China unlikely to see financial crisis

|

| CAI MENG/CHINA DAILY |

The debt of the central government and households remains modest. But at about 153 percent of GDP at the end of 2016, non-financial corporate debt is very high for an emerging market, with a large share of the debt held by structurally unprofitable companies in heavy industry with major overcapacity.

While the associated financial risks of high corporate debt are in first instance borne by financial institutions, they will in part end up as a liability for the government. Also, local government debt is high and still rising despite the central government's efforts to rein it in. And although poor transparency is hindering visibility, estimates show the nationwide local government deficit has been about 5 percent of GDP in recent years. Hence, the creditworthiness of China's government debt has deteriorated in recent years.

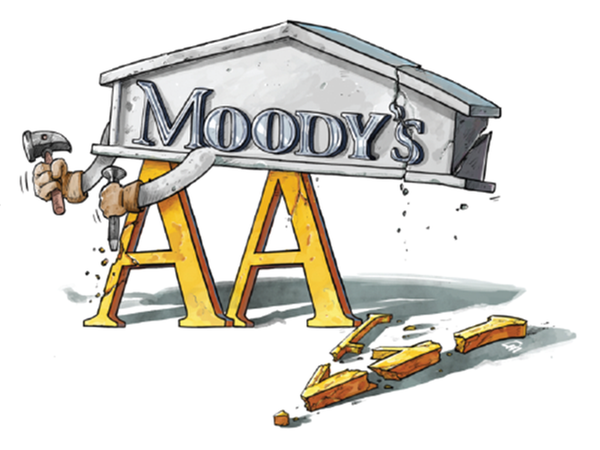

Despite all this, China is still unlikely to see a systemic financial crisis any time soon, because virtually all debt is financed domestically, from high savings in China's own economy. Also, the financial system remains very liquid, with the overall loan-to-deposit ratio being below 100 percent. Indeed, the rating agencies largely agree. Despite Moody's decision, ratings for China's sovereign debt remain relatively benign. To give some context, other economies with an A1 rating from Moody's are Japan, the Czech Republic, Estonia and Israel.

What about the timing? Since late last year, China's senior leadership has been indicating a change in tone on the trade-off between reining in financial risks and supporting economic growth. The change in policy stance is reflected in higher inter-bank interest rates and measures to tighten regulation on shadow banking and local government financing as well as to reduce debt-financed bond investment-which caused bond yields to rise, especially of maturities of around five years.

In recent months, China's leadership has emphasized the need to fight financial risks to such an extent that some observers have become concerned about the risk of excessive tightening. However, in our (Oxford Economics) view the risk of excessive policy tightening in China leading to a sharp reduction in economic growth is low, for the simple reason that the country's leadership does not want that to happen. It still aims at whole-year GDP growth of "around 6.5 percent, preferably a bit more, if possible in practice".

While the efforts to reduce leverage in parts of the financial system are quite forceful, the People's Bank of China, the country's central bank, has been tasked with ensuring that sufficient credit flows into the real economy and recently warned against excessive tightening. Indeed, so far growth of our measure of "overall credit"-total social financing excluding equity finance plus local government bond issuance-came down from 16.1 percent year-on-year in December 2016 to 14.9 percent in April.

According to our calculations, the current monetary plans for this year indicate a target for overall credit growth of 13.4 percent year-on-year at the end of this year, implying a further slowdown but not a major one. And based on current trends, China's overall leverage will continue to rise steadily in the coming years.

While the positive start to growth this year has emboldened policymakers to tighten both monetary policy and regulation of the financial system and local government debt, the Chinese leadership's insistence on meeting economic growth targets puts these tightening measures in perspective. In fact, additional loss in economic momentum in the coming months will probably lead to an easing of the tightening efforts.

In line with this policy stance, and our expectation that real estate construction will slow down, we expect a gradual slowdown in the economy this year, with GDP growth moderating from 6.9 percent year-on-year in the first quarter to 6.4 percent in the fourth. And that should not impinge on global growth too much.

The author is head of Asia economics for Oxford Economics.

- No basis seen for long-term drop in Chinese currency

- Australian securities can be held in Chinese currency

- Chinese currency renminbi will become more important for Australia's economy: ACBC chief

- Chinese currency gains importance in Latin America: Experts

- Dollar and Chinese currency: Mysteries revealed