facilitate the introduction of foreign capital to SOEs," he said.

He added that the moves toward mixed ownership will allow foreign capital to find a larger market and earn higher profits, especially as some SOEs have monopolies in certain sectors.

Wang Chuanlin, an NPC deputy and general manager of China Tiesiju Civil Engineering Group, a State-owned subsidiary of China Railway Engineering Corp, said: "It (reform) will also allow SOEs to deepen their influence on the international market through the use of foreign technologies and overseas sales channels. More important, a growing number of SOEs have started business operations overseas. Cooperation through mixed ownership could help them better explore international markets and become more localized."

He added that the government's next move will be to further promote mixed ownership of SOEs at the local level.

In the past two years, the National Development and Reform Commission and the State-Owned Assets Supervision and Administration Commission have launched two rounds of pilot projects to promote ownership reform. The first round featured nine SOEs, while there were 10 in the second, and they covered areas such as electricity distribution and sales, power equipment, high-speed railways, airline logistics, telecommunications and finance.

New business model

Eastern Air Logistics, the freight division of China Eastern Airlines and the first company in the sector to launch ownership reform, is preparing to go public. To achieve that goal, the management is exploring a new business model, rather than simply remaining a traditional aviation or logistics company.

In June, China Eastern, which is based in Shanghai, sold a 55 percent stake in its fully owned Eastern Air Logistics to investors and core employees with the aim of lowering the unit's debt ratio and improving its market competitiveness.

As a result, Legend Holdings holds 25 percent of the division, while Global Logistic Properties holds 10 percent. The courier operator China Deppon Logistics bought a 5 percent stake, as did Greenland Financial Holdings. The remaining 10 percent was sold to the unit's core employees.

Li Jiupeng, general manager of Eastern Air Logistics, said the company will work hard to lay the groundwork for its listing plan, which will include better market exploitation, an end to reliance on its parent company, rapid eradication of its operating loss, raising its continuous profit-making capability and satisfying all the requirements for a listed company.

According to Li, the unit made a profit of 428 million yuan ($67.6 million) in 2016, while the total value of its assets in the wake of the ownership reform was about 4.1 billion yuan, meaning the company has to double its price-earnings ratio to 20, a stated target, before it lists.

Eastern Air Logistics saw revenue rise to 7.14 billion yuan in 2016 from 5.88 billion yuan in 2014, and in the past three years net profit has surged to 428 million yuan from 49 million yuan.

After restructuring, the company will expand its air cargo-based business into more-profitable sectors, including cross-border e-commerce, logistics and warehouses, logistics solutions, high-end delivery and related fields, said Liu Shaoyong, a member of the 13th National Committee of the Chinese People's Political Consultative Conference and chairman of China Eastern Airlines.

When Premier Li Keqiang presented the annual Government Work Report on March 5, he said the central government will advance the reform of State capital and SOEs this year by formulating lists of investor rights and obligations related to oversight and regulation, and also deepen reform of State capital investment and management companies. In the first two months of the year, centrally administered SOEs made a combined profit of 206.67 billion yuan, a rise of 22.6 percent from the same period last year, while their operating revenue jumped by almost 11 percent to 4.1 trillion yuan, official data shows.

China has 98 centrally administered SOEs, down from 117 five years ago as a result of the central government's policy of restructuring central SOEs to improve their earning capabilities and efficiency.

SOEs' ability to make scientific breakthroughs has been demonstrated by the successful research, development and application of key science and technology projects, such as Huiyan, or "Insight", the country's first hard X-ray modulation telescope, a domestically made aircraft carrier, the Type-055 destroyer, the C919 passenger plane, the sampling of combustible ice at sea and the Fuxing fleet of high-speed trains.

Peng Huagang, deputy secretary-general of the State-Owned Assets Supervision and Administration Commission, said the third round of ownership reform will start this year and will involve 31 SOEs-10 centrally administered and 21 at the local level.

"The first two rounds of SOE reform have made steady progress in promoting economic development, while the State-owned economy has built a sound platform for the further development of the private economy," Peng said, adding that the third round of reform will cover a wider range of areas, including public services.

"We will work consistently to make SOEs into leaner, better performers, increase the core competitiveness of their main businesses, and strengthen, expand and increase returns on State capital," he added.

This year, the government will establish sound, market-based exit mechanisms to ensure that only the strongest SOEs survive, and will move quickly to deal with inefficient State-owned assets.

SOEs at all levels have produced satisfactory performances in the past five years. Last year, total sales revenue reached 50 trillion yuan, a year-on-year rise of 14.7 percent, while profits surged by 23.5 percent to 2.9 trillion yuan.

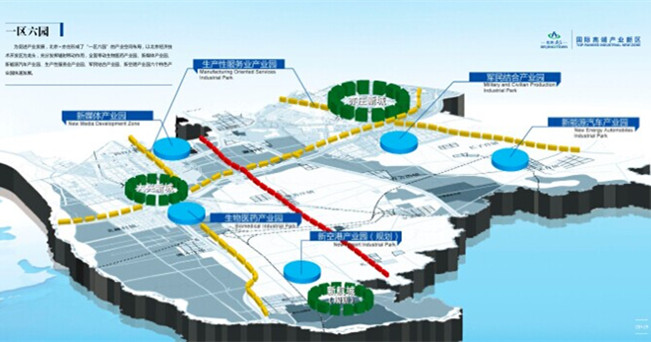

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500