Paying on the never-never set to rise

Updated: 2011-09-20 10:15

By Yang Ning (China Daily)

|

|||||||||||

|

Students from Zhejiang University making applications for credit cards at a temporary bank service stall at the university's campus. Young, affluent people hold the highest number of credit cards in China, according to a recent report released by the Boston Consulting Group.?[Photo/China Daily] |

Report predicts big increase in credit card use and revolving debt

BEIJING - Consumer lending was a new thing in China 10 or so years ago.

Today, however, consumer-lending products, from credit cards to mortgages, and from automobile to education loans, are becoming increasingly prevalent and fashionable among most Chinese citizens, particularly the young and affluent.

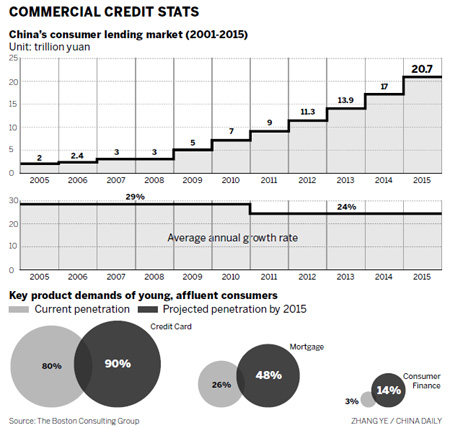

The country's current 7 trillion yuan ($1.1 trillion) consumer lending market is expected to reach nearly 21 trillion yuan by 2015, at an average annual growth rate of 24 percent over the next five years, according to a recent report released by the Boston Consulting Group (BCG).

Mortgages now comprise the largest element of the consumer lending market at 84 percent and they will still dominate during the next five years, said the report.

"We forecast the mortgage market to grow from 6 trillion yuan to 15.5 trillion yuan during the period 2010 to 2015, given that many Chinese consumers believe that owning their residence is essential to having a stable family and that houses have a relatively high cost," said Richard Huang, partner and managing director at BCG.

Personal credit cards were broadly introduced in China in the early 2000s. They now constitute the second-largest market for consumer lending products, accounting for 450 billion yuan in 2010, according to the report.

At the end of last year, approximately 230 million credit cards had been issued in China, figures from China Bank Association showed.

"Driven by rising consumption and market penetration, credit card receivables have been growing at close to triple-digit rates in the past five years," said Huang.

Affluent people aged below 35 with assets of more than 500,000 yuan hold the highest number of credit cards, with 2.6 cards on average. The current penetration rate is roughly 80 percent, he added.

At present, the credit card business is not very profitable in China because the revenue is mainly in the form of commissions paid by merchants and an annual fee from cardholders. In developed countries, most of the revenue comes in the form of interest from card users who do not pay the full amount of debt on the card each month as well as commission from retailers.

However, Huang noticed that more and more young Chinese card users are behaving more like their counterparts in developed countries, not like middle-aged Chinese card users who repay their monthly balances in full.

"Five years ago, less than 5 percent of Chinese card users used revolving credit. Now, in 2011, about 15 percent of card users, mostly the younger adults, are using revolving credit. This is becoming a trend in China and this will gradually change the income structure of card issuers who need to adapt as well," he said.

Zhao Yuzi, general manager of the credit card center at China Construction Bank, said expanding domestic demand is one of the key themes of the country's 12th Five-Year Plan (2011-2015), and credit cards can play an important role in boosting domestic consumption.

"In the coming years, credit cards will be dominant in China's consumer lending market," said Zhao.

In addition to credit cards, young, affluent consumers also have the highest demand and show high growth potential for mortgages and consumer finance, which refers to short-term loans for personal consumption of durable goods or services such as education and healthcare, according to the report.

Mortgage penetration among the young and affluent is projected to double, from 26 percent to 48 percent, while that of consumer finance is likely to rise almost fivefold from 3 percent to 14 percent over the next five years, it said.

Frankie Leung, head of financial institutions practice at BCG, said as this segment matures into middle age, they will further increase their income and accumulated assets, and thus their spending levels.

"Financial services players should invest in and cultivate this segment now in order to win them over as their spending rises," he said.

The report identifies the differentiated approaches that lenders should adopt and the challenges they would face.

Although China's "Big Five Banks" - Industrial and Commercial Bank of China, China Construction Bank, Agricultural Bank of China, Bank of China, and Bank of Communications - and other large players still dominate the mortgage and auto loans businesses, they could further push a comprehensive product line.

"Their main challenges to growth are aligning their complex organization, managing the product portfolio, and improving service quality," Leung said.

For leading joint-stock banks, they should identify and target a select market and consumer segments and get better leverage from the credit card platform.

Smaller banks, with resources more limited than large lenders or joint-stock banks, should seek out niche markets, said Leung.

Related Stories

China's small-loan firms expands to 3,027 in Q1 2011-04-22 09:17

China's credit card delinquency ratio unchanged 2011-08-09 09:43

China UnionPay, CCB launch dual-currency credit card in HK 2011-04-01 11:15

Supersize my shopping and max my credit card, please 2011-03-02 07:46

- China pledges unconditional support for EU

- Alibaba now requires real-name registration

- Chinese tourists to spend more in NZ

- Company buys rare earth element for reserve

- SOEs see slower growth in profits in Aug

- Benin encourages foreign investment

- Lazard bolstering China unit with M&A drive

- Paying on the never-never set to rise